Update on our Canadian home price model

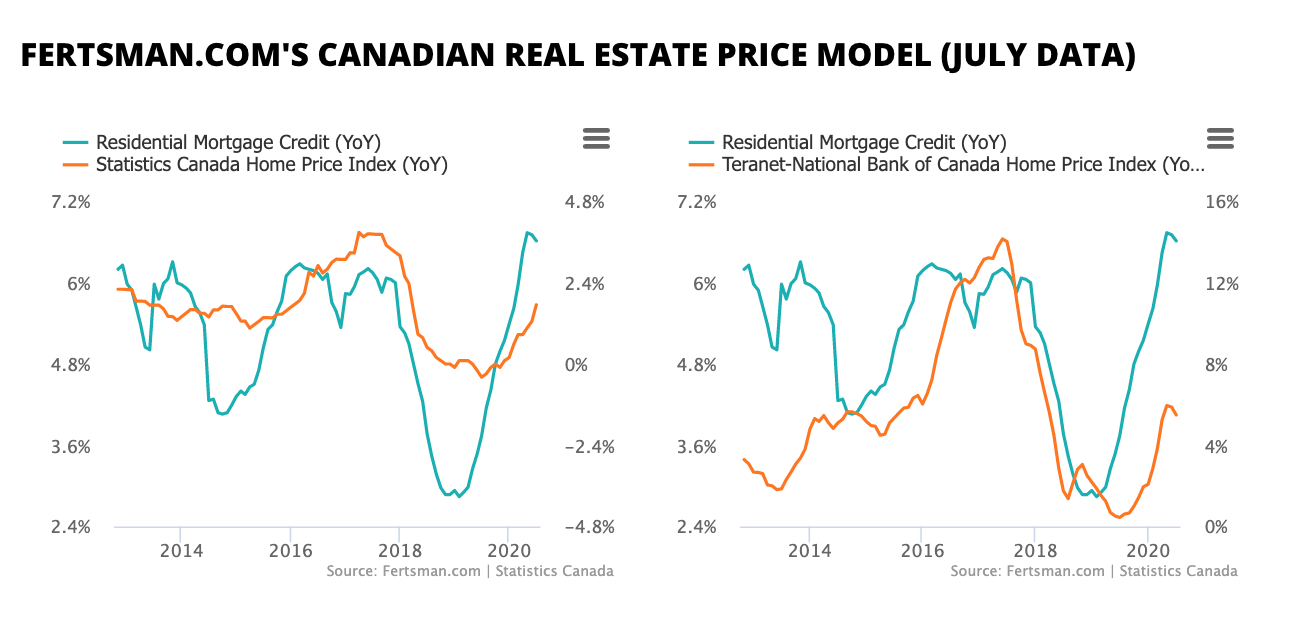

Home prices across many Canadian cities have increased rapidly over the last 6 months. In Ottawa and Halifax home prices are up over 10% annualized. In Toronto prices are back to growing above 8% annualized. Even Vancouver is seeing positive year-over-year growth, where prices are some of the most expensive in the world. Despite the fact that Canada has experienced one of the biggest economic shocks on record, real estate prices across Canada are up overall. Statistics Canada reports that prices are up nationally by almost 2%, while Teranet and the National Bank of Canada report home prices are up across Canada by over 5%. Here's what our Canadian real estate model suggests is going on.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

Home prices are up across Canada because Canadian banks have managed to issue a large quantity of mortgages. If you're new to our site, we came up with a Canadian real estate model based on disaggregated credit statistics. Our model suggests that real estate prices are driven by commercial bank mortgage credit. As you can see on the charts above, home prices and mortgage credit fluctuate in tandem. In July residential mortgage credit was up over 6 percent annualized according to Stats Can.

Thanks to some fancy accounting/regulatory tricks and government support, commercial banks were able to keep lending large quantities of money in the form of mortgages to consumers. The Office of the Superintendent for Financial Institutions (or "OSFI") relaxed rules around the sum of money banks need to hold for a rainy day, introduced loan deferral programs that allowed banks to postpone the recognition of any bad loans, and allowed some banks to sell risky preferred shares to pension funds (something that was frowned upon and even forbidden in the years prior) to raise money for lending activities. Since the rules and incentives around mortgages didn't change, banks continued to focus their efforts in this department. The banks have pushed out more than $25 billion in mortgages out their doors since January of this year. That's record territory.

Consumers also benefited from government programs. Canadians have access to a variety of first-time home buyer programs across the country, hosted by the federal and provincial governments. Those who lost work have received large quantities of government stimulus (i.e., CERB, CESB, etc.). As a result, the mortgage market has seen very little disruption. The banks are still lending and consumers are still paying, even if many of these payment are technically deferred.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

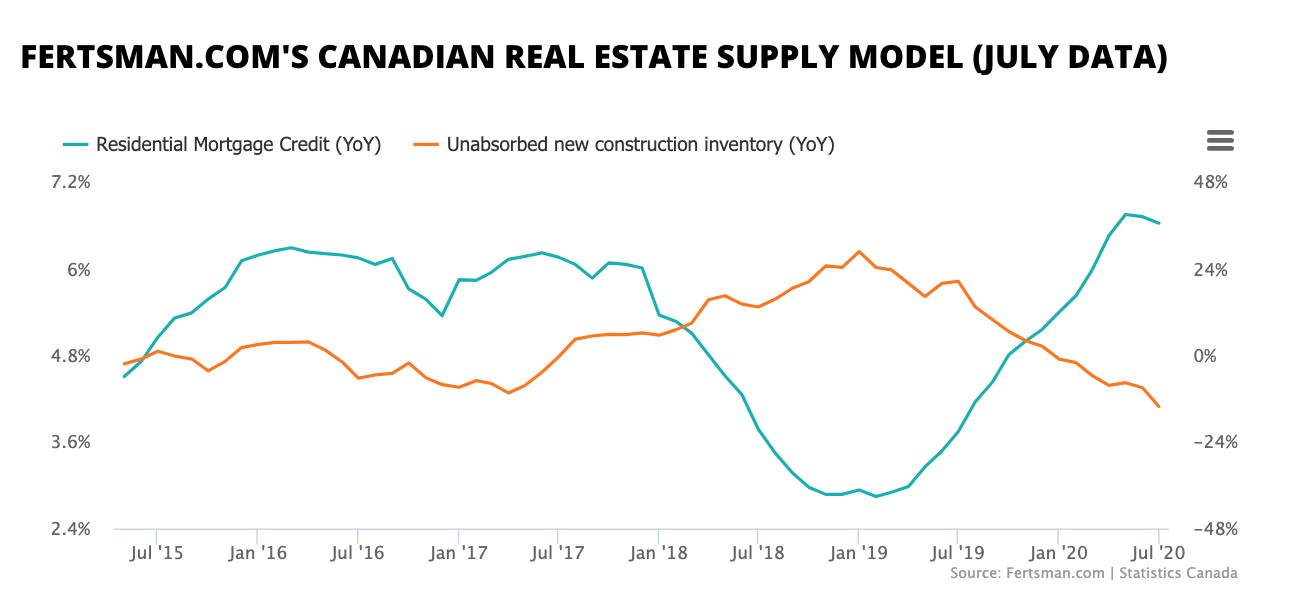

The large growth in the mortgage market has also had a significant impact on supply, which is an underlying factor for prices. In July, when mortgages were up over 6%, unabsorbed new construction inventory across Canada was down more than 14%. New construction inventories started to fall in January for the first time since July 2017 when prices started to decelerate in the real estate market. If mortgage growth continues unabated, new construction inventories will continue to fall and home price growth will accelerate sharply.

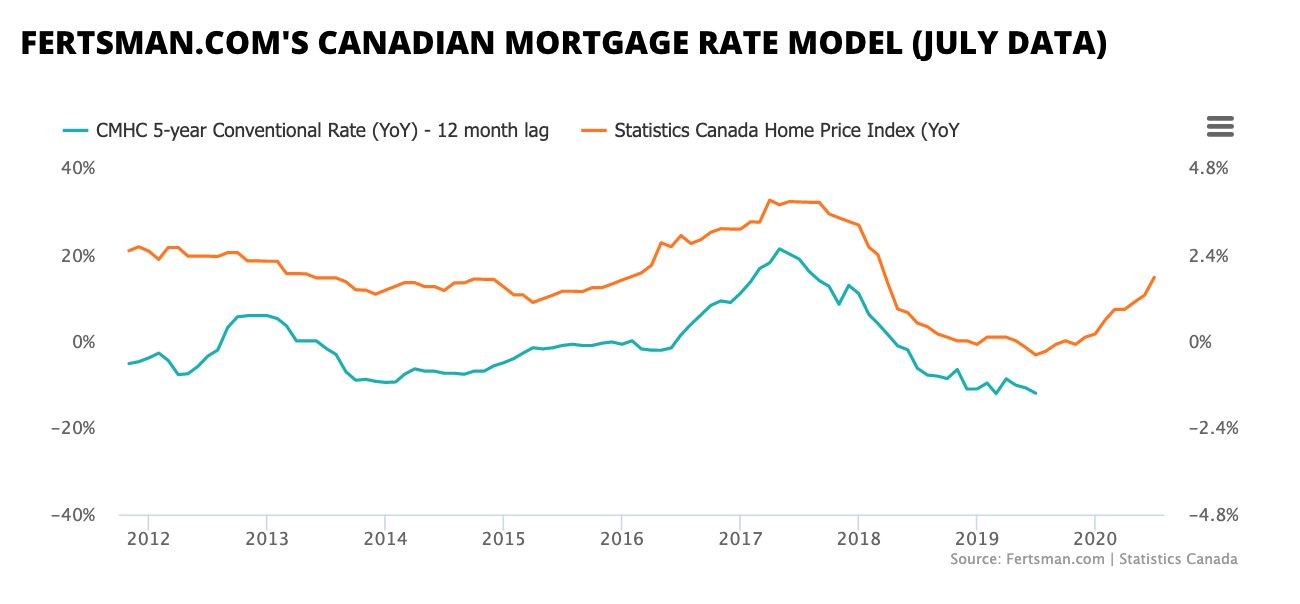

All of this price and supply action is unfolding during a time of very low interest rates in the mortgage market. Rates on many mortgages are now below 2%. Some folks are now locked into arrangements where they are contributing more toward the principle than the interest on their mortgage. Despite the growth in real estate prices and mortgage quantities, this low interest rate environment will likely linger. Generally, interest rates lag Canadian home prices and mortgage credit growth by 12 months. If our model is correct, mortgage rates will only start to bottom on an annualized basis this year and probably stay there for much of next year.

The question now is, will mortgage growth continue unabated or will the banks and consumers be forced to rein in their appetite for unproductive risk?

Cover image by: Pierre Jarry via Unsplash

*This article was modified on September 15, 2020 to properly reflect our interest rate model.

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.