What the OSFI said about banks, mortgages, B-20, and HELOCs at the C.D. Howe Institute

February 3, 2020

Erik Fertsman

Nearly a fortnight ago, the Office of the Superintendent of Financial Institutions (OSFI) spoke

at an event hosted by the C.D. Howe Institute on the subject of "Sound Mortgage Underwriting: Foundations for Stability." The agency was there to talk about "financial stability in Canada and the critical role played by the housing finance sector. More specifically, about how OSFI helps maintain the soundness of lenders and the stability of the Canadian financial system by protecting depositors and other creditors."

This is a pressing subject considering Canada's "housing finance sector," together with government agencies like the OSFI, now oversee one of the greatest housing bubbles in the world. Many are wondering when the government will deal with housing affordability issues, and how. What is more, a large chunk of the services-producing sector of Canada's GDP revolves around real estate, and a portion of the goods-producing sector is made up of real estate construction. Real estate is big business in Canada. So, everyone is interested in hearing what the OSFI has to say about the matter of home financing.

ARTICLE CONTINUES BELOW

What does the Office of the Superintendent of Financial Institutions do?

The OSFI is one out of a handful of government agencies responsible for regulating Canada's financial market (primarily banks). When it comes to the mortgage market, they believe sound underwriting standards (lending rules and procedures) will foster economic stability. The organization said in its speech at the C.D. Howe Institute that it's not in the business of managing "demand for housing or mortgage credit," but rather, they work to "look beyond the immediate environment and to consider what can go wrong and take action according to the risks."

They take credit for "actions over the past 10 years to promote sound mortgage underwriting" which "have encouraged strong governance and risk management practices among lenders." The bottom line is that the agency believes mortgages can be part of a balanced economic diet, and that the rules and standards associated with the issuance of mortgages by banks are important for maintaining and achieving a balanced economy.

B-20 Guidelines

The OSFI's flagship initiative is the so-called "B-20 Guidelines," which are a set of rules for banks to follow when they issue uninsured mortgage products. According to the talk:

"OSFI is focused on preserving sound mortgage underwriting practices at financial institutions. Diligent underwriting improves the financial condition of lenders and, therefore, the stability of the financial system at large. B-20 serves those ends.The original guideline B-20 was issued in 2012 in response to lessons from the global financial crisis, work done by the Financial Stability Board, and our own observations of changes in the Canadian mortgage market.Subsequent revisions to B-20 over the years were all responsive to growing vulnerabilities that, in part, resulted from changing lending practices and uncertain housing market conditions.This includes looking at how lenders measure and assess a borrower's debt servicing capacity. Continually updating our risk data and reinforcing good practices helps preserve sound mortgage underwriting even while products and markets are changing."

In other words, the B-20 rules were introduced to preserve and improve mortgage lending standards and to resolve vulnerabilities in the housing market by ensuring that borrower can afford the housing debt incurred. A ton of effort has gone into the initiative:

"Guideline B-20 is so much more than simply a qualifying rate for uninsured mortgages; usually referred to as the 'stress-test' which is often confused with a similar qualifying rate used for insured mortgages.It demands clear underwriting policies that require complete and reliable information on the borrower, rigorous income verification, and a thorough valuation of the underlying property.Borrowers, as well as lenders, should understand their ability to repay the loan and be able to remain in their home if conditions change. It is prudent for the lender to assess the borrower's ability to withstand not just changes in interest rates, but also changes in property tax levels, utility rates, other debts and expenses and, most importantly, income or employment."

The OSFI contends that the B-20 rules are comprehensive and exist to strengthen banks, borrowers, and the housing market as a whole.

Is it working?

The agency believes that banks are following the rules and they expect this to continue:

"The qualifying rate is working. Firstly, one of the metrics (Loan-to-Income or "LTI") shows that fewer borrowers are becoming over-extended at origination. This is a modest improvement and we will continue to look at developments, as this metric continues to move in response to other factors.Secondly, we have not seen lenders extending mortgage amortizations to avoid the impact of the qualifying rate. The proportion of uninsured mortgages with amortization periods greater than 25 years has remained largely unchanged."

However, they have highlighted a number of challenges with mortgage qualification processes:

"Other challenges in the industry require continued diligence. There has been progress at institutions to improve income verification (self-run businesses, equity lending) and in detecting and deterring mortgage misrepresentation.Based on lender reviews, OSFI has observed that income verification requirements are generally well documented in policies. However, some lenders should clarify their policies related to "full financial picture" and use/definition of "declared" versus "verified" income.Most lenders have removed references to Non-Income Qualifying ("NIQ") / Stated Income mortgages in their policies. Nonetheless, we continue to see deficiencies in independently verifying income, and in ensuring that the source of verification is difficult to falsify."

Indeed, in my own personal conversations with mortgage brokers and real estate professionals, there seem to be a few different ways to get around income verification obstacles. It reminds me of the "due diligence" processes other financial professionals apply when fundraising or selling financial products to "accredited investors." The rules (or incentives) do not seem to be there to ensure that adequate steps are taken to find out if everyone actually qualifies or not. According to the OSFI, they are dealing with this issue when it comes to mortgage loan applications.

The challenge associated with HELOCs

The OSFI is facing some challenges is in a particular financial product segment that has become popular in recent years called the home equity line of credit, or HELOC. These products essentially allow existing homeowners to borrow against the value of their home at very low interest rates and often with no amortization period. Here's what the OSFI had to say:

"There are more than just mortgages and renewals to consider. OSFI also looks at the evolution of home equity lines of credit (or "HELOCs") and combined loans that have so-called amortizing and non-amortizing components.For many Canadians, the appeal of these loans is in the opportunities that this money can provide, post-secondary education for their children, helping a loved one buy a home, or home improvements.Institutions offer a wide range of combined loan products, each with different features and options. Many lenders are willing to provide these loans during stable economic times but may be less open to this lending when the forecast darkens.The evolution of combined loan products can make adding more risk easy for borrowers. OSFI is concerned that some lenders may be taking on more risk than they bargained for with these open-ended commitments."

The OSFI is concerned with HELOCs and the ways in which the product may be adding risks to the banking system. The money extracted from HELOCs can be used for pretty much anything from consumer items to down-payments on a home. We've heard stories that some folks are tapping their parents and grandparents for money via HELOCs to get a down-payment on a home they otherwise couldn't afford. OSFI says they are currently working with the Bank of Canada by collecting data on the impact of HELOCs on the housing market and the economy at large. We look forward to the findings.

The talk raises concerns

Despite all of this, the OSFI concluded their talk by insisting that "the Canadian financial system, financial institutions, borrowers and all Canadians benefit from strong mortgage underwriting." However, the talk raises some concerns from our perspective. First, HELOCs are a form of unproductive credit. At present time, Canada's productive industries are credit rationed, especially entrepreneurs and SMEs. Why the banks are focusing on this product segment when there are other industries to feed it is not clear. If the OSFI is concerned with HELOCs and the systematic risks it introduces into the financial system then why is the product still on the market and growing at breakneck speeds?

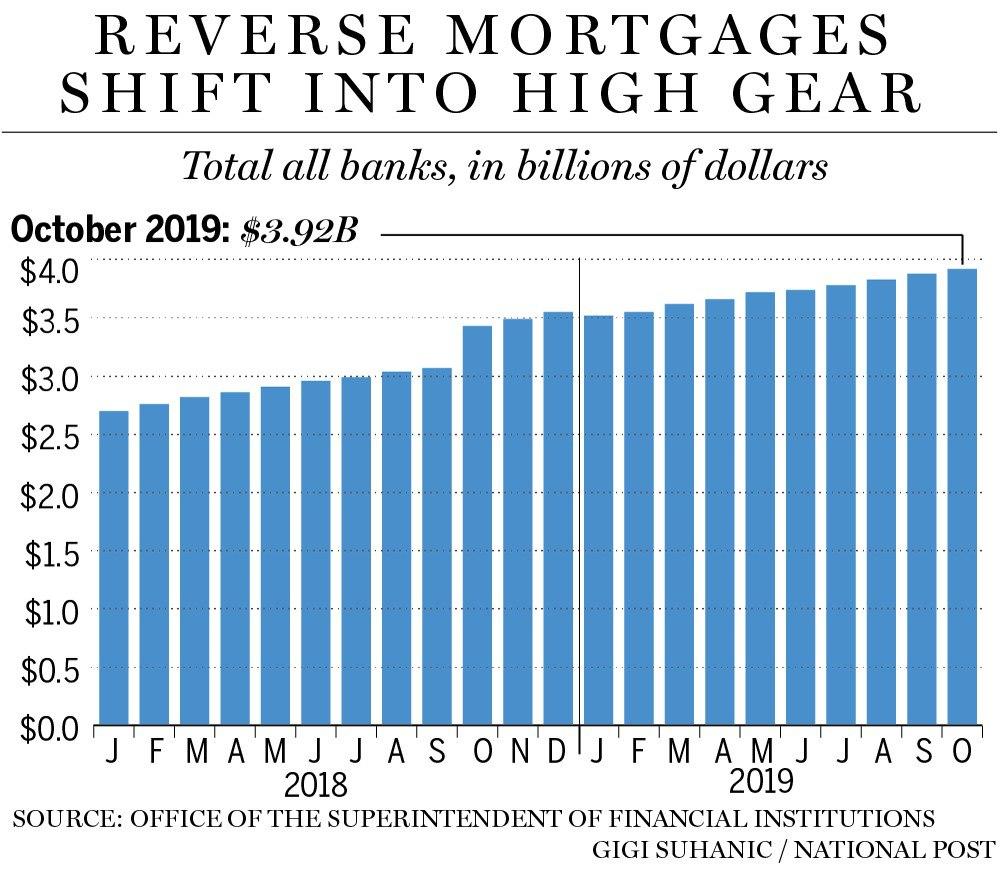

For instance, according to the chart above put together by the National Post using data from the OSFI, there is now approximately $4 billion in outstanding HELOC credit that has been issued by commercial banks. One-third of that originated over the last 24 months. That's explosive growth. The banks issued about $1.5 billion in new money that has gone to homeowners to be spent on all kinds of things. It is likely that the money was spent mostly on consumption and non-productive items. So, it's really a consumer loan backed by a residential property. As we know, this is a poor allocation of money by banks, as it's unlikely to contribute to sustainable economic growth as measured by GDP. Moreover, given that HELOCs are backed by home equity value, the more the banks lend out in HELOCs, the more they will be incentivized to see to it that home prices keep rising. That's not the kind of incentives we need in place amid housing affordability issues and significant leverage ratios.

This leads us to a second concern, which is perhaps the most important. The OSFI does not seem to be aware that home prices (or home price growth) are tied to mortgages (or mortgage growth), nor the problems associated with high mortgage growth. If, as the OSFI contends, its objective is to "look beyond the immediate environment and to consider what can go wrong and take actions according to the risks" then surely it needs to be aware of this. The organization says that its "aim is not to manage demand for housing or mortgage credit," but it does have an impact on supply. The rules it applies essentially determine whether a mortgage can be issued or not. Total mortgage credit has increased massively over the last 10 years - a period of time the organization takes pride in. The more mortgages the banks pump out, the higher home prices will go. We know what happens at the end of bank-credit induced housing bubbles: price busts and financial crises. Surely the OSFI knows this.

Cover image by: Mwangi Gatheca via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX