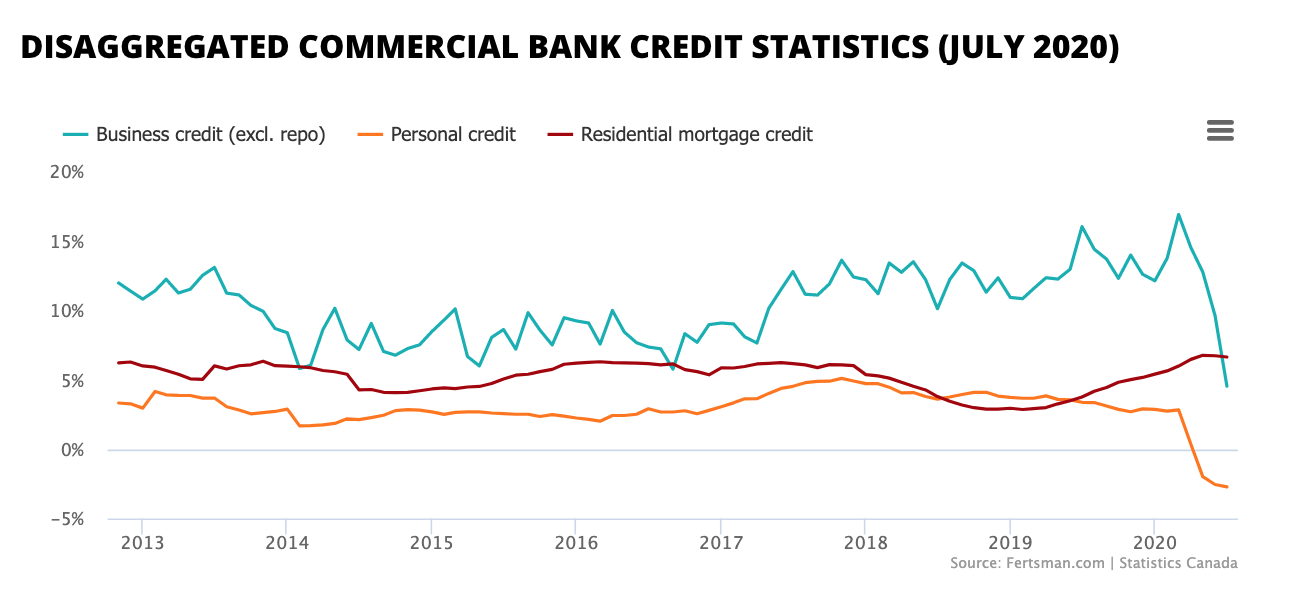

Bank credit growth down sharply in all categories except mortgages

Bank credit is an important building block of any economy. It's issued by the banking system via commercial banks in the form of loans to businesses and consumers. When these loans are drawn up by banks and then drawn down by businesses and consumers, new money is created. This new money then spurs transactions to occur and has an inflationary effect on the goods or services being purchased in those transactions. When thousands of loans are drawn up and drawn down - amounting to billions of dollars - the end result shows up in higher GDP, wage, and home prices figures, for example. Over the last several months, however, personal and business credit growth has gone down sharply.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

In May, personal credit growth contracted for the first time on record. At first this appeared to be a temporary blip, but now it's been three consecutive months where total outstanding personal loans have contracted on a year-over-year basis. In July the annualized contraction came in at 2.73%. This may not seem like much in percentage terms, but a contraction in outstanding loans of this magnitude can do some damage. In July of last year, there was a total of $527.3 billion CAD in personal credit outstanding. At the same time this year, there was $512.9 billion CAD outstanding, a difference of over $14 billion CAD. This means that consumers destroyed $14 billion CAD of deposits that could have continued to circulate within the economy. Total personal credit actually peaked in December of last year at just over $535 billion CAD, so the total amount of money destroyed this year in this credit category is actually higher.

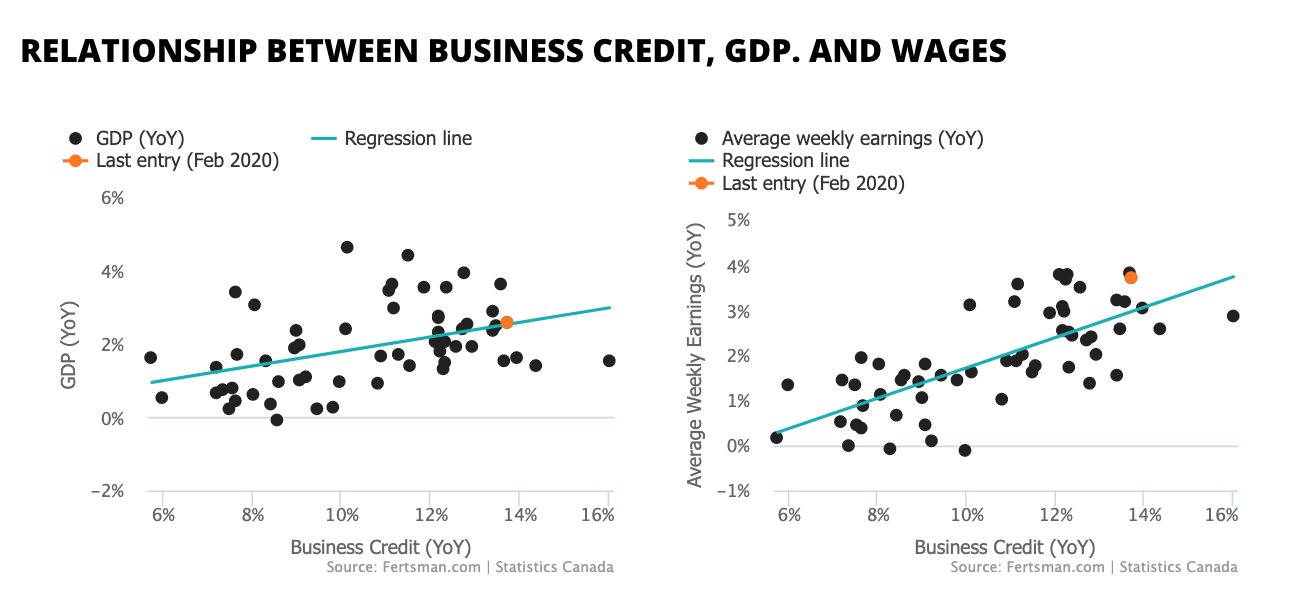

Unfortunately business credit growth has also slowed considerably. As of July, business credit was up 4.5%, but that is one of the lowest growth rates on records. In fact, business credit peaked at $403 billion CAD in March, and is now down to $391 billion CAD in July. Year-to-date, businesses destroyed $12 billion CAD of deposits that could have continued to circulate within the economy. A higher business credit growth is desirable because a lot of this "productive" money ends up in the form of wages (which are used to pay and service consumer loans) and materials for production or resale across Canada. It has a material impact it on wage and GDP growth:

So as you can see, Canada needs to see business credit grow at 15% or more on an annualized basis to see some decent wage and GDP growth.

At least mortgages grew at some of the fastest paces on record. In July, the banks reported the highest quantity of outstanding mortgages on their books on record, coming in at $1.266 trillion CAD. That's trillion with a "t" and not a "b". The pandemic couldn't slow down the real estate market, as we recently discussed here.

Cover image by: Science in HD via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.