Canadian public debt charges fall despite record debt issuance

Over the last several months the Canadian government's revenues in the form of taxes have fallen significantly while expenses in the form of social programs have risen the most on record. How has the government managed to balance this equation? The answer is record debt issuance in the form of long and short-dated securities. One wouldn't be mistaken for thinking that this might be coming at a significant cost to the government. But despite the record debt binge, debt charges are actually falling. Here's why.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

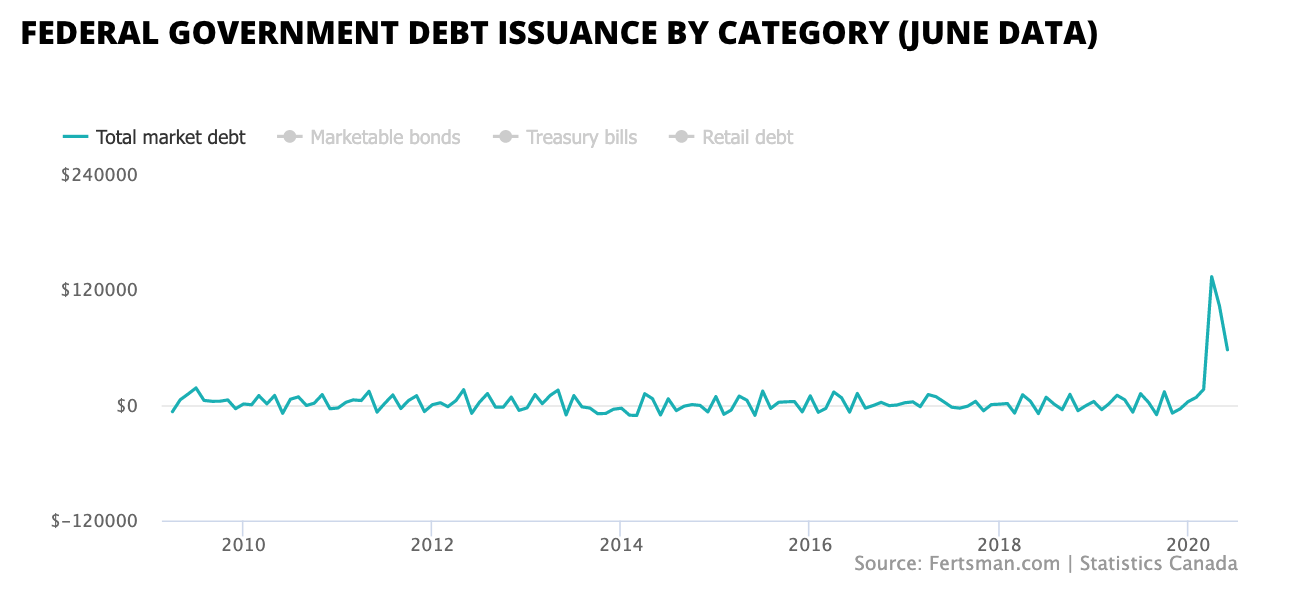

The government's debt issuance began to skyrocket in April of this year, as per the data in the chart above. That month, the government issued over $133 billion CAD worth of securities in the form of bonds and treasures. In May and June, another $160 billion CAD worth of securities were issued. To put these values into perspective, before the pandemic hit total outstanding securities were less than $800 billion CAD. So far, the government has issued almost $300 billion CAD worth of publicly traded debt to fund its operations as of June. That's about the value public officials are expecting the government deficit to be this year.

Most of the debt was issued in the form of short-dated treasuries, which generally come at a lower interest rate than longer-dated bonds (although this does change when crises hit). April treasury issuance came in at over $106 billion CAD, with May and June racking up another $120 billion CAD in treasuries issued. Over that same period, only about $64 billion CAD worth of bonds were issued. Government retail debt in the form of more expensive bank loans has not changed at all. We think that's problematic, but that's a discussion for another time.

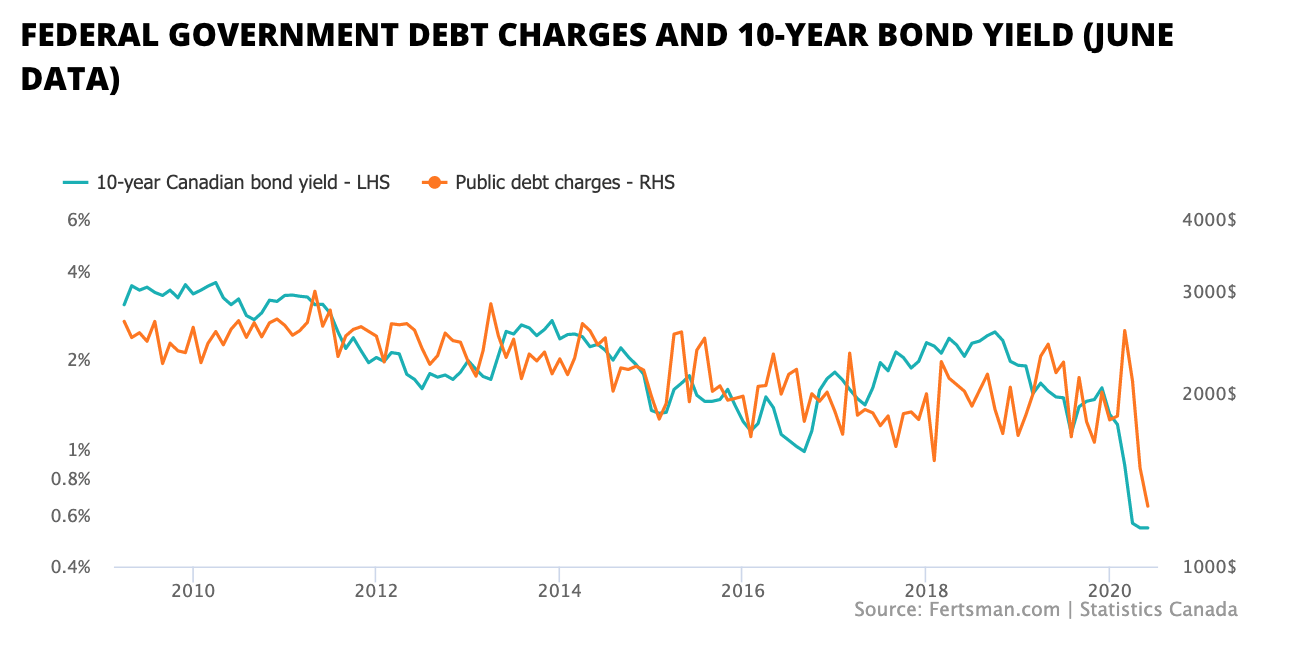

Meanwhile, in April the government paid out merely $2 billion CAD in debt charges. Interest rates fell by more than 50% since the beginning of the year in the bond and treasury markets. In April the 10-year bond yield came in at a record 0.56%. As of writing, the 10-year yield remains around this level. In June the government paid out an even smaller amount of debt charges, coming in at $1.2 billion CAD. Recall that prior to April of this year, the government generally paid out around $2 billion CAD each month on a debt pile worth about $700 billion CAD. Now the government will likely pay less, somewhere in the range of $1.2 billion CAD on a debt pile worth about $1.2 trillion CAD or more.

There is no question that the government is incentivized to borrow more money as interest rates drop. Interest rates have yet to drop to zero on Canadian government debt, so the incentive still has plenty of room to run. Interest rates on government debt have also gone negative in many developed countries around the world, which could compound the government's ability and willingness to issue more securities.

In our view, this has created two relatively large problems:

First, government spending does not generally lead to sustained economic growth, even if it's large. This is because government's tend to mostly spend existing deposits (money) that have been floating around in society. There's little inflationary effect in this case. Sure, the Bank of Canada has recently been the buyer of a significant quantity of government debt (particularly with regard to treasuries), and this has resulted in a very large amount of money printing in relative terms. But unfortunately this money printing has been done via short-dated treasuries which will be extinguished in short order. Also, a lot of the fresh money has gone to highly leveraged Canadian consumers; at least a portion of the stimulus checks have gone to paying down expensive bank debts based on the latest credit statistics released by the banks.

Second, interest rates on government bonds (particularly the 10-year bond yield) are tied to Canadian nominal GDP and inflation figures, as we have been tracking on our dashboard for some time now. Based on the quantity of debt the government has outstanding, authorities are likely not interested in seeing higher interest rates as this would lead to a rapid increase in public debt charges each month. As a result, we believe there is a disincentive for government to engage in policy decisions that would lead to higher nominal growth rates and higher inflation levels at this time.

Cover image by: Christopher Austin via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.