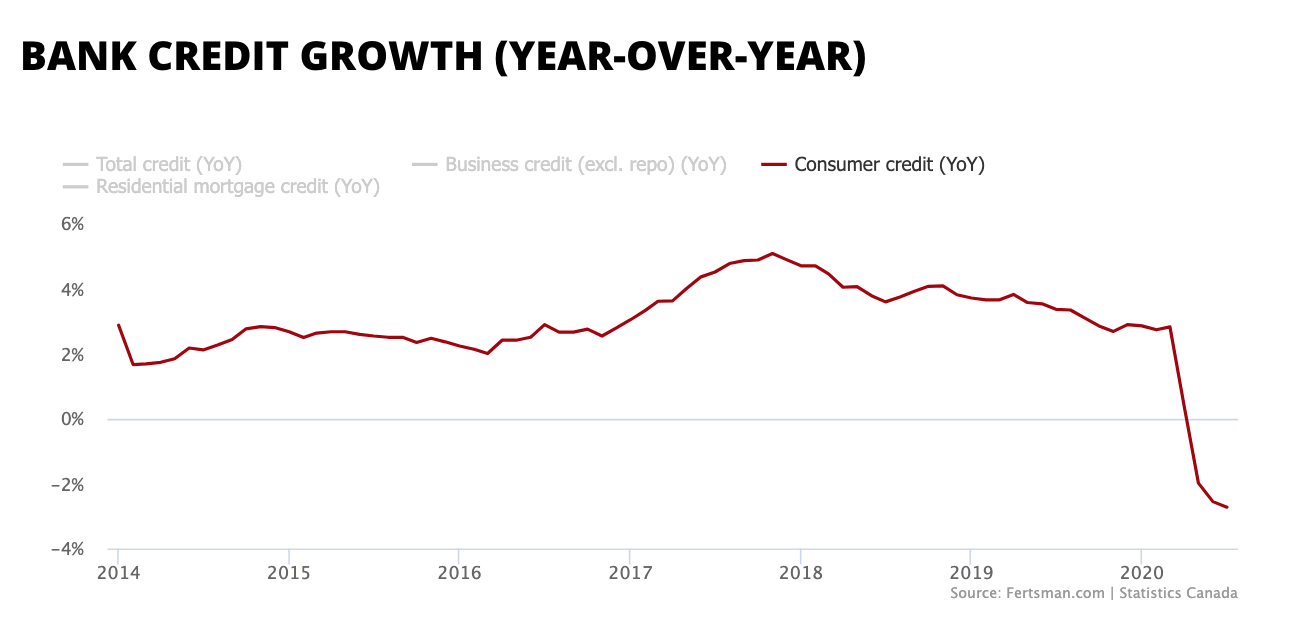

Bank credit growth slows again in July, but consumer credit is officially in contraction

It's official: consumer credit levels in Canada have begun to shrink after more than two consecutive months of contractions. In May, consumer credit was down 2% from the previous year, and in July it was down almost 2.75%. This includes credit card debt, auto loans, and secured and unsecured personal lines of credit. Outstanding consumer debt as of July sits at $513 billion CAD, down from $527 billion CAD the previous year. That means there had been at least $14 billion CAD worth of deposits extinguished in this credit category.

Business credit growth also decelerated sharply in July. Growth came in at 4.5%, down from 9.6% only a month prior in June. Because of dynamics in this credit market, sub-10% growth can be considered weak. Outstanding business credit as of July sits at $391 billion CAD, down from a peak of $403 billion CAD in March when the pandemic was just beginning to set in.

So far residential mortgage credit growth is still hanging on, with the outstanding balance up 6.6% from July last year (that's down only slightly from 6.71% in June). But we're starting to watch the mortgage credit market a little more closely (I'll explain why in a moment).

We're seeing total outstanding credit growth also decelerate sharply as a result of the contraction in consumer credit and the weakness in business credit growth. Total credit was up only 4.18% in July, that's the weakest we've seen since the winter of 2017.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

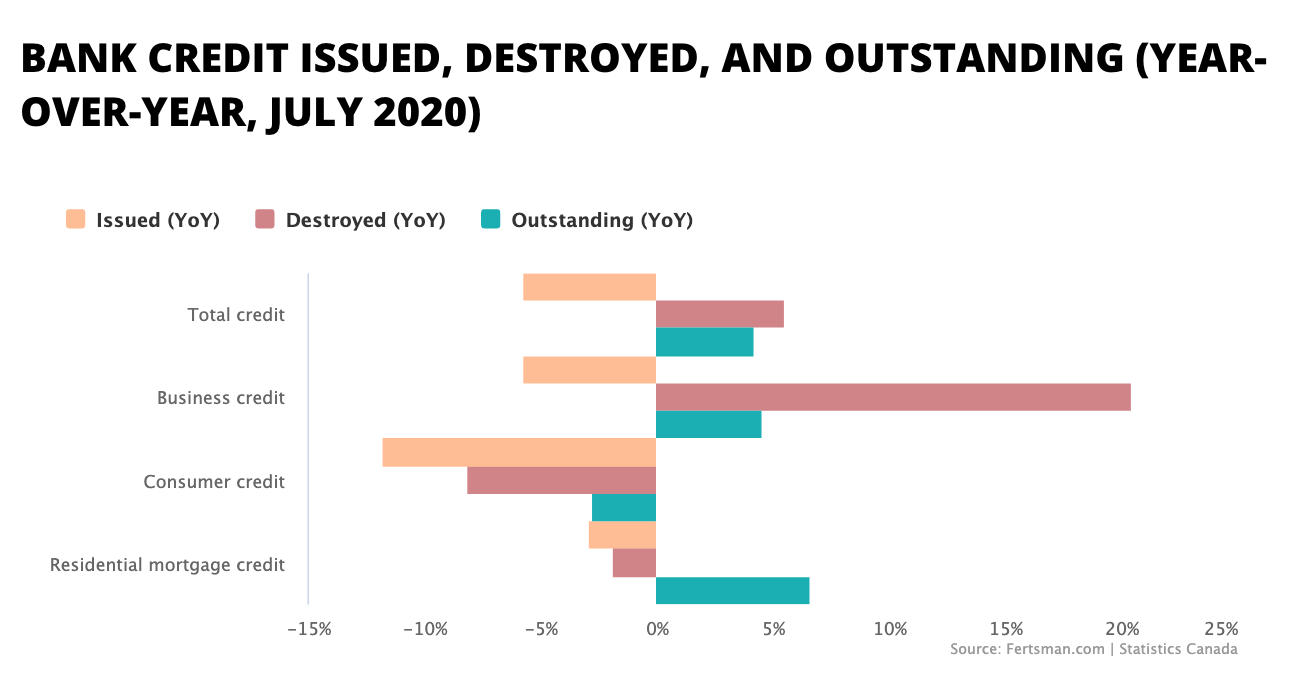

Consumer debt is down sharply because consumers have been borrowing less and have been paying down lots of debt. Since March, consumers have been borrowing between $20 and $15 billion CAD each month, but they've been paying down between $20 and $25 billion CAD each month at the same time. In July, we see that consumer credit issuance is down over 11% from the same time last year, but credit destroyed (or paid down) is down only 8%.

We're seeing a similar thing happen in the business credit market. Businesses are borrowing less and have substantially increased their debt repayments. In July, credit issuance was down over 5% from the same time last year, but credit destroyed up is over 20%! If this trend continues, the bank business credit market will be in contraction before the of the year. This will have profound implications for the labor market.

Finally, all appears to be well in the mortgage and real estate market except when we start to look at the credit issuance/destruction data. In July, residential mortgage credit issuance was down over 2% from the previous year. July is normally a month when we see mortgage credit issuance the highest. So it appears that things may be beginning to slow down in the mortgage credit market on a year-over-year basis.

Luckily mortgage holders have been paying down less debt this year, thanks to mortgage deferral programs. On a year-over-year basis, residential mortgage credit destruction is down almost 2%. This is likely holding outstanding residential mortgage credit levels up. A big question now is, what will happen in this market when deferral programs end and credit issuance drops in the winter due to seasonal factors when people are buying fewer homes?

Cover image by: Juliana Loh via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.