Goods-producing industry in Canada shrunk throughout 2019, here's why

January 27, 2020

Erik Fertsman

Canada's GDP has been slowing since the summer of 2017. But GDP is a fairly large measure, and so the slowdown could be the result of a whole host of things. A closer look reveals that the source of the sore spot has been in the goods-producing sector of the economy, which makes up a large chunk of GDP. This sector includes manufacturing, agriculture, resource extraction, utilities, and so on -- the staples of any strong economy. The latest data from Statistics Canada now shows that manufacturing and resource extraction is to blame for the weakness in the goods-producing economy. Here are the details:

Article continues below.

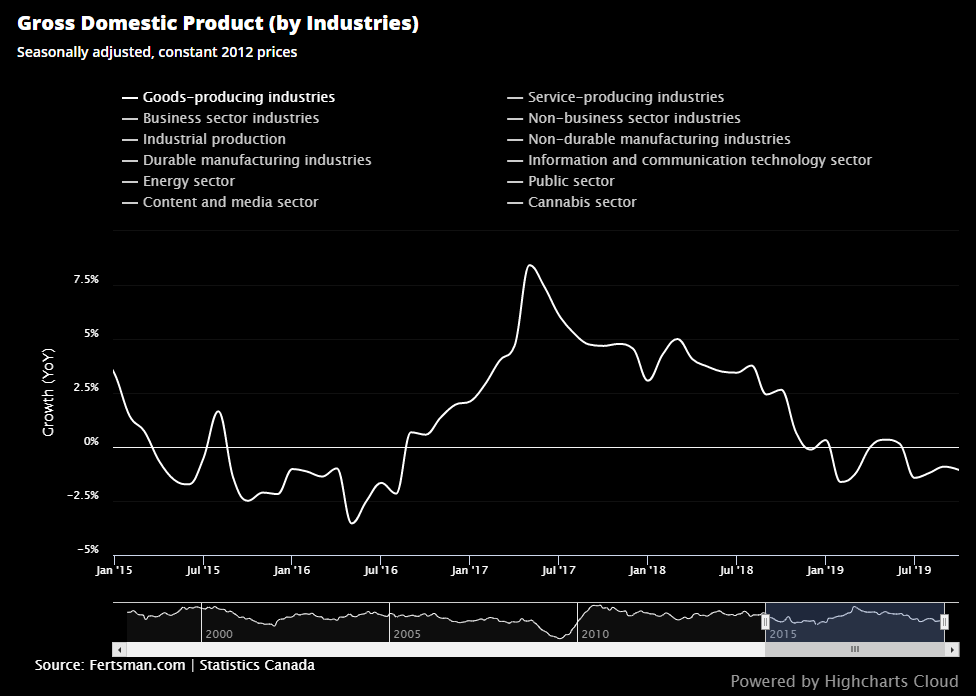

Overall, goods-producing industries are sinking

As we can see on this chart, growth in the goods-producing economy first entered contraction in December 2018 and has remained in contraction territory ever since. As of October, the latest data available, growth is sitting at -1.06%. The pattern is now similar to the one we saw back between 2015 and 2016 when growth in the economy as a whole briefly declined (this is why I am expecting an overall economic contraction in the 2020 data). The thing is, as I explain below, things are a bit different this time around.

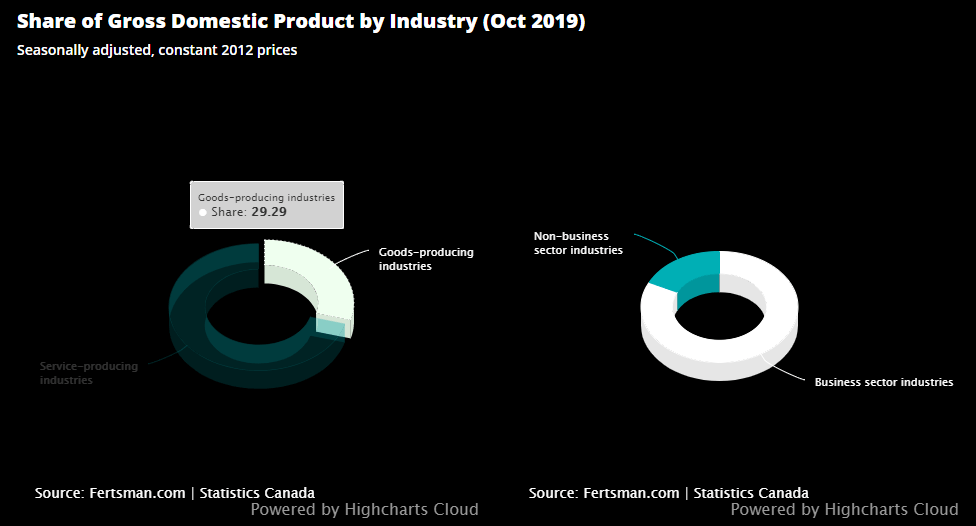

How large is the goods-producing sector relative to the rest of the economy?

Keep in mind that the goods-producing sector of the Canadian economy is not as big as the services-producing side, as we can see on this chart. However, goods still account for over 29% of GDP, and contractions or gains in the sector can have a profound impact on overall growth levels.

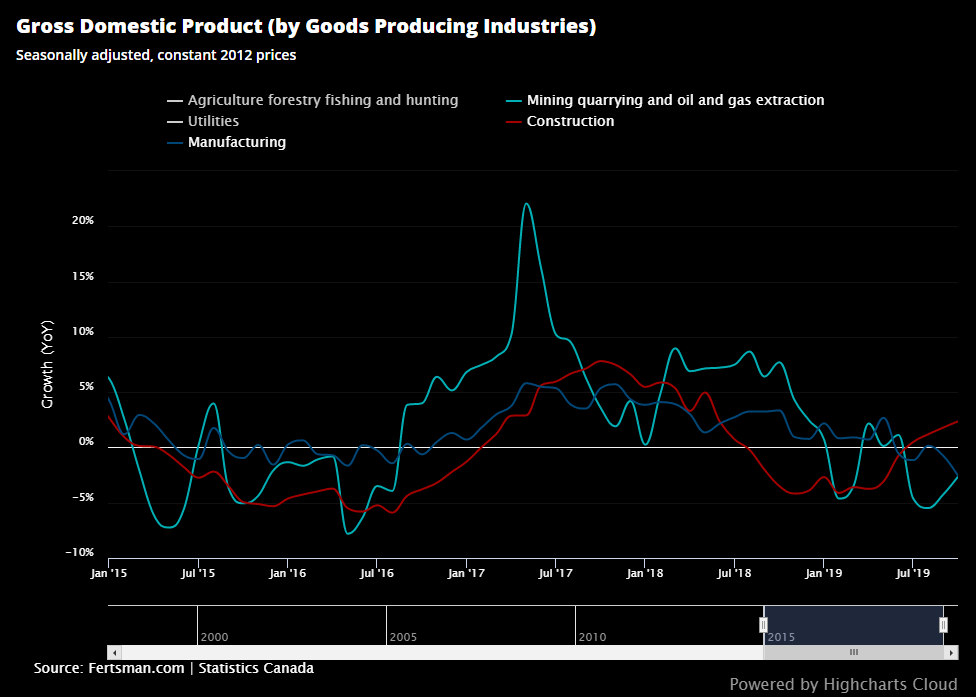

Contraction is being led by declines in manufacturing and resource extraction

The primary cause of the weakness in the goods-producing sector is the contraction in manufacturing and resource extraction (see chart below). Resource extraction growth sits at -2.64% in the latest data, after briefly visiting a three year-low of -5.49% in August. Meanwhile, manufacturing is at -2.56%, which is the lowest since July 2013! There is some good news: construction was up in October at 2.36%, helping offset the declines in manufacturing. But, this means that the current slowdown in the goods-producing sector is different from the slowdown in 2015-2016, since manufacturing was doing better and construction was doing worse. One of the problems with this manufacturing slowdown is that manufacturing tends to be less flexible, making growth and contractions last longer. Construction, on the other hand, tends to move faster in either direction. One theory we can make is that the slowdown in the goods-producing sector could last longer this time around. What's more, there does not seem to be any strong signs that the resource extraction sector is getting the adequate investment and policy response from governments and banks that it needs to turn things around quickly.

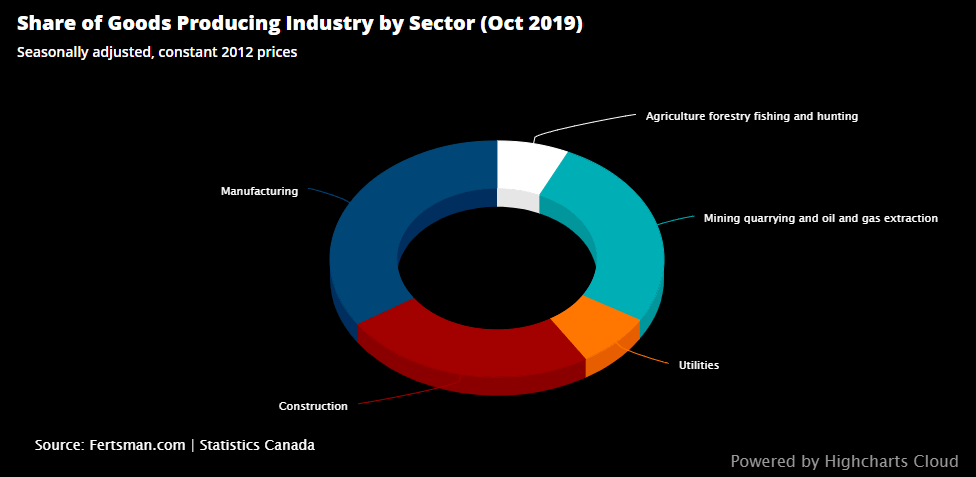

Manufacturing, resource extraction, and construction hold a large share of goods-producing GDP

To put things into perspective a little better, take a look at this chart to get an idea of how large these three sectors are (manufacturing, construction, and resource extraction). As you can see, manufacturing is a huge chunk of the goods-producing pie (over 32%), with resource extraction (26%) and construction (24%) following in second and third place. These sectors are important to gauge when attempting to explain variation in Canada's GDP levels on a year-over-year basis. Unfortunately, what we are seeing are slowdowns in two out of three major goods-producing sectors of the economy. And the thing with construction is that, if things get doggy in the housing market with inventory build-ups and price issues, then it is likely that things could contract even more. What the manufacturing and resource extraction industries need to get out of the current slump is access to more commercial bank loans and industrial assistance from governments in Canada.

Cover image by: Robin Sommer via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX