Average weekly earnings grow faster than home price across Canada, but will it last?

January 31, 2020

Erik Fertsman

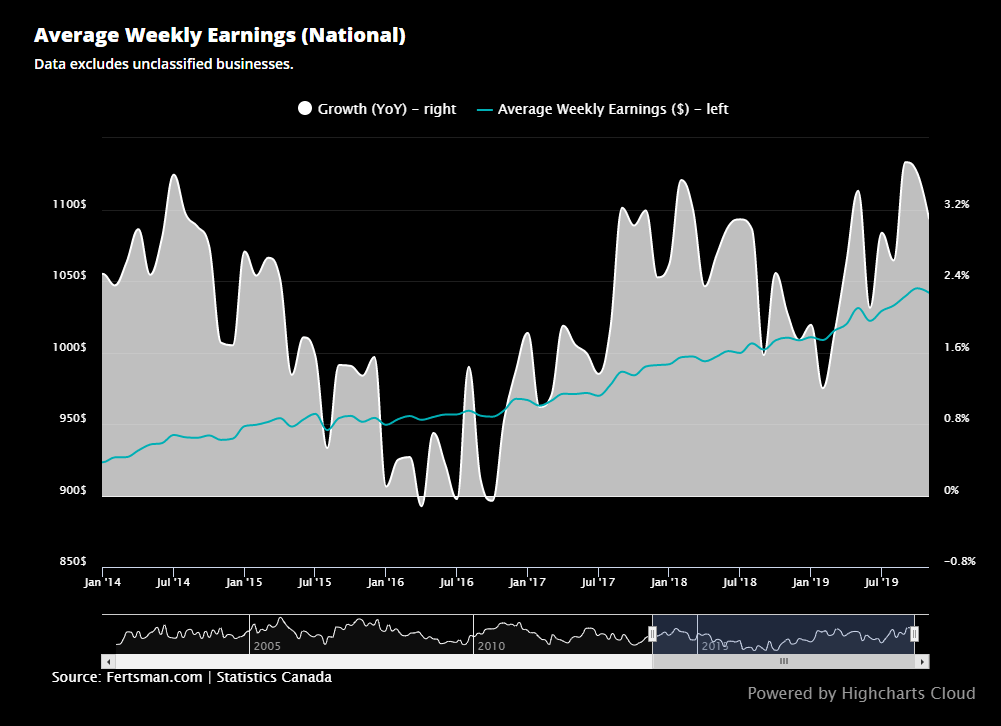

Statistics Canada just released the latest average weekly earnings, which give us a snapshot of what the average worker in Canada is earning each week across the country. For many years now, average weekly earnings growth has been negative relative to the growth in workers' living expenses. In other words, average wages have not kept up with inflation levels in certain baskets of goods, particularly housing. This is the core issue behind the housing affordability crisis that has engulfed Canada. It's also a problem for governments, who end up collecting inadequate tax revenues. Overall, the entire economy tends to suffer (critics will likely say that low wages are better for businesses since it means cheap labor). Anyway, recently, wage growth has been going strong and is currently outperforming growth in home prices. Here are the numbers:

Article continues below.

Wage growth is going strong...

According to the latest numbers from Stats Can, wage growth across the country came in at 3.1% on a year-over-year basis. The average national wage is now at $1041.8 per week, or $54,173.6 annualized. This might not seem like a big increase in percentage terms, but it's one of the fastest increases over the last 10 years; there were only a handful of times when wages increased above 3%. The fastest increase was 3.73% only a few months ago in September 2019. From this perspective, anything over 3% is a cause for celebration.

The spread between wages and home prices is good these days, but unlikely to last...

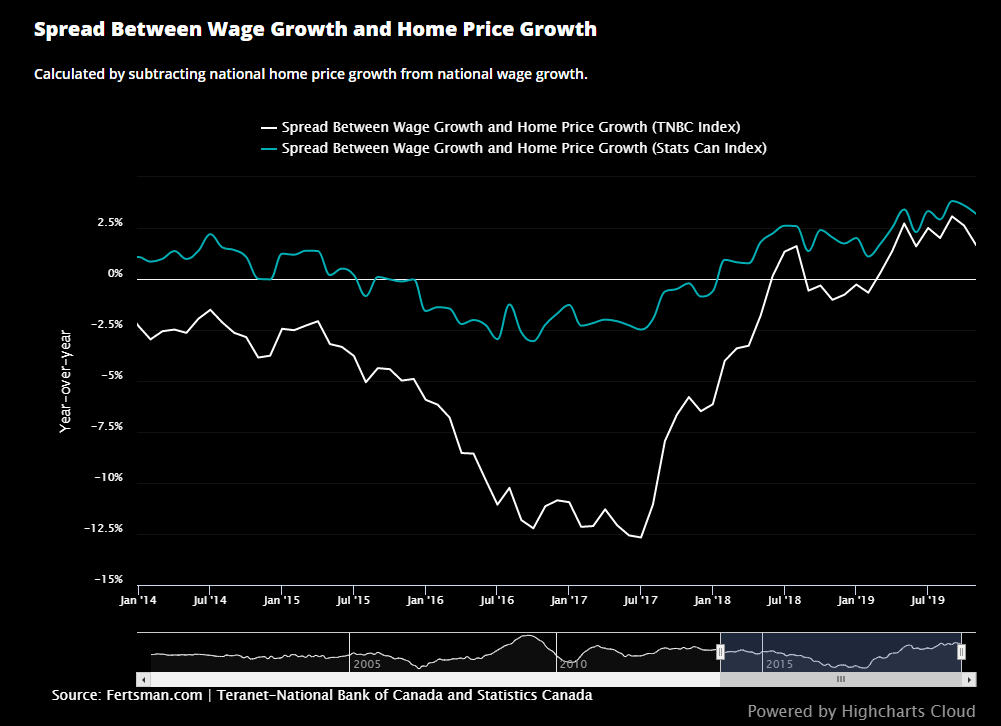

Percentage increases and dollar figures don't say much about the capacity of the average wage. It's more interesting to take a look at wage growth relative to growth in the prices of things you buy, like homes. As everyone knows, home price growth in Canada has been epic. And everyone knows this because housing is a large portion of average personal spending.

We can get a better look at wages by measuring the spread between wage growth and home price growth (see the chart above). The spread is calculated by taking the national average weekly earnings growth figure and deducting by the national home price growth figure. This gives you an idea on whether the average worker's wage is out-performing the housing market or not. If the outcome is positive, wages are performing better. And when wages are performing better, in theory, everything should be a bit more sustainable. Based on the latest data from Teranet-National Bank of Canada, wage growth in November outpaced home price growth in November by 1.6%. That's not too shabby. So, we can conclude that wages were going in the right direction in November. However, if we look at the rest of the chart, we'll notice that wages have severely under-performed over the last six years. Will wages continue to perform strongly? At the moment, we don't think so. Why? Because the banks are still focusing too much of their lending efforts on unproductive loans like mortgages rather than directing their talents on productive investments to businesses who pay good wages.

Cover image by: Verne Ho via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX