A closer look at Canada's shrinking consumer credit market

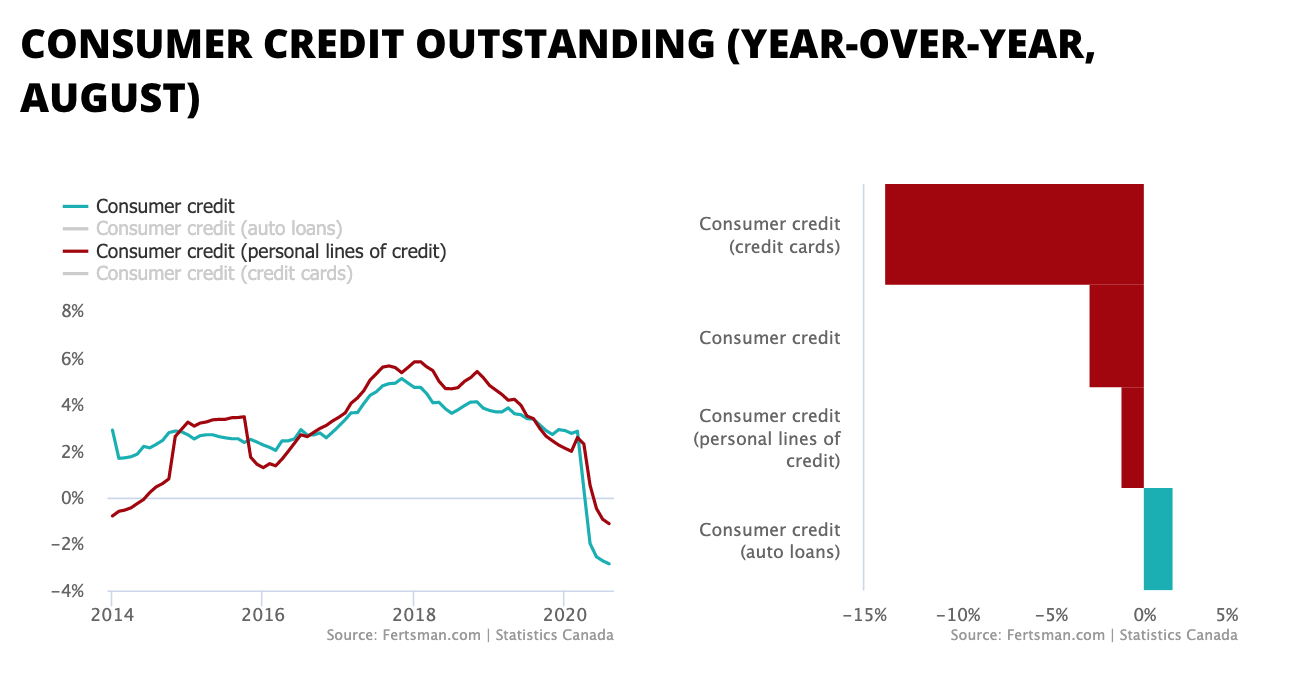

Consumer credit levels held by Canadian banks have begun to shrink. In July, consumer credit levels were down almost 2.75%.

When outstanding credit levels fall, we tend to see deflationary pressures kick in where prices on things start to drop. This is because deposits (money) are destroyed when bank credit is paid down, resulting in less purchasing power in the economy. We're already beginning to see the beginning stages of these price drops with the consumer price index - a broad measure of inflation - barely floating above zero.

The consumer credit market is huge, sitting at $513 billion CAD in July (that's about 40% of the size of the Canadian mortgage market). So, we've taken a closer look at this now shrinking credit category.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

The biggest contraction in the consumer credit market has been in the credit card segment, dropping a significant 13.82% in August. From the same time last year, outstanding credit card balances are down by almost $12 billion CAD. Total outstanding credit card debt is now at $73.5 billion CAD.

Meanwhile, the biggest consumer credit segment is personal lines of credit, with outstanding balances coming in at $311 billion CAD in August. This category is down only 1.14% from the same time the previous year.

It appears that both the credit card segment and the personal lines of credit segment are to blame for the contraction in the consumer credit market. Auto loans, another large segment in the consumer credit market, are up 1.56% year-over-year, sitting at $109 billion CAD in August.

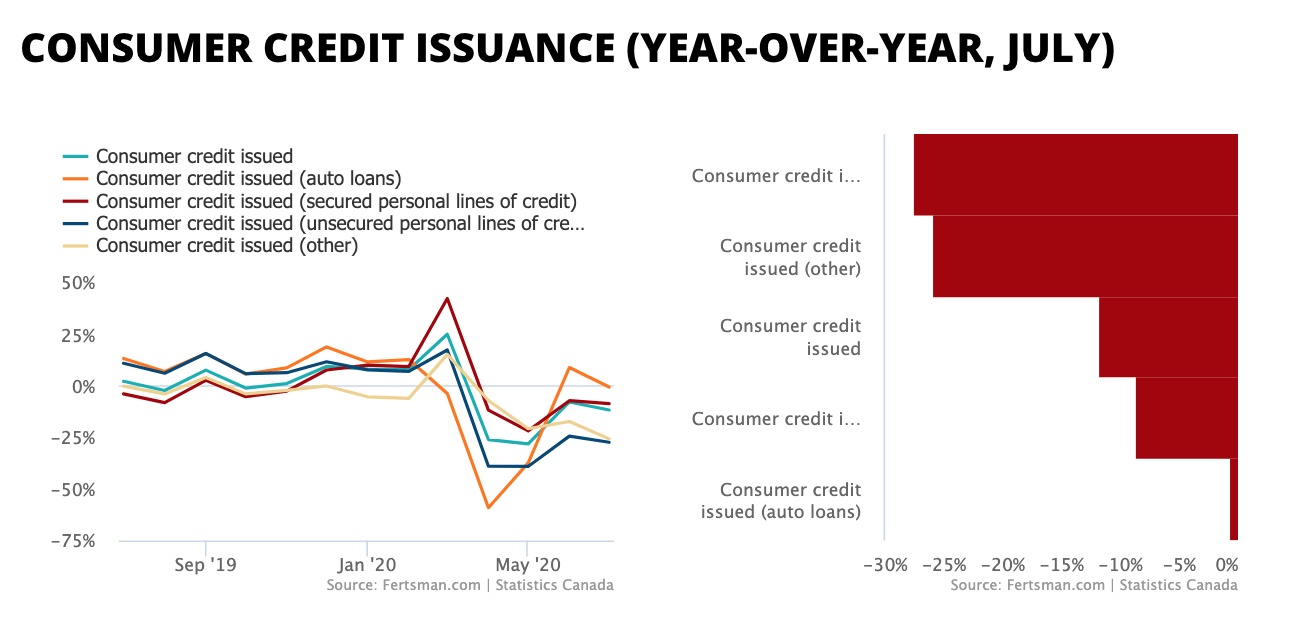

Now, to at least partially understand why outstanding consumer credit levels are falling, we can draw on the consumer credit issuance data. We don't have a category available to us that specifically looks at credit card debt, but we do have unsecured credit information (which credit card debt would fall into).

Unsurprisingly, the biggest drop in credit issuance in the consumer credit market in July was in unsecured personal lines of credit, coming in at 27.38%. It fell even more back in April, coming in at 39% year-over-year. Even secured personal lines of credit issuance was down in July, dropping 8.6%.

As you can see on one of the charts above, auto loan issuance collapsed the most in April, dropping almost 60%! But it managed to stage a sharply recovery in June, with issuance growing that month at almost 9%. This is why outstanding auto loan balances are still growing.

An important thing moving forward for us is to see consumer credit issuance return to growth, otherwise outstanding balances are poised to keep contracting. This could be exasperated if consumers decide to more rapidly pay down existing balances. That scenario could be quite deflationary.

Cover image by Mick Haupt

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.