Unemployment rate eases slightly in August

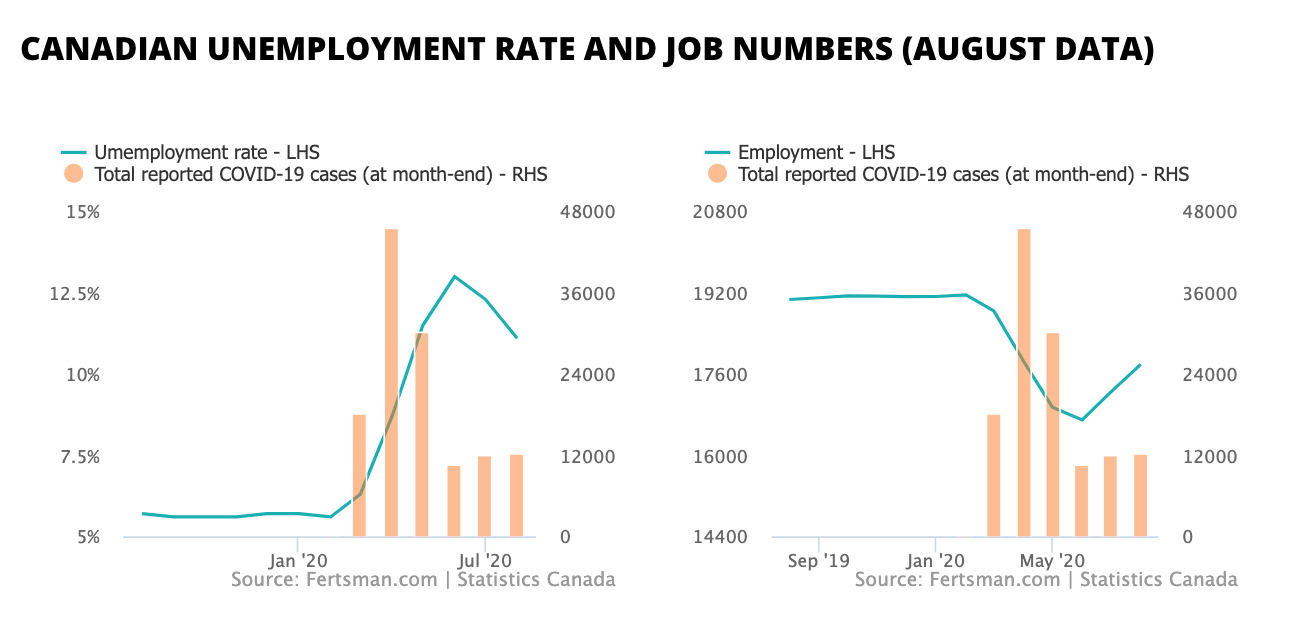

The Canadian unemployment rate dropped to 11.1% in August, down from 12.3% in July. On a year-over-year basis, the unemployment rate is still up 94%. Before the pandemic hit the country, the unemployment rate was around 5.6% and there were about 19 million jobs. As of August, the country still has about 17.8 million jobs.

This week the minority Trudeau government promised to create 1 million jobs to make up for effects of the pandemic and related government initiatives.

Our models show that employment levels are tied closely to bank business credit. Data for July show bank business credit growth continues to decelerate. It is not clear how Canadian authorities plan to incentivize businesses and banks to grow their business loan balances at this time. Moreover, the latest COVID-19 data shows a potential second wave beginning to unfold across the country. This is likely to put a significant damper on business investment and consumer demand in the months ahead.

Cover image by: Scott Webb via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.