National home prices post gains in December

January 24, 2020

Erik Fertsman

National home prices across Canada posted growth in December after first entering contraction territory exactly one year ago. For homeowners the data comes as a relief, especially for millennials who have composed a large portion of first-time home buyers over the last 5 years. But for those priced out of the market or renting their accommodations the resumption of growth is bad news. Meanwhile, for the economy as a whole, the re-acceleration of growth in real estate prices will likely come at the expense of growth in the productive economy and wages.

Article continues below.

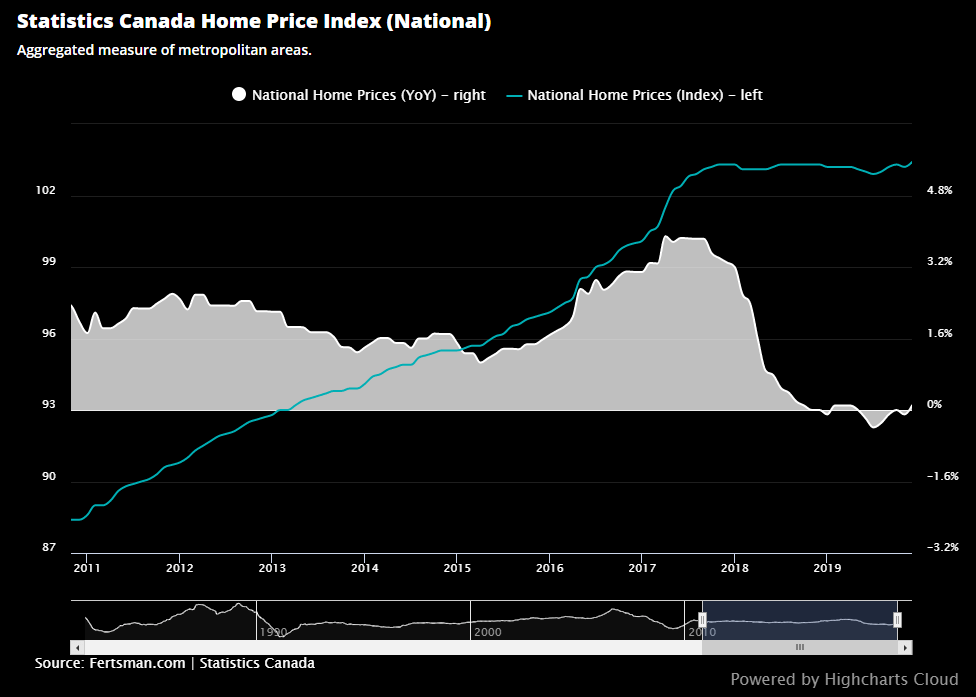

National home prices

On a year-over-year basis, national home prices edged up 0.1% in Statistics Canada's home price index, which measures a large number of urban centers (see chart below). While the gains seem low, it was enough to push the index to a new all-time high of 103.4. Technically speaking, when a market breaks its previous all-time high it can be seen as a big sign of strength.

The Teranet-National Bank of Canada index, which measures a smaller number of CMAs, also came out this week and posted year-over-year gains of 1.95%. This largely confirms the idea that growth rates in the housing market as a whole experienced a soft landing. This also means that Canada has yet to see a correction in its housing market. The TNBC index posted a fresh all-time high of 228.44.

Best performing markets

It is worth remembering that housing in Canada is better gauged by looking at the performance of individual subnational markets, which together compose the national indexes. In some regions prices are up, while in other places prices are down.

Looking at provincial markets, we can see that the best performers in Stats Can's index were Quebec, Prince Edward Island, and New Brunswick (see chart below). Quebec is a relatively large market, while the other players are small. The predominantly french-speaking region managed to post a year-over-year growth rate of 4.93 in December!

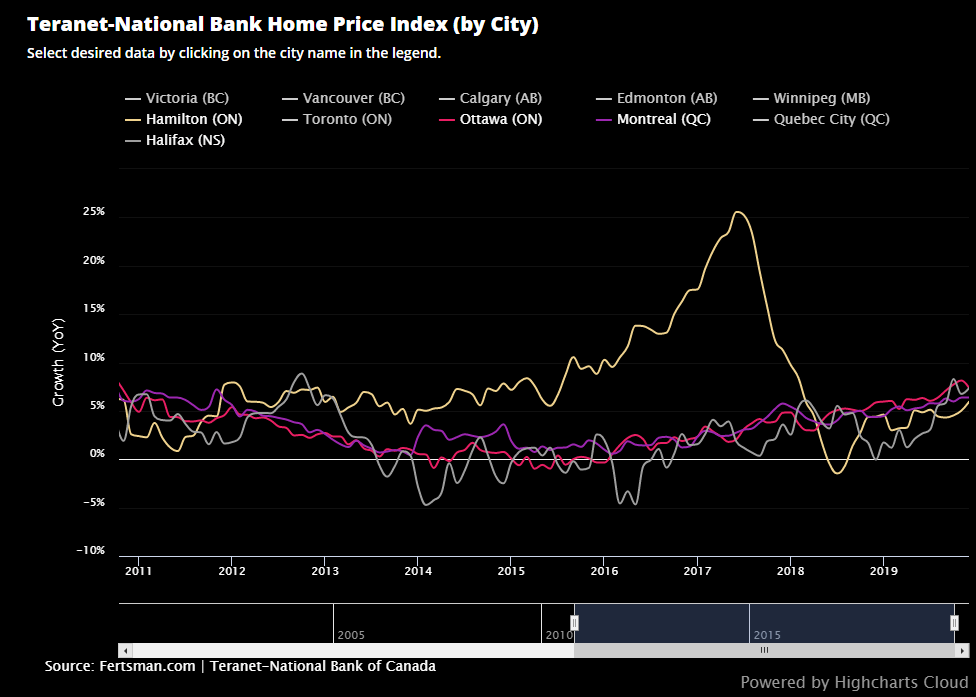

However, the best performing CMAs in TNBC's index were Ottawa, Montreal, Hamilton, and Halifax (see chart below). The nation's capital managed to post a growth rate of 7.38%, which is down slightly from a score of about 8% in November. For a nation struggling with housing affordability such high rates of growth in the capital certainly gives off the impression that the Federal government is on the side of homeowners, or at least doesn't have a handle on asset price inflation.

Worst performing markets

The worst performing provinces were Newfoundland and Labrador, Alberta, Saskatchewan, and British Columbia. The resource-rich province of Alberta that is struggling with a full-blown recession came in the lowest at -2.21%. In some regions of the province, like Fort McMurray, reports have shown that folks are literally walking away from their properties and mortgages after experiencing a combination of spikes in insurance premiums and home value drops. The other provinces are also experiencing economic growth problems. So far, however, overall home price drops in the data have been low.

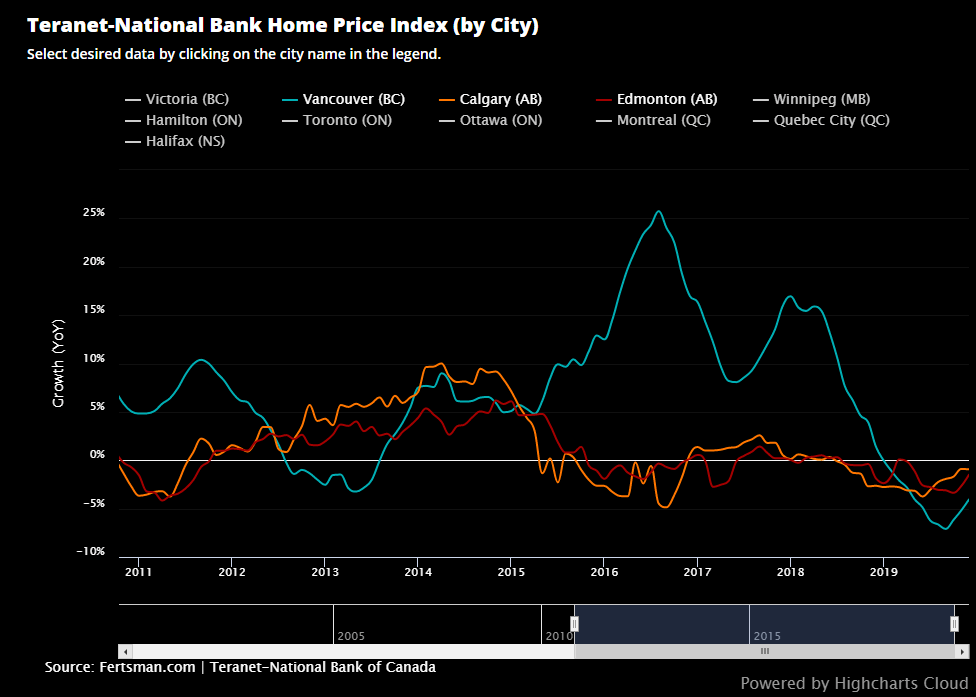

Alberta's home price struggle is also reflected in the TNBC data. Two out of the three worst performing cities in Canada were Calgary and Edmonton. Price growth in these two cities began to contract back in August 2018 and are contracting steadily. Calgary's index is down to 176.6 from an all-time high of 188.35 in October 2014, which is only a drop of 6.24%. Lastly, Vancouver posted a growth rate of -4.05%, up slightly from -5.19% the previous month. The market is widely considered to be one of the biggest housing bubbles in the world in terms of price growth, so it is not surprising to see that prices are still falling. Vancouver's index is only down to 273.81 from an all-time high of 294.03, which a drop of 6.88%.

The next round of home price data will be out sometime during the third week of February.

Cover image by: Adrianna Kaczmarek via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX