Strong home price growth continued in August across Canada

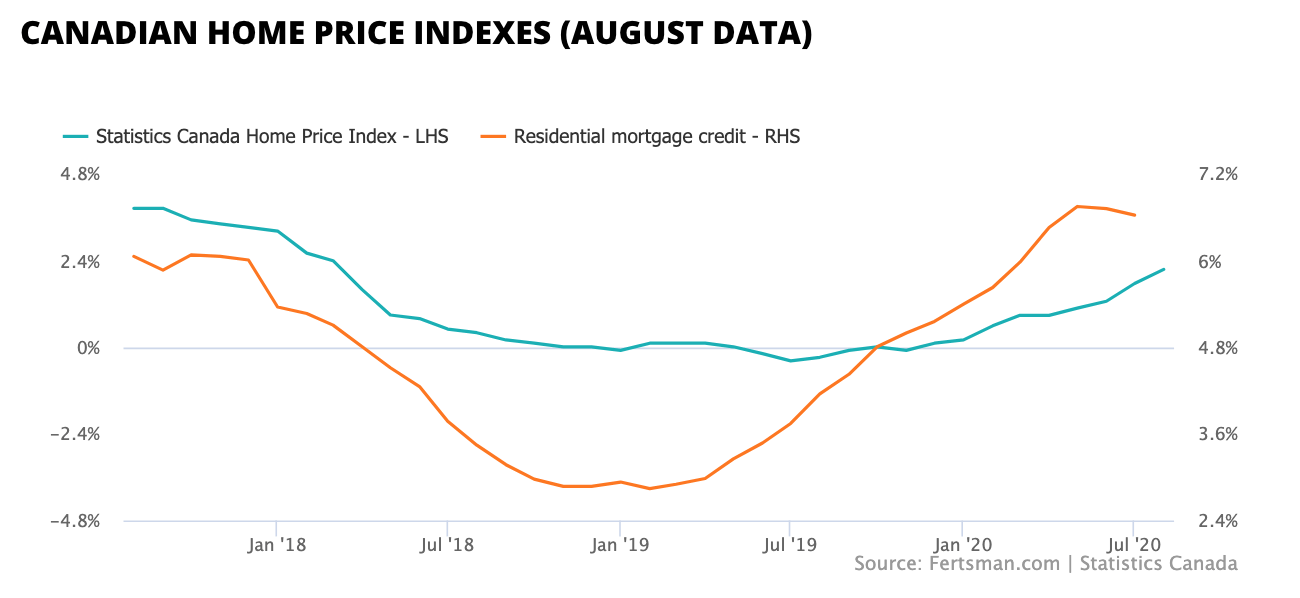

The latest data published by Statistics Canada and Teranet show that Canadian home prices grew strongly in August. Statistics Canada reports that its aggregate home price index rose over 2.14% year-over-year, while Teranet reports that its composite index grew by 5.68% year-over-year. The strength in the housing market comes from strong demand enabled by record residential mortgage growth, as we reported last week. This demand is putting considerable pressure on new and existing housing inventory levels, resulting in significant market competition in the form of bidding wars.

The cities to experience the strongest price growth rates this year are Ottawa (+12.65%), Halifax (+11.13%), and Montreal (+10.14%) based on data provided by Teranet. Toronto posted a growth rate of 7.32% in August. Vancouver is looking at a year-over-year growth rate of 3.21%.

Cover image by: Eugene Aikimov via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.