Unabsorbed new construction falling in Vancouver, Edmonton, and (almost) Calgary, increasing odds of price rallies

January 28, 2020

Erik Fertsman

The latest data on unabsorbed new construction inventories show some promising developments for the Vancouver, Edmonton, and Calgary housing markets, which are currently experiencing falling home prices. Inventory levels are now decreasing or, as is the case in Calgary, close to decreasing. And this has been historically followed by price rallies.

Article continues below.

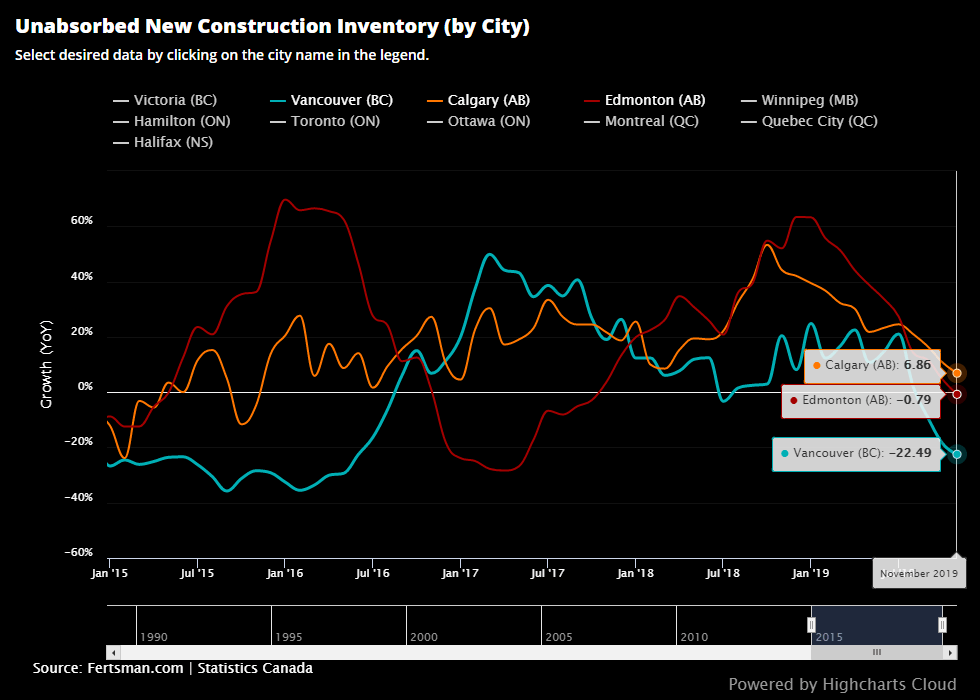

Total unabsorbed new construction now contracting in markets with the worst home price performance

As per the chart above, unabsorbed new construction inventory is down over 22% in November on a year-over-year basis in Vancouver. This is a pretty large drop in percentage terms. What's more, inventory in Edmonton is also just starting to drop, coming in at -0.79% in the latest data. Meanwhile, inventory in Calgary was still increasing in November at over 6%, but overall growth is trending downward. Notice how long inventory levels have been piling up in all these markets. In Vancouver, new construction has been increasing fairly consistently since the latter half of 2016 when economic conditions started to deteriorate. Things have been worse in Calgary and Edmonton, with inventories increasing since at least the first half of 2015 when things got bad in the resource sector.

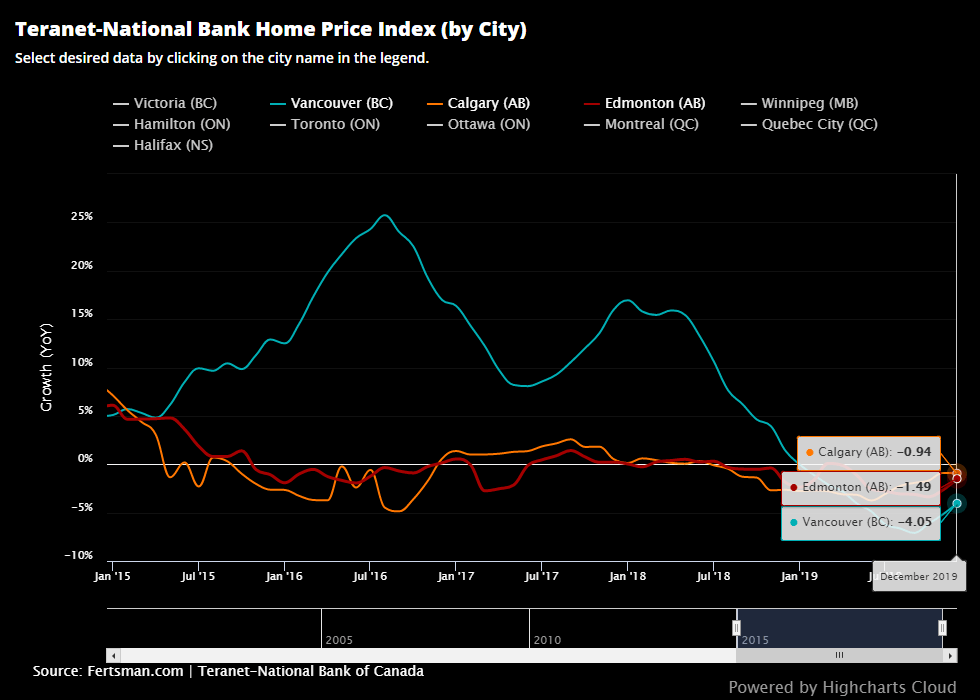

Home price index contractions are reversing toward growth

Looking at the home price index data for Vancouver, Edmonton and Calgary, we can spot trend reversals in the home price contractions. Vancouver's contractions were a little over 4%, down from 5.18% in November. Contractions in Calgary and Edmonton were also down slightly from the previous month in the data. Generally there is a bit of a lag between trend changes in inventory levels and the price data, but the correlation is clear. Look at how price growth started to dive in the latter half of 2016 in Vancouver just as unabsorbed inventory started to pile up. As long as inventories keep dropping, odds are good that we'll start to see prices rally in these markets this year. Of course, inventory draw-downs largely depend on mortgage originations, but provincial mortgage statistics for the fourth quarter are not out yet so stay tuned.

Cover image by: Kyle Ryan via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX