Canada's GDP was down 5% in July, nearly 70% of GDP was still in contraction

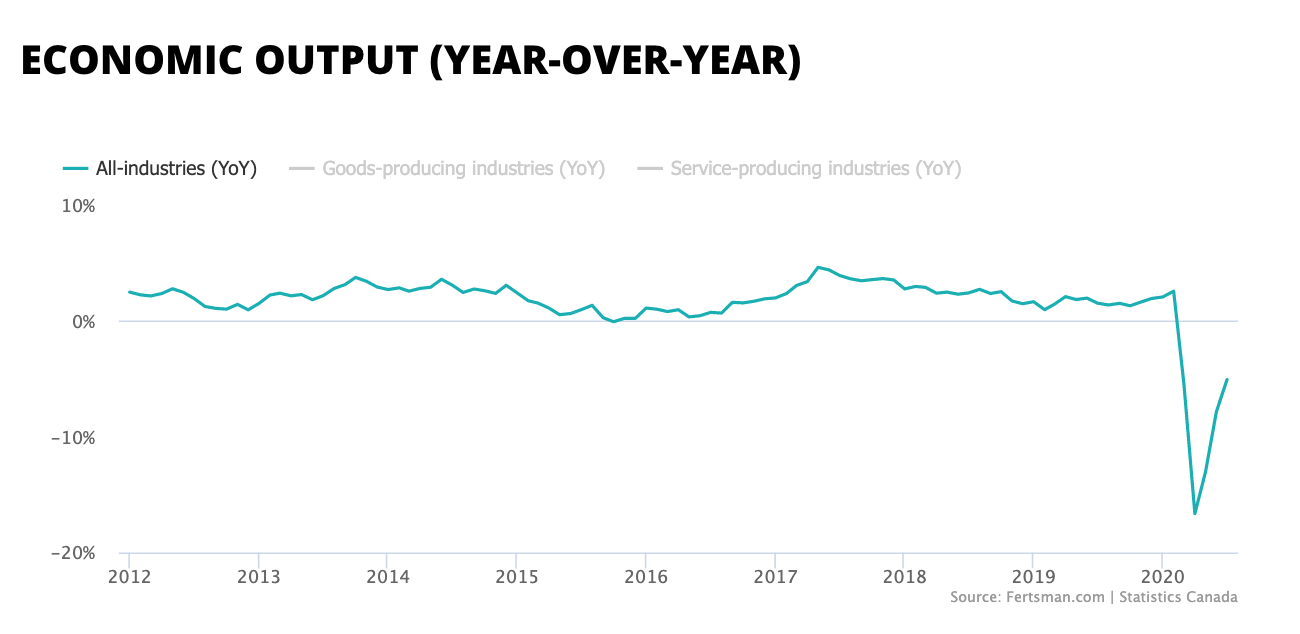

Despite the flattening of the pandemic curve and efforts by all levels of government to create some kind of economic recovery, Canada's economic growth came in at -5.07% in July on a year-over-year basis. Total output came in at $1.88 trillion CAD, down from $1.98 trillion CAD the same time last year - a gap of $100 billion CAD.

The data doesn't come totally unexpected. Bank credit growth sharply decelerated, many government-mandated social distancing measures remained in place, and total COVID-19 cases came in at approximately 12,000 (up from approximately 10,000 cases in June when the economy posted a growth rate of just 7.83%).

While distancing measures and the pandemic remain active, economic growth will likely remain sedated.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

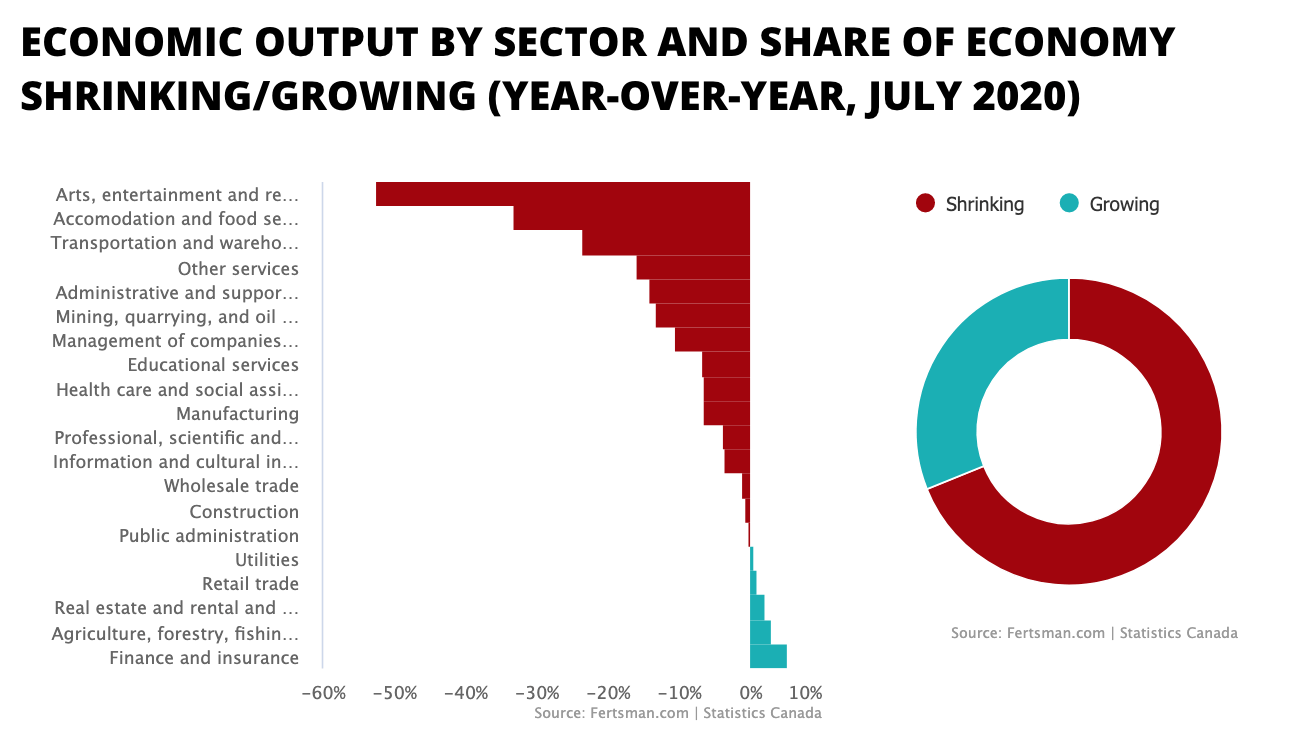

Even though GDP growth has rebounded from the trough, which came in at -16.5%, the rebound has been extremely uneven. The chart above shows you GDP growth for July broken down by industry sectors. What we can see is that most industry sectors continue to post contractions. In fact, these sectors make up almost 70% of GDP!

Growth in arts, entertainment, and recreation is down by over 50% since last year. Accommodation and food services is also down over 30%. Meanwhile, only a select few industries are posting growth, like finance, agriculture, real estate, and retail trade. The numbers are all over the place, as well.

One thing is becoming more certain: the economic recovery will not be v-shaped. Industries which posted growth in July like finance, agriculture, real estate, and retail trade can quickly lose steam. Meanwhile, industries which have been posting contractions since earlier this year like accommodation and food services, arts and entertainment services, and manufacturing take longer periods of time to return to growth after experiencing shocks.

Cover image by: Rob Lambert via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.