Over 11% of Canadian households were "in core housing need" in 2018

According to the latest numbers released by Statistics Canada and the Canadian Mortgage and Housing Corporation more than 11% of total households in Canada are "in core housing need" - a huge number of families.

A household "in core housing need," according to Statistics Canada, is one that is living in a dwelling that is unsuitable, inadequate, or unaffordable and cannot afford to gain alternative housing in their local community.

A dwelling is unsuitable when it is too small and has too few rooms for its residents as determined by the National Occupancy Standard. Housing is inadequate when major repairs are necessary. And housing is unaffordable when it costs more than 30% of the household's before-tax income.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

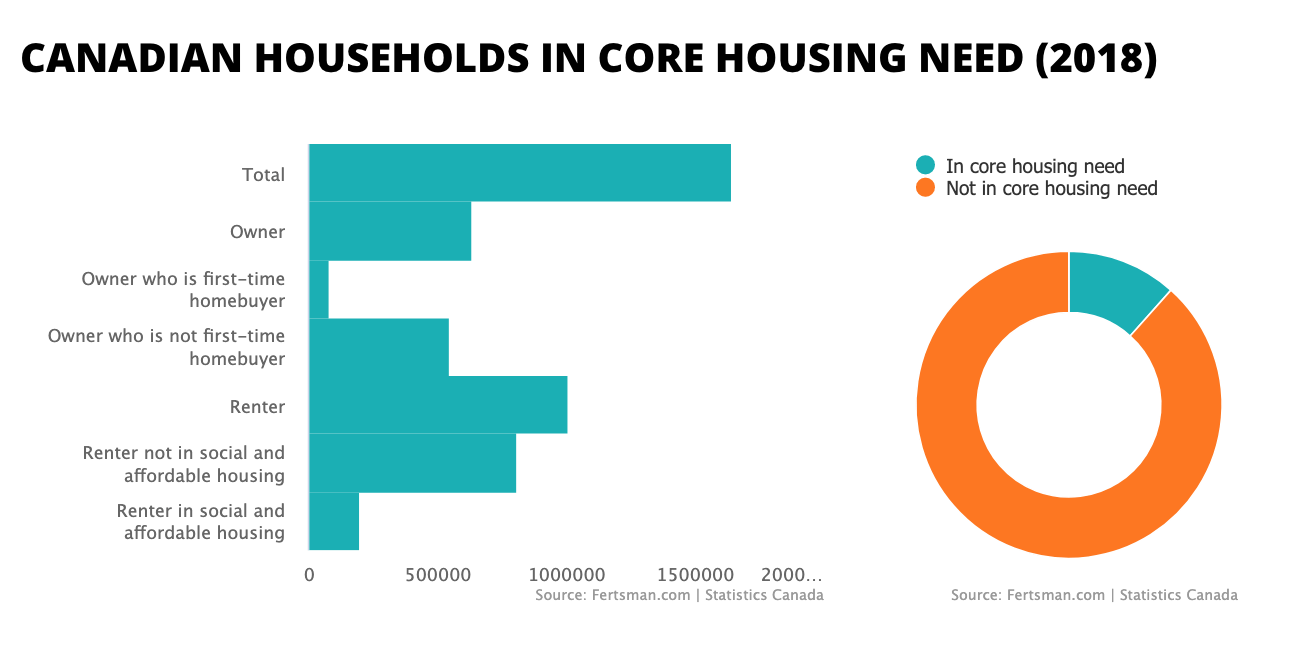

11% of households in core housing need translates into about 1.65 million households across the country. Out of these households, over 600 thousand owned their dwelling, and over 1 million were renters. Most of the homeowners afflicted were not first-time homebuyers, and most renters afflicted were not renting what is considered "social or affordable housing."

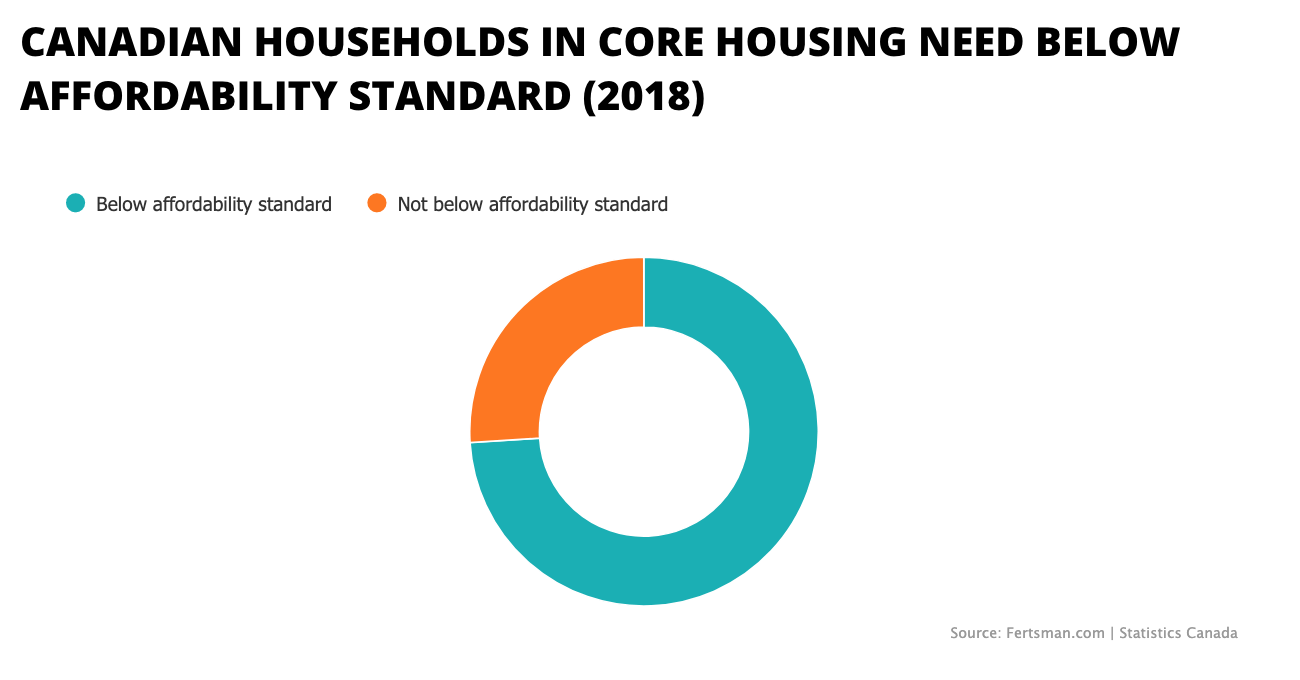

What's the biggest driver of households falling into the "in core housing need" category? Almost 75% of household in housing need fell into it solely because they did not meet the affordability standard. Over 1.2 million households in Canada spend more than 30% of their before-tax income on shelter costs.

The high rate at which home prices have risen and the low rate at which wages have risen has pushed many households into the "in core housing need" category.

Unfortunately this is a direct result of economic policies exercised by the federal and provincial governments in Canada. Banking and insurance rules favour bank lending for real estate transactions, inflating home and rent prices. Meanwhile, government policies favour low labor wages, suppressing a necessary rebalance from occurring.

Until we see these policies reversed we expect the number and percentage of households who fall into the core housing need category due to affordability issues to grow.

Cover image by: Omar Ram via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.