What's the fuel that's pumping Canadian real estate? Hint: the money laundering theory of home price inflation is wrong

June 22, 2019

Erik Fertsman

Theories about the source of home price inflation in Canada range from immigrants to money laundering. This is misleading, considering banks are the source of the majority of funds entering real estate. How do we know this? Let's take a look at the data provided by the banks themselves.

For the most part, migrants and foreign students prefer to rent or lease their living spaces and modes of transportation- at least until it becomes clearer to them whether or not they will permanently settle and work in Canada. Once they do decide, or are granted permission to permanently settle and work in Canada, they become the same as any other Canadian citizen; paying taxes and contributing to local economic growth. More importantly, most end up with a mortgage from a Canadian financial institution. That is, if they don't get priced out of the market as the Huffington Post recently reported.

The money laundering theory of home price inflation

After citing a report

that says, "Analysis has been done on this issue [money laundering] for approximately 20 years; however there appears to be no consensus about which methodology, if any, can be relied on for this purpose," Halifax Examiner's Tim Bousquet writes:

There are lots of ways money is laundered, but real estate is probably the best of them. Developments can be financed through sketchy offshore companies and then ownership shuffled through numbered companies that make it hard if not impossible to identify the primary owner, and sales and rental incomes provide a steady legalized stream of future income.

That, I believe, is the primary reason for the global explosion in construction, and for the resulting boom in housing costs: the entire global real estate market is awash with trillions of dollars in illegal money, the proceeds of the drug and armaments trades and other illicit activity.

Time to cut off that foreign money!

But wait... Tim, do you have documents that prove a substantial amount of foreign funds coming into the Nova Scotian real estate market are in fact illegal? If not, what you are describing is foreign-direct investment, no? Also, Canadian investment firms and private lenders set-up offshore vehicles all the time. That way they don't pay taxes twice (you know, once for the corporation and then again when the investors take profit).

Plus, if we are talking commercial real estate, construction booms always lead to an over-supply of rentals at some point, which eventually brings prices per square footage down. Just look at commercial space in Halifax: isn't more than half of the new BMO Center vacant? I know the TD building is ghost city. And Sobey's has a ton of vacant commercial space. This is why commercial square footage is decreasing in price!

But let's focus on residential real estate, shall we?

Mortgages are the source of home price inflation in Canadian real estate

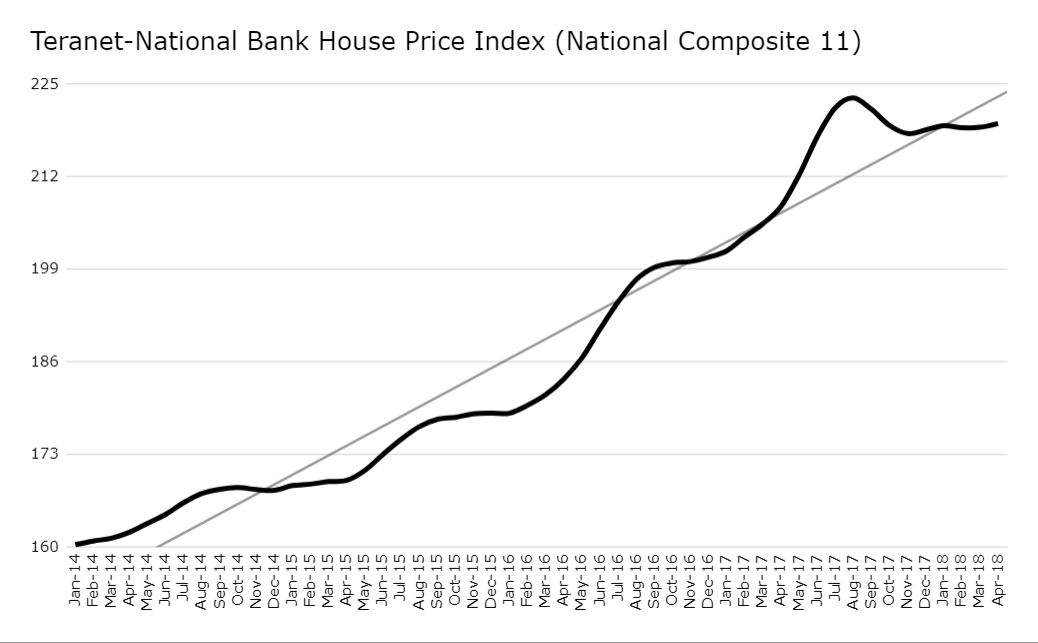

Recently the Bank of Canada came out with this fancy chart (below) which shows nominal mortgage origination between 2014 and mid-2018. We are particularly interested in the green line, ignore the other ones for the moment. Notice the two vertical dotted lines. This is where rules affecting mortgages kicked in. Those are the ones that now require higher down payments from borrowers, and that they get stress-tested under a higher interest rate, that sort of thing.

Ok, now take a look at the blue and yellow lines. The blue line demonstrates higher ratio mortgages (ones where borrowers would enter the loan at a debt-to-income ratio of over 450 percent) and the yellow line includes lower ratio mortgages (so anything below 450 percent debt-to-income ratio). You can see that a combination of mortgage rule changes and a higher interest rate caused nominal mortgage origination to fall, with high-ratio ones collapsing! Everyone is still arguing about whether it was mortgage rules or interest rates that pulled the rug from underneath the mortgages, but that doesn't matter right now. What does

matter is the event, and what we are looking at is the collapse in mortgage origination or credit allocation

to the Canadian real estate market.

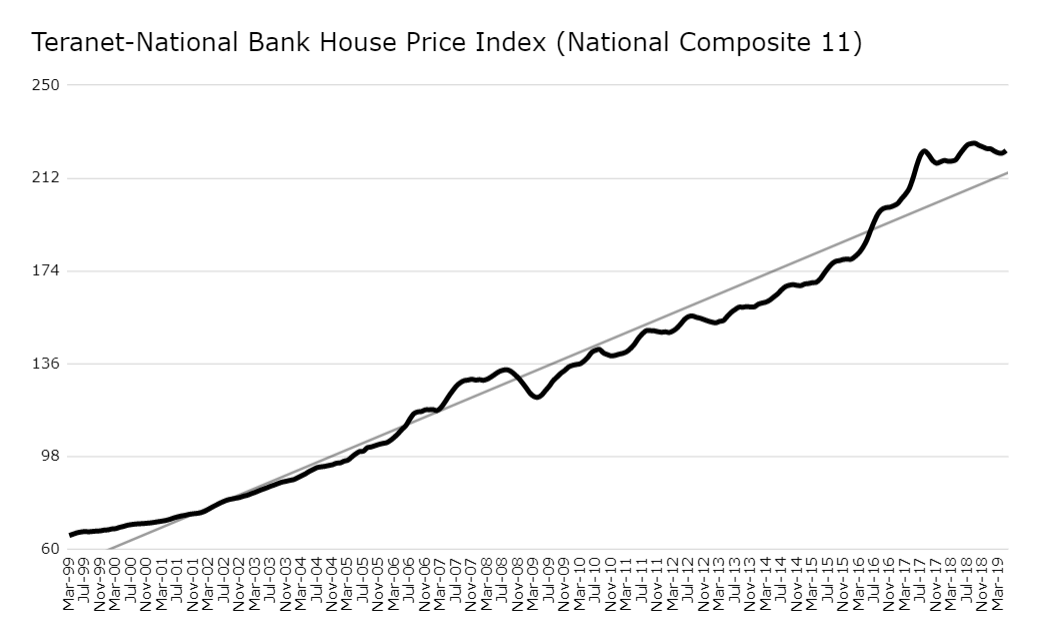

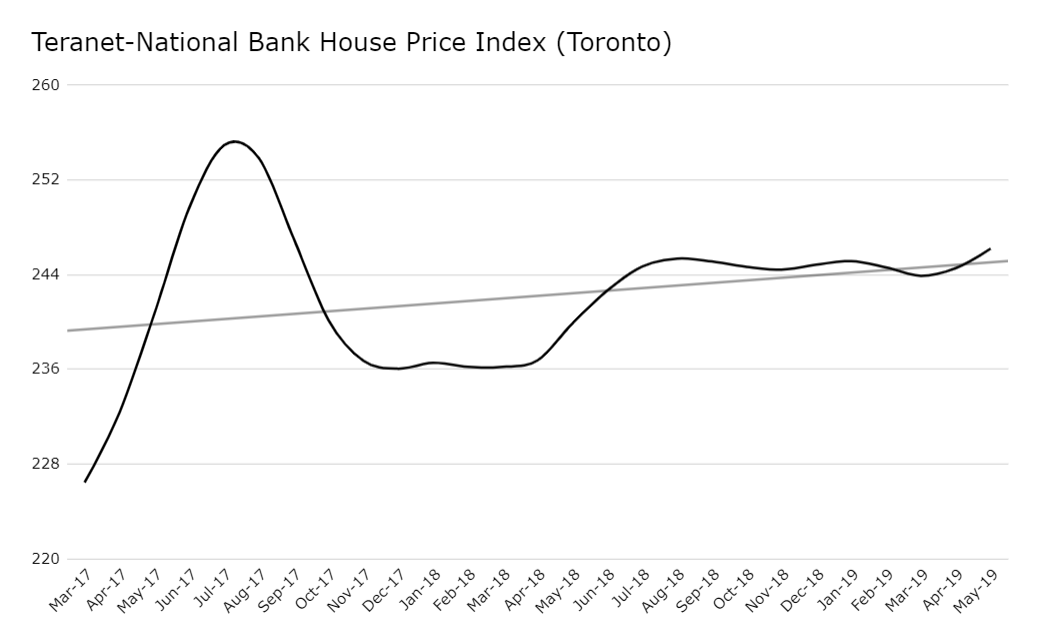

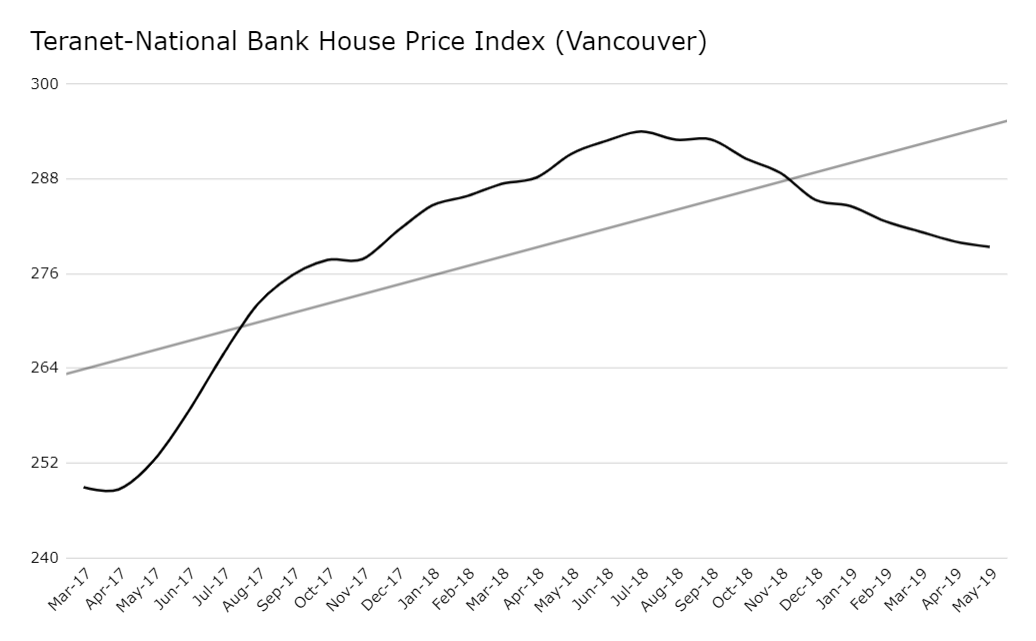

Now, recall the Teranet-National Bank House Price Index. Here's the chart I shared with you in this

post.

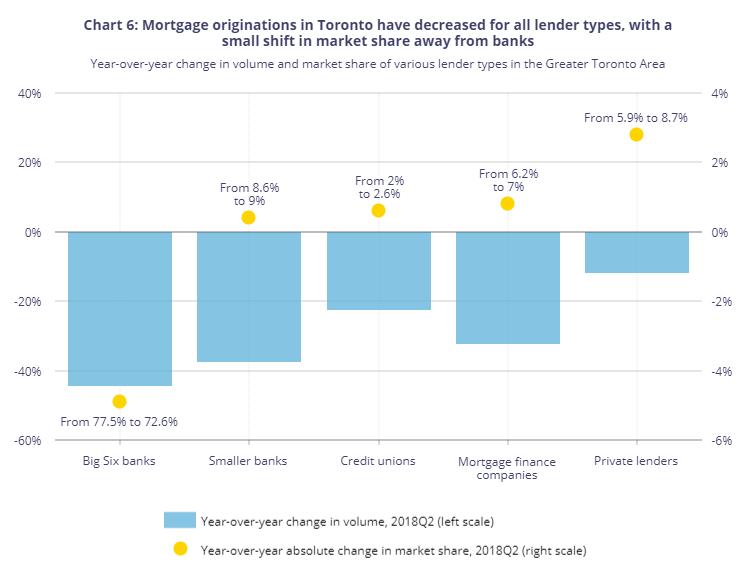

Banks are the key credit originators pushing home price inflation in Canadian real estate

This chart also shows you how, after the mortgage rules changed and nominal mortgage origination dropped, smaller banks, credit unions, financial companies, and private lenders started to take more of the market share away from the big six banks. Pay special attention to private lenders: these are folks who don't have to follow the mortgage rules or comply with stress-test rules. That's because they don't function like banks (creating fountain-pen money). They are more like venture capitalists or private equity firms. Private lenders are the money launderers that Tim says are pushing up home prices (LOL). They only constitute a tiny

share of the overall lending market in real estate. Honestly, they will be the first to lose their shirts, just like Home Capital Group. Actually, they are already losing their shirts- remember HCG got a bailout from Warren Buffett back toward the end of 2018? Was the HCG bailout simply a coincidence with the plateau in home prices across Canada six months earlier? Nope, I don't think so. It's all related.

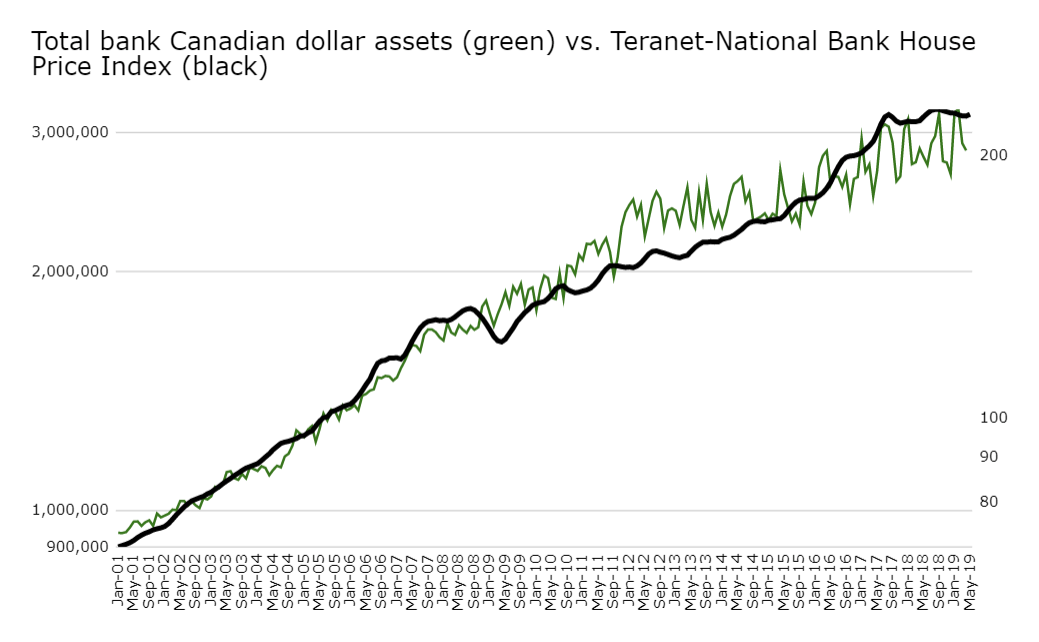

Now that you understand the underlying dynamics in the Canadian real estate market, whom originates the majority of credit for home purchases, and how that large spigot (when it gets turned off) impacts the prices of homes, you're ready to understand something fundamentally larger. The chart above shows you total assets denominated in Canadian dollars among Canadian banks plotted against home prices. Loans, and so mortgages, are noted as "assets" on bank balance sheets. They make the bank money. Bank deposits, or your paycheck and cash you feed your teller or automated teller, are liabilities for the banks. Bank deposits cost the banks money (interest paid to you on your deposits), but they have

to take them from you to create a favourable "capital ratio" so they can lend.

What should be clear here is that bank assets increase at more or less the same rate as home prices; they are positively correlated. When the big six banks are lending lots of money and increasing the assets on their balance sheets, home prices are increasing by leaps and bounds. This is because the origination of mortgages has been a large part of the Canadian bank business model- especially the big six banks who hold most of the 3 trillion dollars worth of assets noted on the chart above, on their

balance sheets! The mortgage market is, what, approximately 1.25 trillion dollars worth? And if the banks have approximately 75 percent of the market share of the mortgage market? That means 1/3 of those assets in that chart up there got parked in homes. That's nearly 1 trillion dollars! That's way more than what private lenders or Tim's money launderers could ever do in Canada.

Who should be held responsible for pushing up home prices in Canada?

This is a complicated question, but there is a simple answer: the banks and their authorities- agents of whom I think matter the most with regard to this issue. The regulators who oversee these publicly traded financial institutions include the Bank of Canada and the Office of the Superintendent of Financial Institutions (OSFI). These are the authorities who have done a wonderful job ensuring "bank profitability" and the continuance of bank-lending. But there is a problem... home prices have run away from wages and the day-to-day realities of Canadians. And so now people are trying to point fingers at who dunnit, as it were.

My take is that the Ministry of Finance and the minister of Families, Children and Social Development are ultimately responsible to direct attention to these types of problems, because they are the representatives Canadians have elected to look over the well-being of the country's finances and social development. Housing price inflation might be good for a while, but it quickly erodes the financial well-being of Canadians. But you know what Bill Morneau (finance) and Jean-Yves Duclos (social development) are doing to help Canadians with home affordability? They are adding more fuel to the fire in the form of principal and interest-free credit to first-time home buyers, just as I wrote about here. They don't want to deal with this problem appropriately, but of course, the Ferts will keep ranting about it and offer solutions on how to put Canada back on track with home prices, and importantly, how to put Canadians back on track with their finances and social development.

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX