IMF says home price crash will force banks to factor in added risk on new mortgages and renewals, suggests drawing crisis plans

August 7, 2019

Erik Fertsman

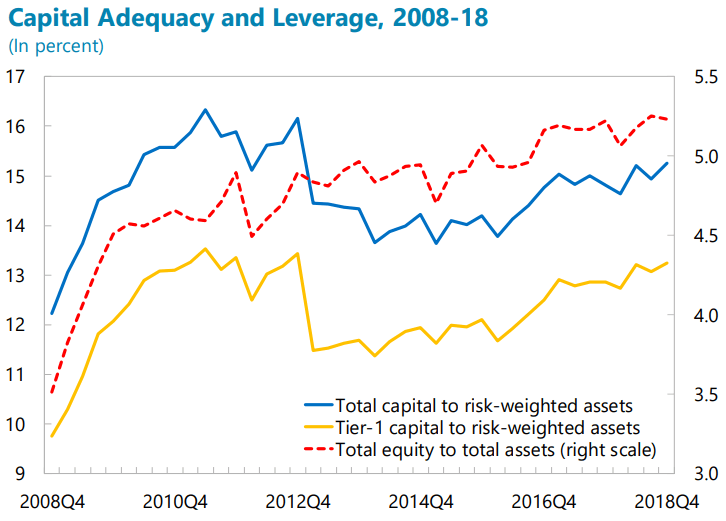

The banking industry has been a top performer within the Canadian economy over the last decade: bank stocks have performed aggressively, and bank profitability keeps rising. By their own numbers (that is, the banking industry's numbers) they have sizable capital buffers, which means the banks should be well poised to withstand economic shocks such as asset price collapses and bank runs.

As you can see above, Canadian banks seem to have good capital adequacy and leverage levels, and they've expanded aggressively abroad into places like the US, the Caribbean, South America, and Europe. As a result, the Canadian banking system has developed close linkages with foreign markets, especially with the US. If trouble brews at home, their foreign operations will help prop them up.

Of course, this is just a narrative, and it all originated in the offices of the big banks who create their own risk-weighted numbers. This includes those risk-weighted numbers that form their own capital buffers. Over the last 6 months, banks have been adding funds to their loan-loss provisions, but why should they if they have fantastic capital buffers that they themselves create?

Article continues below.

Canada's economy has performed strongly, but a collapse in real estate prices may force the banks to reprice mortgages by properly risk-weighing them

However, according to the IMF's

2019 Financial Sector Assessment Program report, the length of Canada's economic expansion (spanning over 20 years, now) combined with massive credit growth, historically-low interest rates, and low rates on mortgages, has resulted in perplexing conditions that the entire world is now watching. Together with housing affordability policies, banks and Canadian governments have fueled an epic borrowing binge that has fueled home purchases.

Seriously, the IMF squarely points out how the banks and Canadian governments are responsible for fulfilling the Canadian dream of owning a home. The result of these confounding factors that they mention? Massive asset price inflation in real estate, according to the IMF. This lead them to conclude in their report, that:

- downside risks to home prices are sizable in the medium term (3 to 5 years) given affordability issues and overvaluations; and,

- Canadian-specific characteristics in the financial sector may amplify the effects of a downturn in house prices on housing and the economy.

Uh-oh...

While the report doesn't quite say what, exactly, causes home prices to form a bubble and then pop (outside of vague terminology), they do believes that a downturn in home prices could make things harder for homeowners looking to refinance their mortgages that come due for renewal. This is primarily due to two factors: 1) rising interest rates and 2) credit availability.

You might ask: how could interest rates rise during a period where interest rates are trending toward zero, and are even going negative in some countries? That's because Canadian banks have been doing a clever job at pricing risk

into mortgages, and the IMF believes that will change when prices correct.

You see, in order to make the Canadian home ownership dream a reality, over time banks and the government had to collaborate and come up with ways to lower borrowing costs (interest rates) and make credit widely available. Coming up with clever risk pricing is a clever way to reduce borrowing costs and make credit more available. Here's a chart that compares how Canadian banks are pricing in risk on mortgages compared to their peers:

Above, Canadian insured and uninsured mortgages have a different risk weight density in percentage terms, but they've essentially got the same credit spread. The trend you get when comparing national financial systems, is to see credit spreads rise with higher risk weight densities.

Doing a better job with pricing risk into mortgages means interest rates would need to be much higher on home purchases and refinances. This kind of move would make life hard on existing home owners and lock many non-homeowners out of home ownership altogether. This would have a substantially larger effect on financially weak households.

Article continues below.

As residential mortgage credit growth grinds toward zero, the IMF's "adverse scenario" becomes more likely

The banks have already begun scaling out of the mortgage lending game; they don't want to double down anymore with new lending rules and home prices trading sideways. Unfortunately, the alternative lenders will only be able to lend so much in the residential mortgage market, since the mortgage market is dominated by the commercial banks who originate over 75 percent of total loans. B-lenders don't lend newly created deposits, so their investors demand a higher return on their money and there's only so much of it.

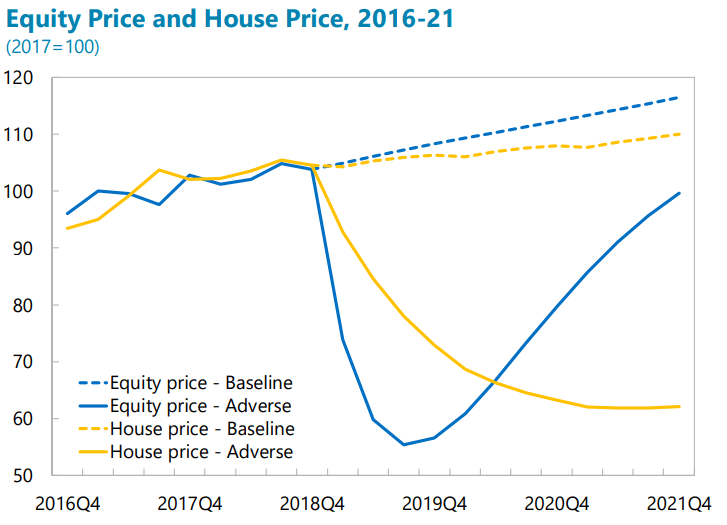

We're now facing a situation where cheap and newly printed money is no longer entering the home market at the same clip. The banks are putting the final nails in the coffin by reducing their mortgage originations. What's next? Well, the IMF has run a simulation of an "adverse scenario" in the Canadian economy, and here's what they see rates doing:

You can just imagine what would happen to mortgage growth - and by extension, home prices - if rates doubled over a short period of time. Actually, you don't even need to imagine, as the IMF has a model for that, too:

They see home prices (yellow line) taking at least a 40 percent dive, with the downturn lasting at least 3 years. Meanwhile, bank stocks would see loses in the region of 50 percent. That would significantly change the banks' capital buffer numbers. At that point, attention would be firmly on the banks, so they'll have a harder time squeezing and massaging their risk weight numbers. This has another consequence which the IMF gladly talks about: deposit insurance and bail-ins (I'll touch on this in another post, though).

Federal safety nets need to be established

Canada currently doesn't have a policy framework for managing a downturn in housing. So the IMF suggests that Canada quickly develop one. And one with enough teeth to make economic adjustments, and, in their words, "limit moral hazard and safeguard taxpayers' interest." Oh boy.

One of the primary reasons why the IMF believes regulators need to do more with monitoring efforts, is because banks have created large external foreign-denominated funding positions, embraced the extensive use of derivatives (those same financial products that brought down the US and Europe in 2008), and have helped grow the non-prime mortgage lending market. The banks say that external linkages with other countries help them "diversify risk." That's only the case if trouble doesn't spread there first, or everywhere at the same time.

Yet, I see the current situation with mortgage credit growth slowing down to multi-decade lows - during a time when home prices are near all-time highs - as a sign that the banks are, in Steve Eisman's words, "not psychologically prepared" for what's coming, and what they've done. If they wanted to rescue themselves from a housing price correction, and the effects that could have on rates and their stock price, then they could have found a way to keep mortgage originations higher.

Well, I guess they couldn't because prices are lofty enough and various stakeholders had to act. In fact, they're so lofty that wages probably need to increase for 10 years, all while home prices stay flat in order for things to balance out. Check out the data here.

Cover image source: Antony Xia

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX