Trudeau’s Liberals are rolling out First-Time Home Buyer Incentive, and it's the foolish path of least resistance

June 18, 2019

Erik Fertsman

Yesterday morning Jean-Yves Duclos, Minister of Families, Children and Social Development posted this tweet that demonstrated his concern over housing affordability for Canadian families:

Everyone needs a place to call home, but too many Canadians are being priced out of the housing market. The new First-Time Home Buyer Incentive makes home ownership more affordable for first-time buyers by lowering their monthly mortgage payments. https://t.co/ZLIEMoKftm pic.twitter.com/zE29MVNuB0

— Jean-Yves Duclos (@jyduclos) June 17, 2019

The thing he is referring to is the First-Time Home Buyer Incentive (FTHBI), a program that will be administered by the Canada Mortgage and Housing Corporation (CMHC). Affordability, in his view, is based on people’s cash-flow or their ability to meet lower monthly payments. The balance doesn't really matter (actual home value) or the fact that the home purchase they want you Canadians to make will turn you into a debt slave, destined to walk around with anywhere between 200 and 400 percent debt to income.

The tweet was followed by an official

press release by the government. Here’s what it says:

Starting on September 2, 2019, the First-Time Home Buyer Incentive will help middle class families take their first steps towards homeownership by reducing monthly mortgage payments required for first-time homebuyers without increasing the amount they need to save for a downpayment. This program complements other measures taken in Budget 2019 to support first time homebuyers with their downpayment such as increased RRSP withdrawal limit from $25,000 to $35,000 The Government of Canada has allocated $1.25 billion over three years (starting in 2019) for this program. The incentive will be available to first-time homebuyers with qualified annual household incomes up to $120,000.

In other words, you can reduce your monthly payments for a home without needing more upfront. And the government is gonna pile a huge amount of money into housing over the next three years through this program (if people sign up).Who are the people that are considered first-time home owners you might ask? They are using the Canada Revenue Agency’s definition, so anyone who has not lived in a home they own or their partner owns in the acquisition year,

and in any of the four years preceding the acquisition.

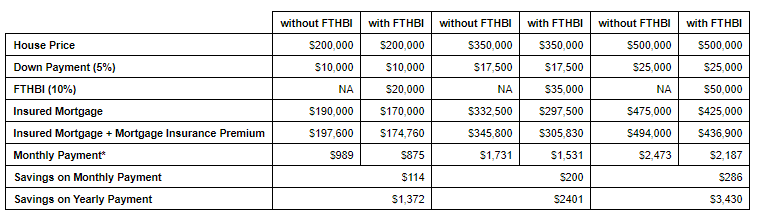

So, the deal provides an interest-free loan of up to 5 percent for the purchase of an existing home, or up to 10 percent for a brand new home. Repayment must be within 25 years or as soon as you sell the home you purchased under the program. There are no monthly payments! Yeah, I can see how that would be appealing, as people would be given the ability to enter the realm of home ownership at lower monthly payments. The press release even included this fancy chart with some quick math done for us:

Jean-Yves Duclos said that the “National Housing Strategy […] will reduce the monthly mortgage for your first home by up to $286. This will mean more money in the pockets of Canadians and will help up to an estimated 100,000 families…” Meanwhile, the finance minister said the incentive will “...benefit those who need more assistance with housing costs, middle class Canadians [...] families will have hundreds of dollars each month [...] to spend on things like healthy food, sports activities for their kids, or even save for the future.”

So... Jean-Yves will be a saint to as many as 100,000 people, and the finance minister, the guy who is supposed to be looking out for the financial sustainability of Canadian taxpayers, wants you to spend more on consumption goods as opposed to building more equity in your home (LOL). I'm surprised they didn't mention millennials. Did they forget we exist and that we are entering the home ownership scene with 2x (200%!) more debt to income than our parents? (I'll touch on this in a separate post- don't worry).

But wait! The program says that if the price of the home increases after receiving a FTHBI loan, the government will receive a portion of the increase equivalent to the portion of the FTHBI loan to my total home value if I sell? And if the home price falls, the government will eat the loss proportional to what they invested if I sell? What...?

Thus, if I participate in this government program (I currently don’t own a home and haven’t in the past 4 years) and take a FTHBI loan worth 10 percent of my home cost, when the home is sold, the government will take 10 percent of whatever the home value is at the time of sale? Doesn’t that mean I don’t get to build that equity in the home? I mean it's great if I sell my home for less at a loss. The government will get rekt (wrecked) with me. But if the home price increases 5 percent year over year… you know what, I'm not sure this is possible but I’ll just repay the initial amount borrowed a few months before I sell. That way I don’t have to get the CMHC appraisal and give the government the profit on the home. Great.

Obviously this program won’t help people who need to buy a home valued greater than $480,000, so this program isn’t for you people who live in locations throughout Ontario and British Columbia where housing expense relief is needed the most.

What strikes me the most with this program is that, like other financial instruments such as RRSPs and tax-free savings accounts, this one will likely provide added liquidity to those who already have plenty of it. Why? Because those who pay down the FTHBI loan before selling their home will end up keeping a larger portion of the profit (equity) when they sell their home at a higher valuation. But importantly, this demonstrates how historically low interest rates (the cost of money) are no longer enough to get volumes and prices up, and that we have entered the territory whereby loans for homes carry no interest and

principal payments.

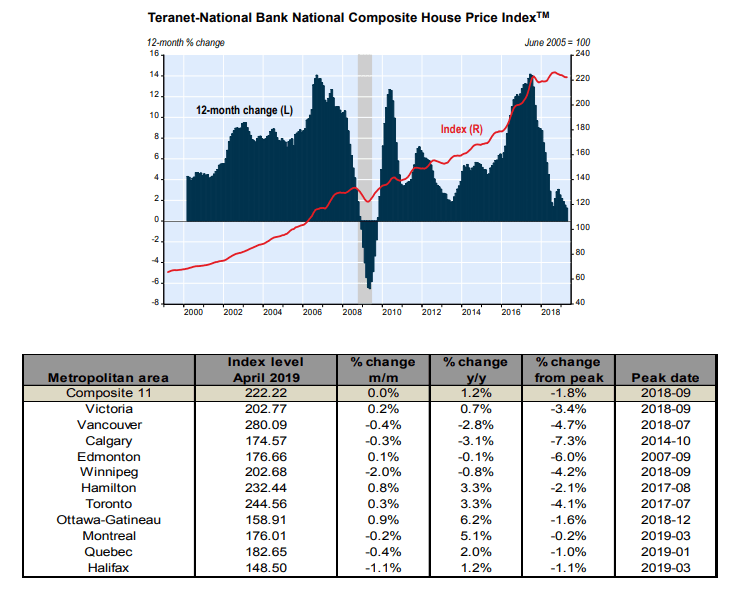

Let’s recall the Teranet-National Bank Index:

What's great about this index is that the National Bank (this is not the Bank of Canada) has created a methodology that is way more accurate at measuring house price changes. Rather than taking aggregate values and changes in median prices, they measure the percentage change of the same house. This is a way more accurate demonstration of price since not all homes, even if they priced the same, are comparable. What we are looking at is a market that expanded its prices between 2006 and 2017 by close to 6 percent per year. Ask yourself, did your wage increase by more than 6 percent year over year? Better yet, did most of your other day-to-day expenses like food drop every year?

Yes, there are some signs the housing market is backing down from its peaks and the trend upward may have been violated. This is especially the case for the Edmonton and Calgary markets. But to be honest, it's a mere drop in the bucket, and very few technical supports have been broken (so, the psychology in these markets is still very bullish).

The government's FTHBI is designed to bring down monthly payments, but what it will do is pump more money into an asset class that has already experienced a crazy amount of asset price inflation. The entire world is watching Canada's housing market (which has become famous for its price inflation- famous like bitcoin... lol), while at the same time, the government continues to add more juice to it right before it goes for re-election. I hate to say it, but this policy is 100 percent election candy, and it's the kind that will rot the financial sustainability of the people who eat it or just taste it. Eventually, home prices will need to "normalize" (i.e. come back to earth and in-line with living wages...) and if more credit gets allocated to the housing market before it corrects, it's going to put those people who are piling money into this thing (the government, its taxpayers, and the banks) into a whole lot of trouble. Well heck, when the market does

come down, the response will likely be even more foolish.

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX