GDP bounced in November, but goods-producing sector remained in contraction

February 1, 2020

Erik Fertsman

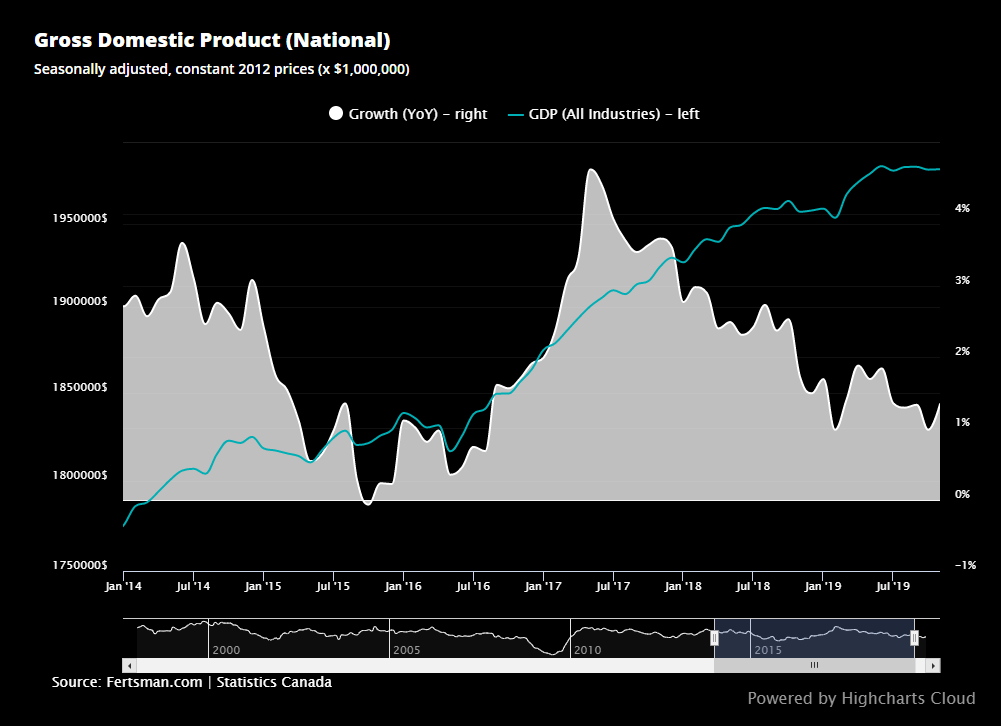

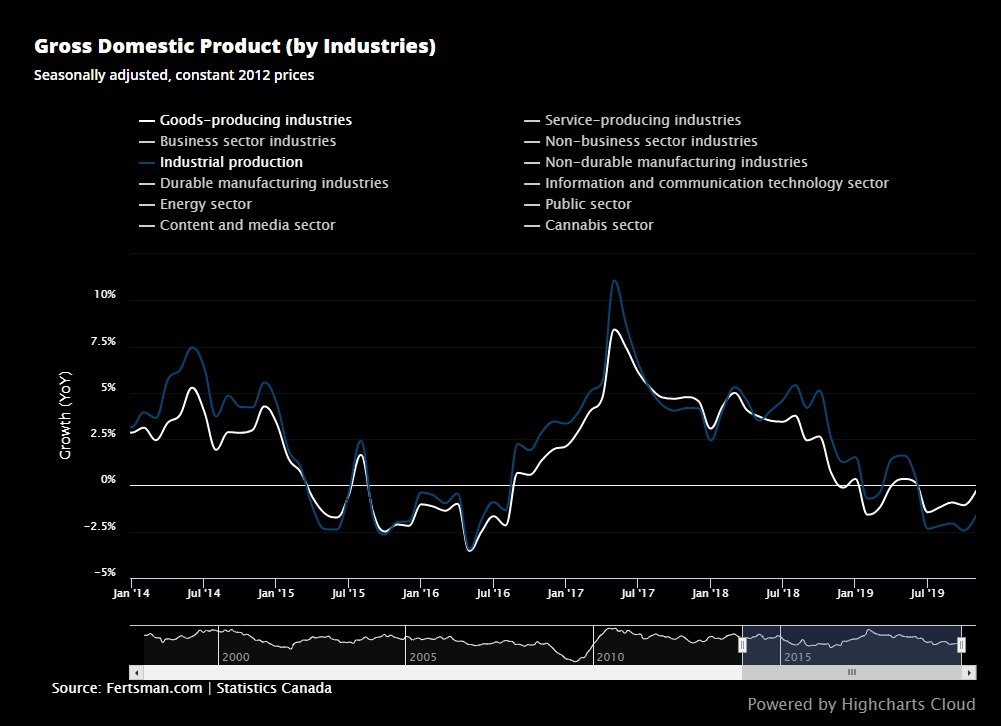

Yesterday, Statistics Canada released the latest economic growth figures. November saw economic output jump slightly, but the growth deceleration that we've been watching for a few years now is still intact. Goods-producing industries remained in contraction, led by falls in industrial production (especially in durable and non-durable goods and energy). Non-durable manufacturing is now contracting at levels beyond anything recorded between 2015 and 2016. Here are the numbers:

ARTICLE CONTINUES BELOW

GDP bounced, but momentum is still fading...

On a year-over-year basis, Canada's GDP growth came in at 1.34% in November. This is up slightly from 0.98% in October. As usual, the previously reported numbers were revised slightly. Total economic output came in at $1.983 trillion, which would be equivalent to about 9% of the US economy.

Goods-producing industries are still in trouble...

One of the largest drags on overall economic output at the moment can be found in the goods-producing sector of the economy, which includes things like manufacturing, resource extraction, and energy production.

According to Statistics Canada (see the chart above), goods-producing industries contracted by 0.3% on a year-over-year basis. This is down from over 1% a month before, but the downtrend in the growth rate of goods-producing industries is still intact. Moreover, industrial production contracted by 1.64% from a year prior, which is near the all-time low in the chart above. Luckily things are not as bad as 2016, but the risk of further contraction is still there.

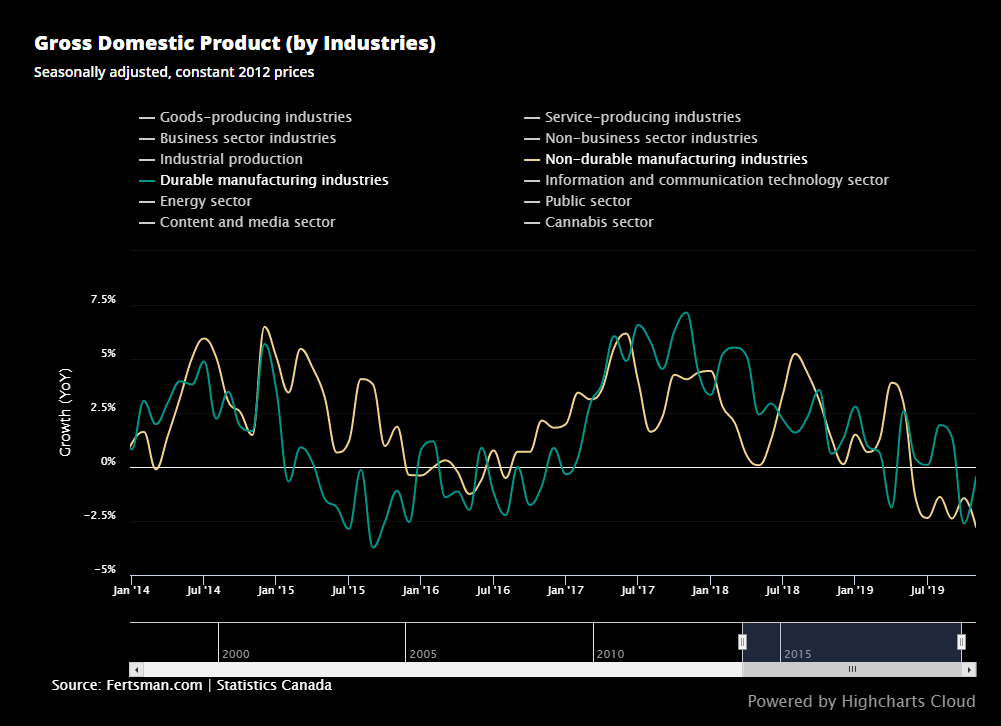

Moreover, durable goods manufacturing is down by 0.46% on a year-over-year basis, which includes things like automobiles, appliances, consumer electronics, jewelry, firearms, medical equipment, and so on. Meanwhile, non-durable manufacturing contracted by 2.77% on a year-over-year basis. Non-durables include things like food and other "soft goods" which are consumable and either wear out or become useless after a short period of time. As you can see, non-durable manufacturing is contracting harder than it did during any period between 2015 and 2016. Uh-oh...

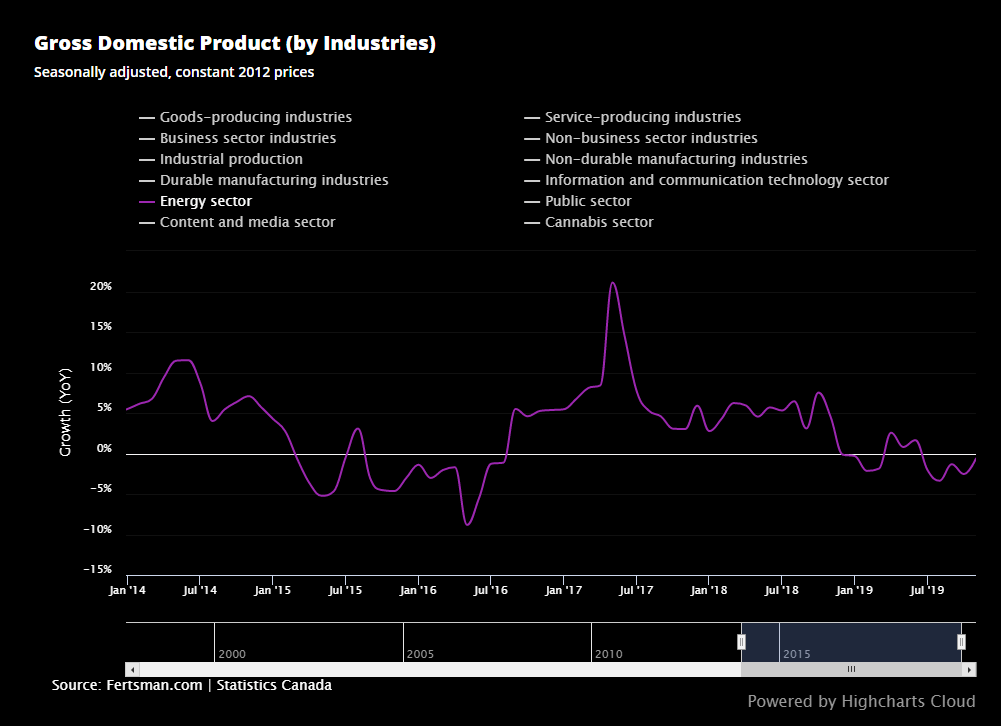

Lastly, we've also noticed that overall growth in the energy sector has been trending downward and is now contracting. In November, the energy sector in Canada contracted by 0.63% on a year-over-year basis. The sector is composed primarily of transactions in oil and gas extraction, coal mining, ore mining, supporting activities for resource extraction, electric power generation, resource transmission and distribution, petroleum refineries, and pipeline transportation.

In terms of the overall significance of these contractions, it's worth taking a look at the size of the sectors that are contracting at the moment (see the chart above). Industrial production is about 20% of GDP, while non-durable and durable production is about 4.5% and 5.5%, respectively. The energy sector is almost 10% of the economy. So, based on these numbers, the contractions we see in the goods-producing sector are significant relative to overall GDP and explain why there is so much weakness in the Canadian economy at the moment.

It should be noted that many economists these days contend that 1% to 2% economic growth is adequate based on Canada's "capacity," However, this is quite misleading, as historically Canada's economy has shown that it can grow at 4% to 6% on an annualized basis. Also, our economy has only become better at what we do and we have a better educated workforce. Therefore, we believe the current economic output that is averaging about 2% and is repeatedly landing around 0% indicates that there are some serious structural issues in the economy that governments and important economic stakeholders like commercial banks are not dealing with.

Cover image by: Spencer Davis via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX