Repeat of 2016? Employment levels contract in Alberta and Newfoundland

January 29, 2020

Erik Fertsman

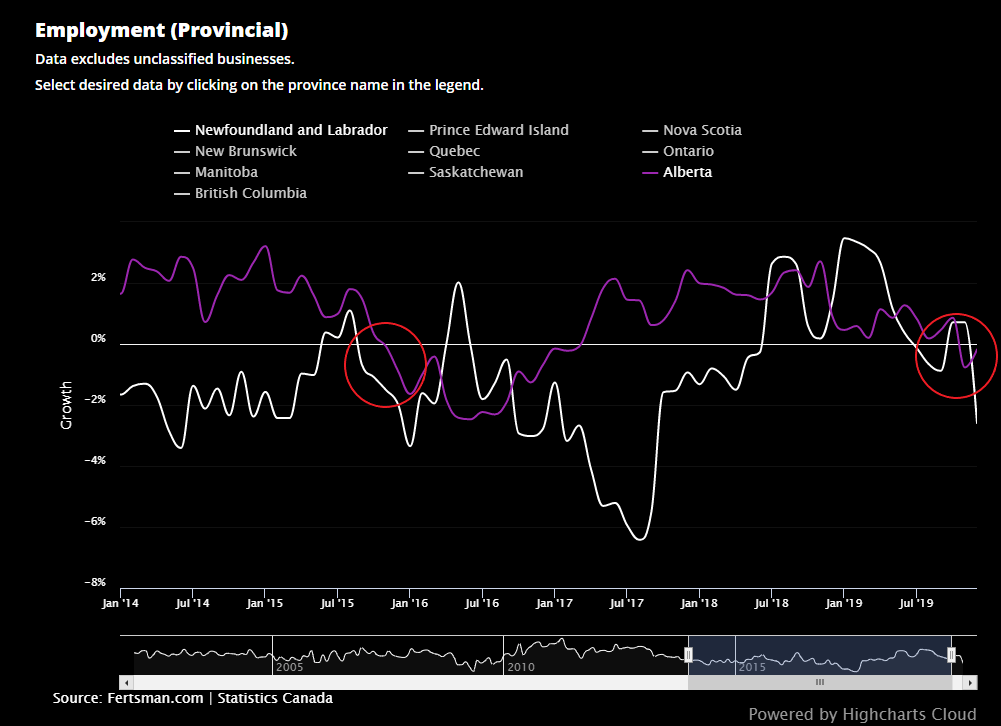

Things just don't seem to be getting better in resource-based economies across Canada. The latest provincial labor data shows employment growth has gone negative in Alberta and Newfoundland and Labrador in December on a year-over-year, seasonally-adjusted basis. The pattern or shape of the drop in employment is similar to the one we saw back in 2015 that preceded the downturn in 2016. That downturn eventually sent employment insurance claims skyrocketing between 75% and 100%. Will it be the same thing this time around?

Article continues below.

The employment situation in Alberta and Newfoundland

As you can see on the chart above, employment data for December has contracted by 2.59% in Newfoundland and Labrador. Similarly, in Alberta, employment figures are down by 0.18% on a year-over-year basis, slightly better than the drop of 0.88% in November. This is seasonally-adjusted data, so unless things gets revised to the upside in the coming months by finding more employed during the period of December, it seems that both provinces are now beginning to experience another downturn wave. (On the chart above you can see the similarities between now and the 2015 drop).

This latest employment drop doesn't exactly come as a surprise, because earlier this week

we saw how the sore spot in Canada's economy has been in the goods-producing industry, which has been shrinking primarily in manufacturing and resource extraction. And the economies in Alberta and Newfoundland and Labrador have large resource-based industries.

The biggest employment drops in Newfoundland, according to Statistics Canada, were in the goods-producing sector at 9.8%. To get more specific, the "Forestry, fishing, mining, quarrying, oil and gas" sector dropped by 20.4% in December on a year-over-year basis! That's a huge drop. Even, employment in utilities took a large hit, dropping at 16.7%. Another problem is that the goods-producing industry is not isolated; the services-producing sector caters to the resource-based companies and utilities in the province. For example, "Transportation and warehousing" is down by 11.4%. And even "Finance, insurance, real estate, rental and leasing" is down by 7.2%. Its a bit too early to tell, but it's likely that the downturn in the goods-producing sector is now starting to have ripple effects on services-producing ones in Newfoundland and Labrador.

In Alberta, it's a similar story, but the drops are not as big. The biggest declines in employment were also in the goods-producing sector, according to Statistics Canada, coming in at 3.9%. "Forestry, fishing, mining, quarrying, oil and gas" saw a drop of 10.7%! Meanwhile, manufacturing and construction is down by 3.3% and 1.9%, each. "Transportation and warehousing" is also down by 5%. And, "Business, building and other support services" that includes support industries for the aforementioned sectors is down by a huge 17%. Ouch.

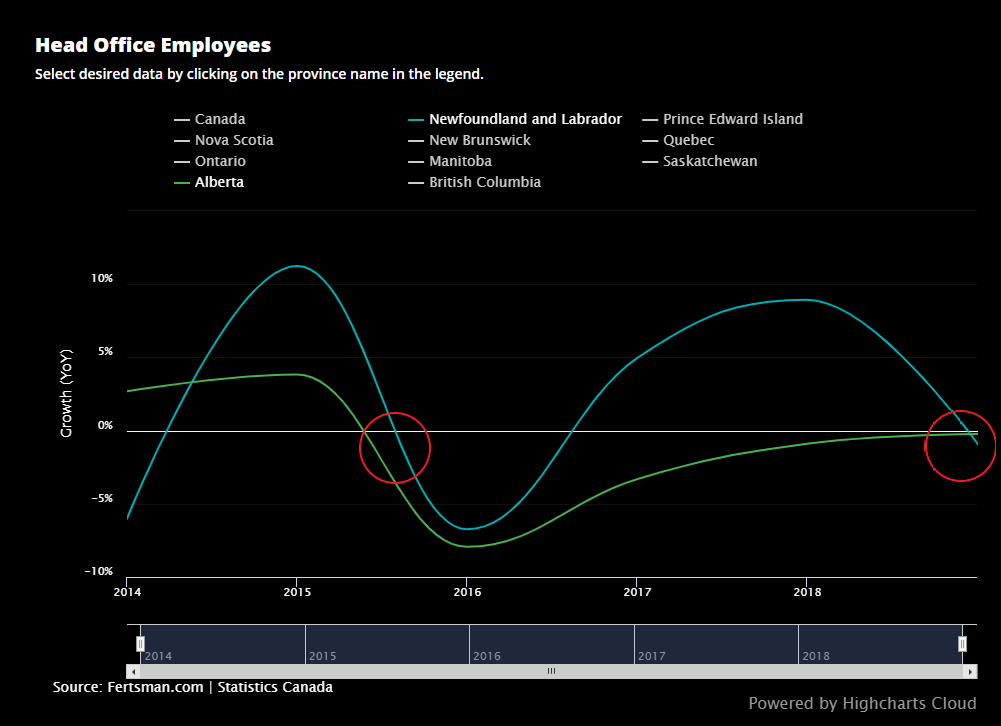

Statistics Canada has also started collecting some other type of employment data over the last several years to give us a few different angles to look at. Above is a chart that gives you annual data for total employees in head offices in Newfoundland and Alberta, but it doesn't include 2019. In Newfoundland we are beginning to see that employment dropped in head offices across 2018. Meanwhile, in Alberta, the head office body count has been dropping since at least 2016. If anything, this serves as a confirmation of sorts that employment is trending downward.

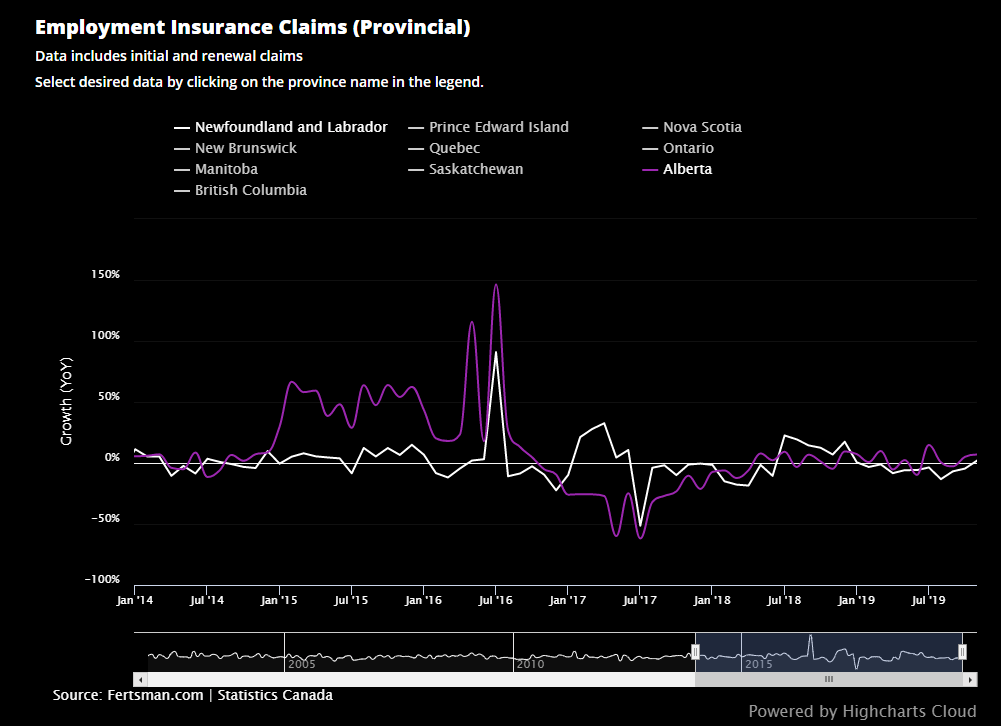

Growth in employment insurance claims remains low

While employment levels are dropping overall and in specific sectors in Alberta and Newfoundland, growth in employment insurance claims remains low (see the chart above). When things started to go downhill in 2015, the effects were not felt in the employment insurance data until later in 2016. As you can see, things got pretty hairy at the time, with claims growing very strongly mid year. So, it's likely that things will stay quiet in the employment data until later in 2020. And if employment growth manages to (hopefully) resume in the early months of 2020, then maybe we won't see anything crazy in the employment insurance data at all.

Cover image by: Erik Mclean via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX