Here's our home price model and home supply model for September 2020

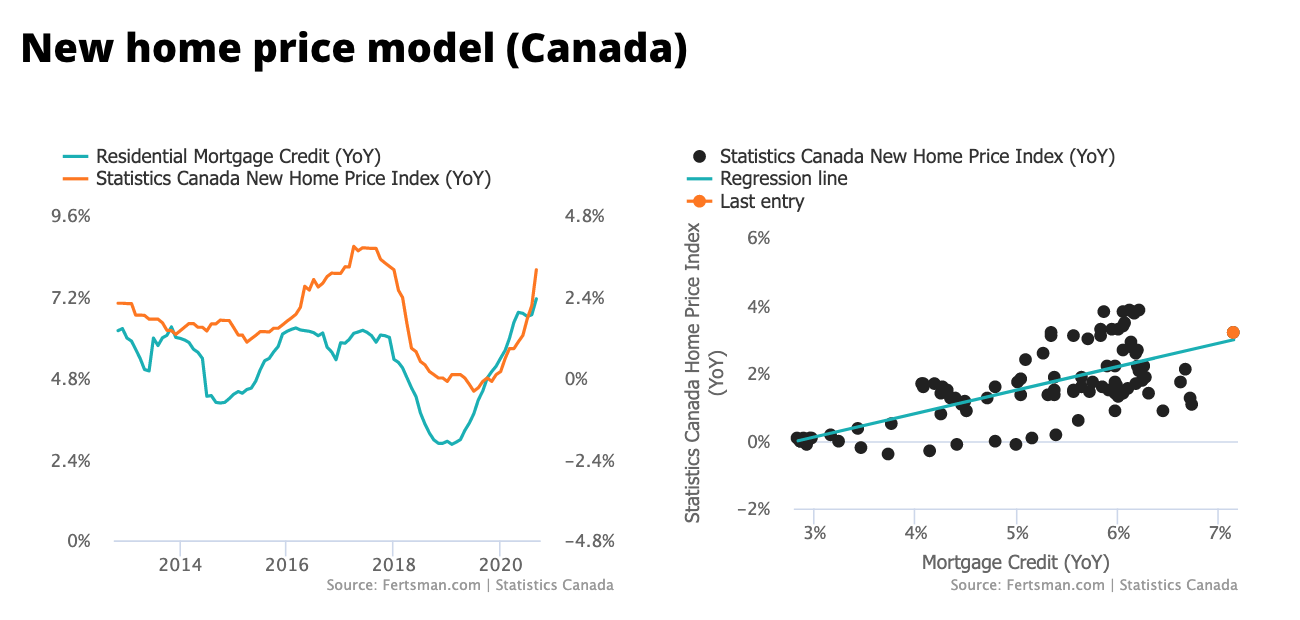

Here are the latest results of our home price model with data for September 2020.

We use changes in commercial bank residential mortgage credit statistics to explain changes in the price of new (and used) homes. In September 2020, Canadian banks managed to grow the total pile of outstanding mortgage credit across Canada by 7.14% (or $85.85 billion CAD) from the same time the previous year. As a result, new home prices across the country grew by 3.2%.

The reason we use commercial bank residential mortgage credit statistics is because the overwhelming majority of real estate transactions in Canada involve a mortgage - a key factor enabling transactions. What's more, banks create new deposits when they issue these loans. This money, especially in large quantities, has a highly inflationary effect on the real estate market.

If you'd like to know more about this model, read this article.

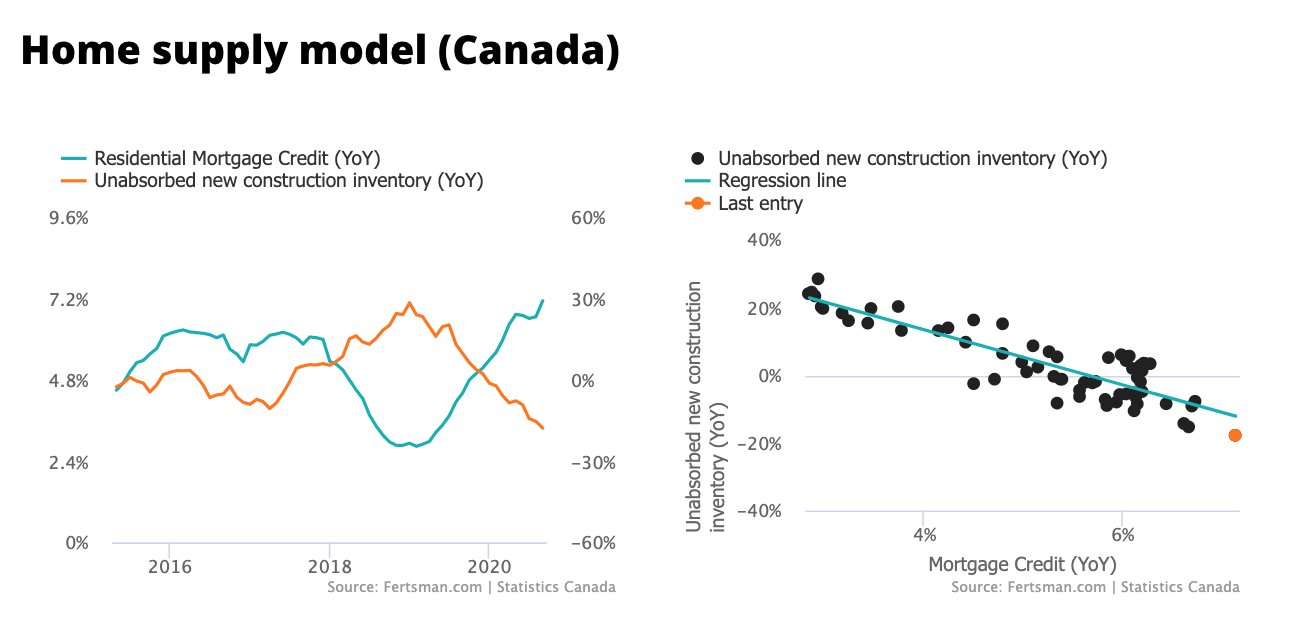

Meanwhile, here are the results of our home supply model with data for September 2020.

We also use changes in commercial bank residential mortgage credit statistics to explain changes in unabsorbed new construction inventory. In September 2020, unabsorbed new construction inventory fell by a huge 17.77% from the same time the previous year.

Don't forget that you can always access these models along with the most recent data on our dashboard.

Cover image by: Scott Webb

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.