Canada's GDP was down over 4% in August, and 49% of GDP was still shrinking

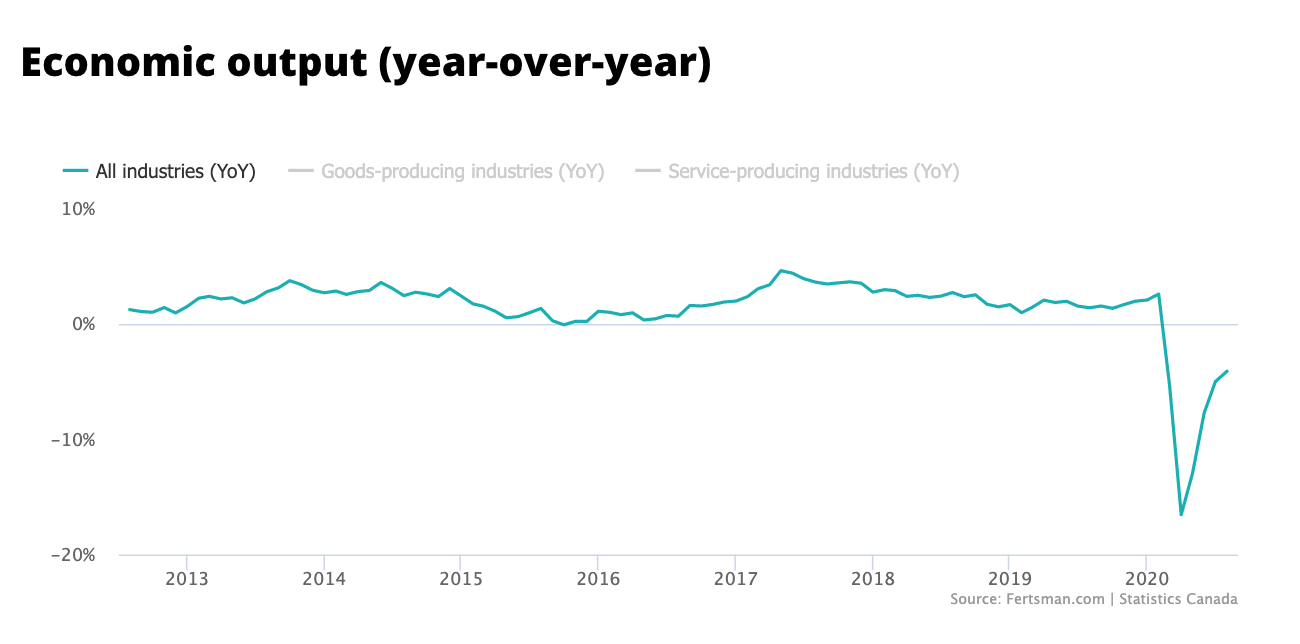

Canada's gross domestic product (GDP) came in at -4% in August on a year-over-year basis, up slightly from the -5% registered in July. Total output came in at $1.9 trillion CAD, down from $1.98 trillion CAD the same time last year - a gap of $80 billion CAD.

The latest GDP data shows that the economic rebound (which followed the first wave of Covid-19) began to slow down in August. This was particularly the case for goods-producing industries, which registered a lower growth rate in August (-5.69%) than in July (-5.61%). Services-producing industries faired better, growing at -3.44% in August against the -4.74% scored in July. However, overall, it's clear that the rebound lost steam in August.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

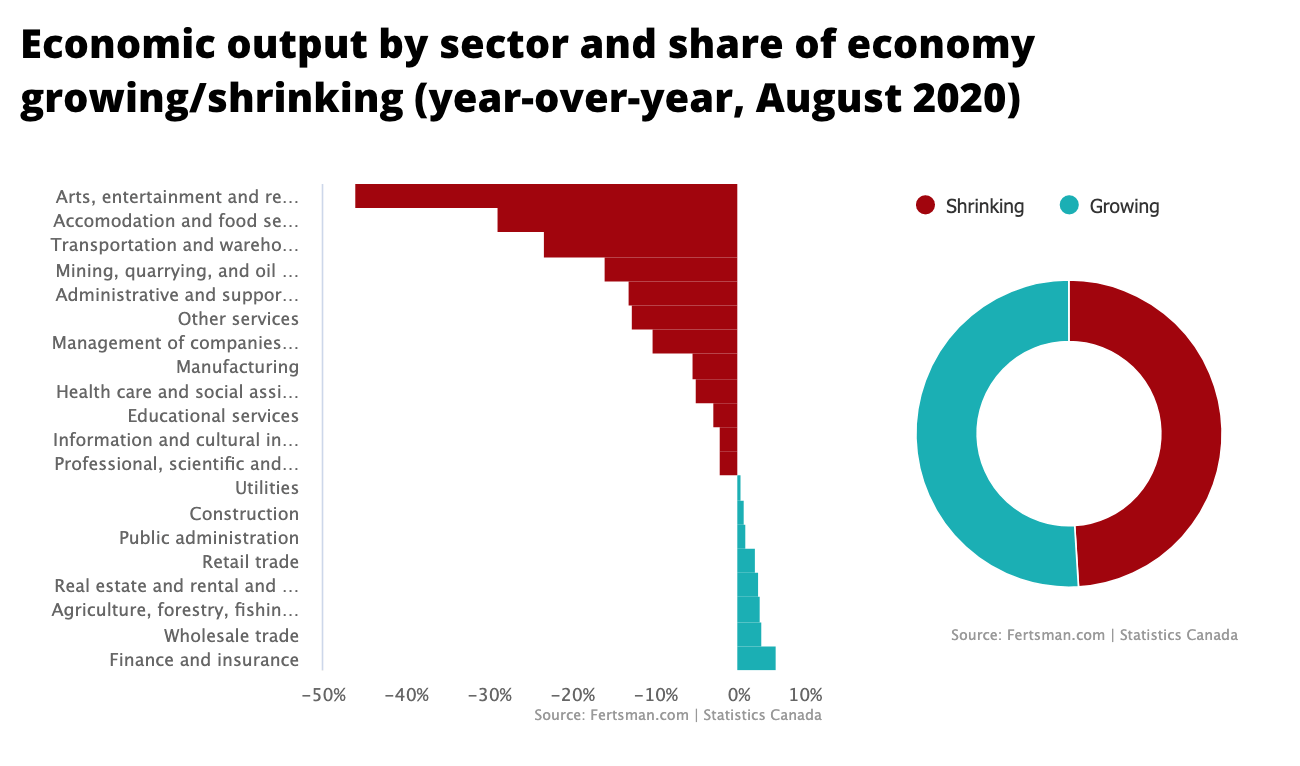

There is some good news: the August data demonstrated improvements across all industries and sectors relative to July, and a greater share of GDP was growing relative to the previous month.

Arts, entertainment, and recreation was down 45% from last year (it was 52% in July). Accommodation and food services was also down 28% (it was 33% in July). Manufacturing was down 5% (it was down over 6% in July). Meanwhile, finance and insurance grew at over 4%, and real estate, rental, and leasing was up more than 2.5%. Most notably, public administration (+1%) and construction (+0.8%) came out of contraction into growth territory. The August data shows that only 49% of GDP continued to shrink, as opposed to 70% recorded in the July data. That's quite an improvement. That being said, the rebound continued to be extremely uneven.

Last time we covered GDP data, we concluded that the economic recovery after the first wave would not be v-shaped, especially because industries like finance, agriculture, real estate, and retail trade can quickly lose steam. And, industries like accommodation, food services, entertainment, arts, and manufacturing take much longer period of time to return to growth, especially during a pandemic that comes in waves. The August data continues to support this hypothesis.

In fact, the data for September may even show further deterioration in gross domestic product, given the weakness of the August data relative to the July data. Plus, Covid-19 cases in September came in at almost 34,000, more than double the number of cases registered in August. We also know that credit growth decelerated in almost all categories in July, particularly in consumer credit. We suspect that credit growth could actually soon enter contraction.

Get ready for some nasty GDP numbers in the fall.

Cover image by: Clayton Cardinalli

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.