Business loan growth near zero in Alberta and Newfoundland, but mortgages are up

January 30, 2020

Erik Fertsman

Things are not so hunky-dory in Alberta and Newfoundland. These two economies have been hit with performance declines in their goods-producing sectors, and its beginning to affect everything from the services-producing sectors to employment figures. As always, we like to take a look at commercial bank credit statistics in these cases because they reveal a lot about the underlying cause of the performance issues. For example, are the banks doling out productive credit so that the economy can get out of the rut, or are they simply doing the usual thing and pumping out unproductive credit for asset purchases like homes? Here's what we found:

Article continues below.

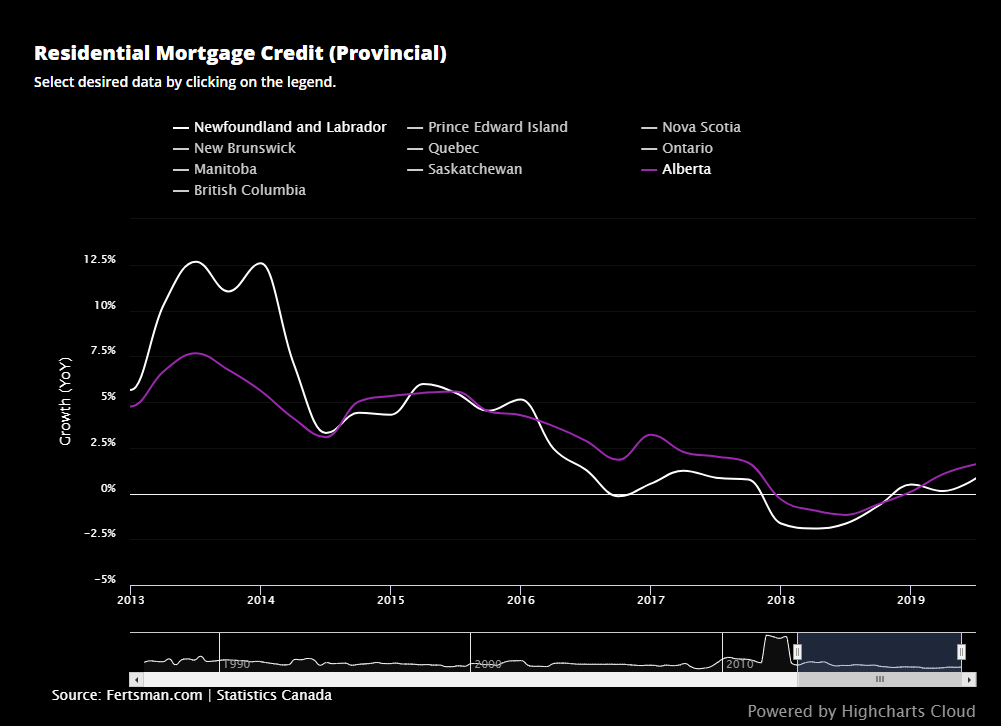

Mortgage credit is now growing again...

Just to recap, the economic growth issues in Alberta and Newfoundland are quite pronounced. Both are suffering from economic growth contractions that are being driven by issues in goods-producing sectors (primarily in resource extraction, but also in manufacturing and utilities). Both registered falling employment figures in December on a year-over-year and seasonally adjusted basis. Both markets are currently experiencing declining home prices. However, the housing markets in Calgary and Edmonton have seen growth in unabsorbed new construction inventory come down significantly, indicating that prices might have a chance to bounce back soon after almost two years of declines. But this is a bit puzzling, because home prices shouldn't be on the rebound during such economic conditions.

On the chart above you'll see data for growth in commercial bank mortgage credit in both Newfoundland and Alberta. And what this data is telling us is that, despite depressed economic conditions, the banks have been doling out mortgage credit again. In the Eastern province, mortgages are up 0.83% on a year-over-year basis as of Q3 2019. In the Western province, mortgages are up 1.6% on a year-over-year basis as of the same period. These numbers are currently far too low to have a positive influence on housing prices (according to our model these provinces need about +5% growth in mortgages on a year-over-year basis to get things moving off the ground). However, the trend seems to be changing, and the banks appear to be increasing mortgage originations. A big question that stands is, why are the banks pumping out mortgages again when the underlying economy is performing so poorly? Mortgages are a form of unproductive credit, and so there is nothing fundamentally good about them when you're trying to get the economy off the ground.

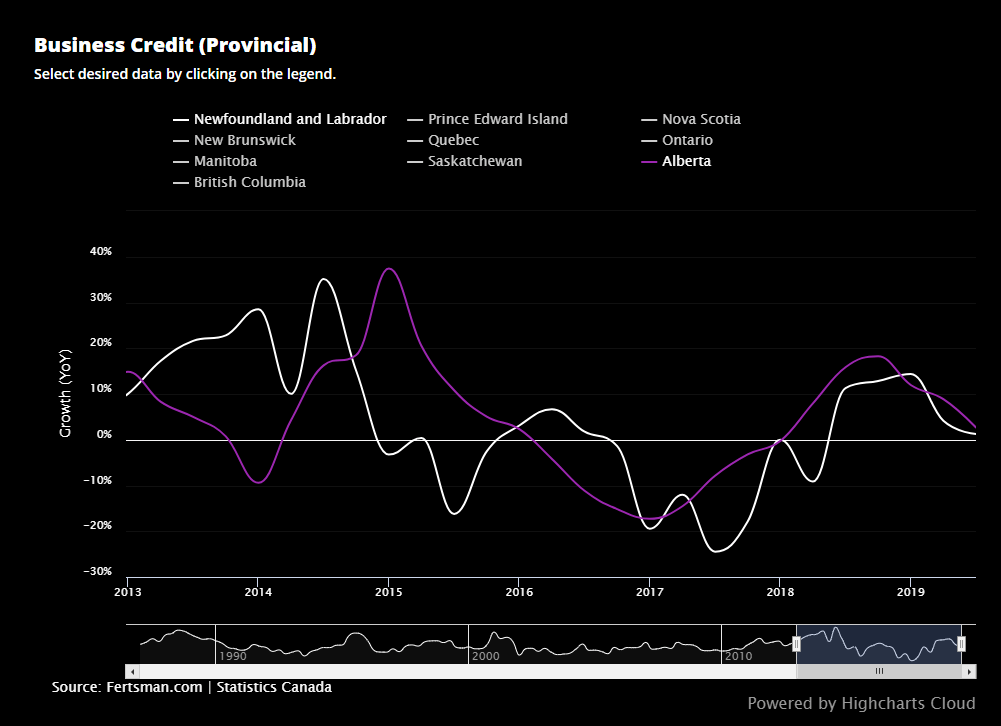

Business credit is barely growing. Why?

If you've been following the Alberta and Newfoundland economic story for the last half a decade or so, you'll know that both provinces experienced quite a few issues back in 2015-2016 when economic conditions completely stalled. This stall did a lot of damage: unemployment increased and employment insurance claims went through the roof. There is now a fairly large degree of separatist sentiment in Alberta, and "Western alienation" is back on the table. The single biggest cause of the economic stall in Alberta, as well as Newfoundland, was the collapse in commercial bank business credit. These loans are super important for economic growth, including GDP and wage gains. Without them there is no effective productive investment, which is achieved when banks create new purchasing power that is injected into the real economy. The result is economic stagnation, not only on paper but also in real life.

As you can see on the chart above, the drop in business loan growth was quite profound in both Newfoundland and Alberta between 2015 and 2018. In Newfoundland, business loan growth contracted by as much as 24% in 2017. And in Alberta, peak loan contraction came in around 17% at the end of 2016. Those are absolutely massive drops. Business loan growth only bounced back in 2018 - three years later! Unfortunately, we are now seeing business loan growth approaching zero once again in the Q3 2019 data. It is no surprise, then, that we are starting to see falling employment levels and significant contractions in goods and services-producing sectors of the economy. It's too bad the banks are busy doling out mortgages again...

Cover image by: Daven Froberg via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX