Canadian home prices in cities post soft landing in August, but will it last?

September 19, 2019

Erik Fertsman

Last week we reported

on what Statistics Canada's home price index gave us for July. The results were a confirmation of the worst: in aggregate, home prices have been falling across Canadian provinces and cities this summer.

This comes at the worst possible time, because we're supposed to be in the middle of a summer price boom, just like we've always been. It's also required to keep the Canadian dream alive. You know, the dream where you can retire using the equity value of your home like an ATM, rather than depend on those government and private pension plans that seem to have more liabilities than assets.

The price crunch in the Statistics Canada data has, for the most part, been ignored by everyone including the media. Actually, the media has been celebrating, popping champaign, and saying that the housing market has recovered. Provinces like Alberta and Newfoundland have been in deflation mode for years now, thanks to crappy provincial economic growth rates caused by government and private credit misallocation. And they're still contracting. You can now find home price contractions in every Canadian province.

OK. So, what if we only look at the cities? Last time we reported

on the cities we saw home prices climbing, but at the slowest pace in 10 years. This morning, Teranet and the National Bank of Canada (TNBC), our frequent source for home price data for cities due to their methodology, released their home price index data for August. We're finally starting to get a better picture of the summer sales season this year.

Article continues below.

Cities form soft landing amid mortgage credit bounce

Here's the latest data, take a look:

According to the data above, TNBC's national index recorded a rise of 0.61 percent in August, up from 0.44 in July. Compared to the Stats Can data, where prices are in contraction now, the TNBC data looks to be forming a soft landing where price growth has slowed but has not formed a deep trough in the form of a huge price correction.

It kind of makes sense, given that there's been a bounce in commercial bank residential mortgage credit growth. In July the banks posted a 3.7 percent growth in mortgages on a year-over-year basis. This is up from the 2.8 percent growth rate we had back during the winter in February.

However, we're looking at the peak of the summer real estate sales market, where performance is at its highest. In 2018, home prices between July and November recorded between 1.37 and 3 percent growth. The year before that we had growth ranging from 10 to 14 percent! Plus, mortgage growth is down quite a bit from the 5.5 to 6 percent year-over-year growth rates it was experiencing during the heyday of the home price boom.

In fact, suggesting that the cities are experiencing a soft landing right now is like saying Trudeau is going to win a landslide in the election this year after the "brownface" scandal that's now in full bloom. It's simply too early to confirm a reversal of the downtrend trend.

Article continues below.

Mortgage growth is not conducive to high price growth at the moment

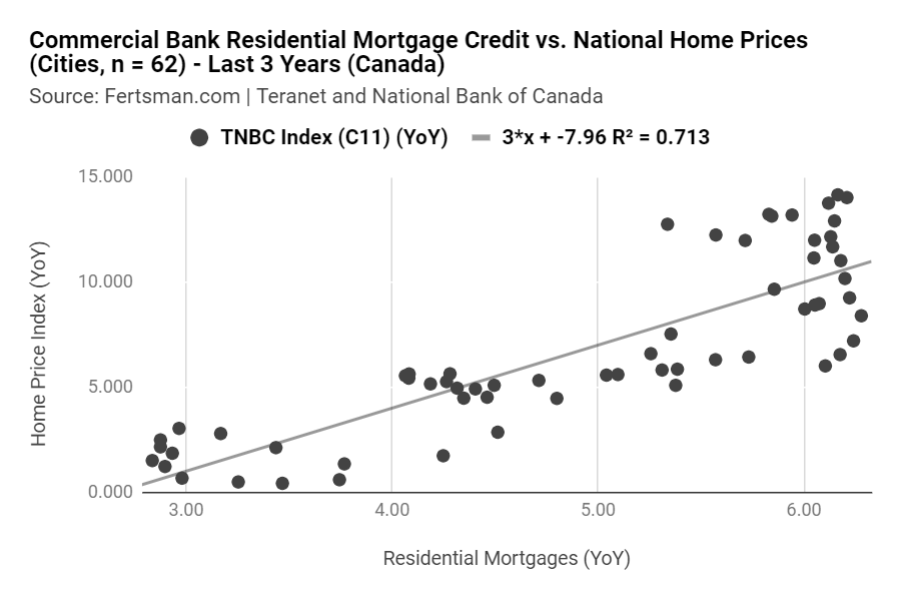

We can, however, take a look at things through our fancy model we put together a few months back that is able to largely explain home prices based on mortgage credit. Here, check it out:

As you can see, our model shows that the residential mortgage growth rate can explain over 70% of the nominal change in the TNBC home price index. Based on this, if mortgage growth can stabalize around 4 percent we could see aggregate price growth across Canadian cities resume to about 4.04 percent.

So, if you live in a city and are worried about home price contractions, it's totally plausible that home prices could form a soft landing here and stage a come back next summer to experience summer 2018-style growth (2 to 4 percent). But, it all depends on how many mortgages, in dollar terms, the banks can pump out over the next 6 to 12 months. It also matters where they pump out these mortgages.

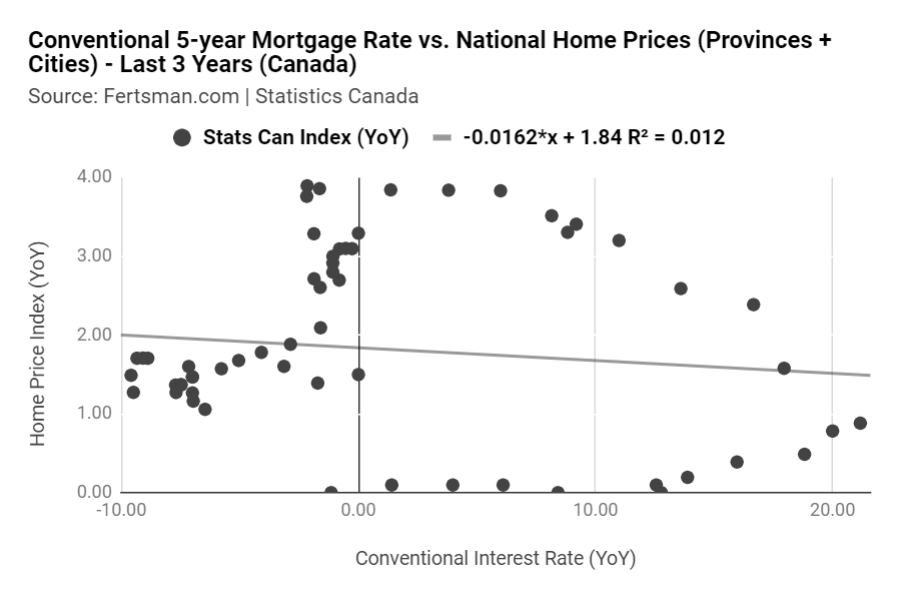

What about interest rates? Well, the next time you hear an analyst or economist talk about interest rates as if they dictate the price of homes, just remember the following chart (hint: it's a mess):

Article continues below.

Vancouver is crashing

It's also worth looking at a select few cities to get a better grasp of the dynamics underlying the aggregated statistics we looked at above.

Here's Vancouver:

This chart paints a bit of a worrying picture. In August, home prices shrunk 6.63 percent on a year-over-year basis. You can also see how sales are still shrinking (teal line, right axis). A soft landing is completely off the table for Vancouver, and a hard landing is nowhere to be seen at the moment. One of the problems this creates is that banks might become increasingly risk averse in British Columbia, and even the rest of Canada if they begin to experience loses.

As you know, the assets behind the mortgages issued by the banks are marked-to-market, so eventually the banks will need to start worrying about the collateral of their loan portfolios in Western Canada. It's already a problem in Alberta where home prices have been falling for 3 years now. BC will only compound problems. Even though BC is far from Toronto and other key census metropolitan areas, it's the same banks that service them.

Toronto's soft-ish landing

Here's Toronto:

This is the market that the Canadian Real Estate Association has been touting. The 2018 summer sales season was terrible, but this year things have managed to get positive and sideways. Sales grew in August by 15.36 percent year-over-year. Boom, let the good times roll.

Not so fast. Even though Toronto has managed to go through something of a soft-ish landing, they're not out of the woods yet. This is currently the best performance the city will see until 6-9 months from now. If you bought a home in the last few years, hold your breath! One of the biggest concerns here is how the banks react. If they can't or are unwilling to pump out more mortgage credit, or there's issues with delinquencies, then all bets are off for Toronto.

Article continues below.

Halifax's resilience

Then, there's Halifax:

This place has always been on my radar. Look at the chart, it's just humming along. Home price growth recorded at top-heavy 5.53 percent in August. Why top-heavy? Because wages don't grow that fast in Halifax. Sales are also up 5 percent, down from a crazy 46 percent in July. Halifax is a small market, with monthly sales measured in the hundreds rather than the thousands like in Toronto or Vancouver.

One thing that is quite revealing in Halifax data is the seasonality of home prices. If you live in Halifax, you might be celebrating this year's strong single digit gains. However, home price growth is usually up to 4 to 6 percent year-over-year growth by March and April. This year April registered a 1.25 percent growth rate, which is weak for that time during the sales season. It's not surprising either: commercial bank residential mortgage credit in the second quarter in Nova Scotia posted a 1.2 percent year-over-year increase. That's terrible when compared to the historical average pace of loan growth.

Overall, structural weaknesses are apparent in all Canadian housing markets, even the good ones. And it all largely comes down to mortgage credit growth. Maybe soon we'll dig into the latest provincial mortgage statistics. In the meantime, watch the banks closely. If they stop pumping out that credit for financial transactions, it's game over for the home owner.

PS. if at any time you'd like to see the latest home price data, head over to our Canada dashboard

and you'll see an option to browse through all of the available home price data.

Cover image by: Annie Sprott

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX