Trudeau promises jobs, money, and more money in throne speech while holding over $120b at BoC

The Trudeau minority government has provided a high-level outline on where it wants to take the country in the latest speech from the throne. Delivered by the Governor General, the speech outlined economic, healthcare, and environmental initiatives that the government wants to push forward.

But, the initiatives appear to come with massive costs. The main question now is: how will these costs get paid? Well, Trudeau is sitting on a $120 billion CAD war chest at the Bank of Canada.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

The Liberals are promising to introduce initiatives that will increase pandemic testing capacity, increase financial assistance to companies impacted by the pandemic, and to increase funding for provinces and their education and healthcare systems.

The speech rejected austerity, underscored the upcoming Canada Emergency Response benefit and promised to launch over 1 million jobs aimed at social and infrastructure sectors. The Liberals also plan to maintain and introduce incentives for companies to hire and retain workers by extending the emergency wage subsidy until next summer.

There's also talk of launching an action plan for women, an affordable childcare system (dubbed a Canada-wide early learning childcare system), and expanding the Canada emergency business account to improve access to credit for businesses.

Trudeau's speech also touched on a message coming from Canada's central bank. We've heard that monetary policy now has limited effects on stimulating inflation and economic growth. As a result, Trudeau is looking to continue to spend large quantities of money to make up for this shortcoming and to keep interest rates low in order to be able to manage the debt pile that eventually generates the large quantities of money.

The government wants to focus on "targeted investments" to generate growth and tackle income inequality. A lot of these investments look like they will likely land in housing; the government is aiming to double down on the National Housing Strategy and will be adding to the first-time home buyer's incentive program.

In the speech, Trudeau reaffirmed that real estate is a key engine of economic growth in Canada and that everyone "deserves a home." Virtually nothing was said about natural resource extraction or energy, or other important sectors of the economy like manufacturing.

Overall, the speech made is clear that the government wants to continue the policy stance of the last 6 months. Recall that in the second quarter of this year, the government's expenses rose by over 100% on a year-over-year basis, even though revenues shrank by more than 12%.

Members of the opposition and observers are now asking the Prime Minister and the Finance Minister where the money is coming from to pay for the government spending. The Liberals have provided no verbal answers, but luckily we have access to government financial statistics.

ADVERTISEMENT - ARTICLE CONTINUES BELOW

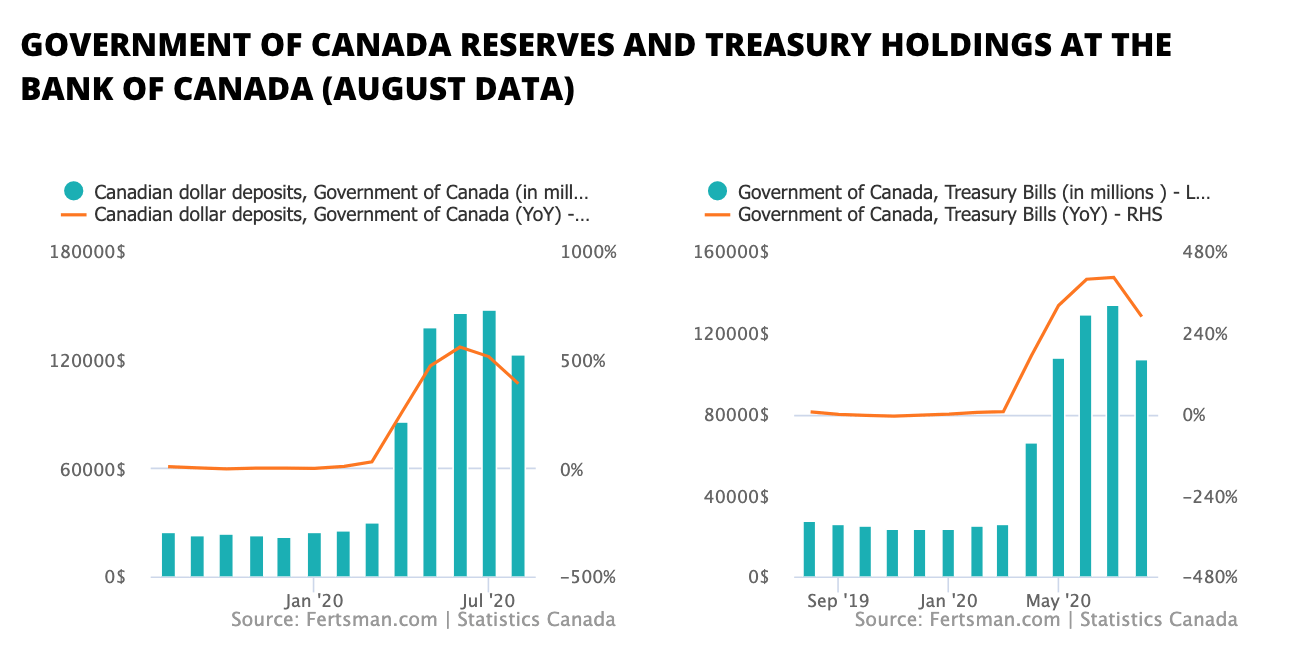

As of August, data from Statistics Canada shows that the Finance Minister's banker (the Bank of Canada) holds over $123 billion CAD worth of reserves that belong to the government.

Normally, the Bank of Canada maintains around $20 to 30 billion CAD in the government's account for "liquidity management purposes." The way it does this is by purchasing short-term securities from the government by debiting some newly created "reserves" or central bank deposits into the government's account on its books. When the securities come due, the central bank destroys the reserves and pockets an interest which is used to maintain the bank's operations.

The Bank of Canada is owned by the finance ministry, so all of this constitutes as self-financing; the government creates its own money. This activity normally allows the government to comfortably manage day-to-day payment flows, which can be substantial.

Based on the data from earlier this year, the Bank of Canada substantially increased its purchases of treasuries to substantially increase the amount of money available to the government. In April, treasury holdings increased to over $65 billion CAD, peaking in July at over $133 billion CAD. As a result, the government's reserve holdings increased to $85 billion CAD in April, peaking in July at over $148 billion CAD.

There is approximately $120 billion CAD still on the books at the Bank of Canada. So, the government is effectively sitting on a war chest that could be used to fund a huge amount of spending over the next 6 months during (say) a second wave of COVID. If the government manages to form a coalition in the house of commons, it could certainly use these funds to fuel ambitious pandemic plans.

Cover image by: Chelsey Faucher via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.