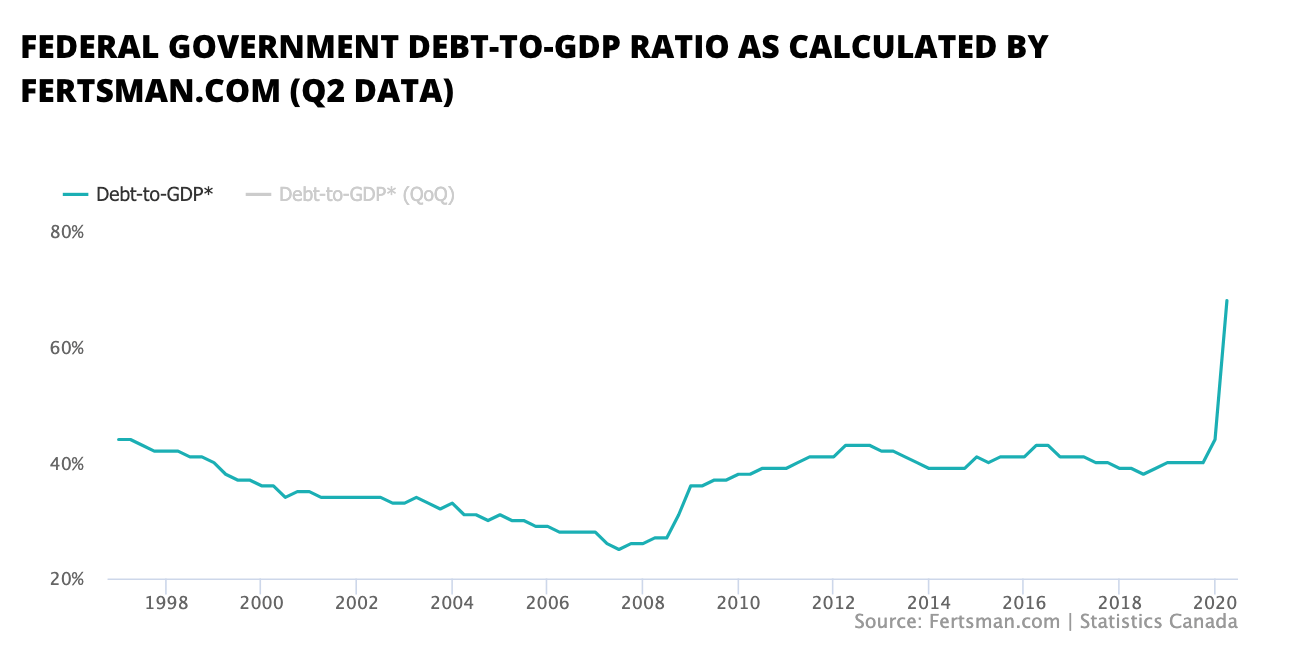

Federal government's debt-to-GDP ratio rises sharply in Q2

The federal government's debt-to-GDP ratio (as calculated by Fertsman.com) reached 68% in the second quarter of this year, up 70% from the second quarter of last year. GDP came in at $1.7 trillion CAD in Q2 while total loans, securities and other shares outstanding on the government's balance sheet came in at $1.17 trillion CAD.

The debt-to-GDP ratio climbed at a steeper rate this time around than it did during the great financial crisis. During the first quarter of 2009, Canada's federal debt-to-GDP climbed only 38%. If government spending continues to climb and GDP continues to fall, the debt-to-GDP level could reach 100% before the end of 2021.

The debt-to-GDP data has now been added to the dashboard overview page.

Cover image by: Charles Deluvio via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.