Employment growth stalls in British Columbia

February 8, 2020

Erik Fertsman

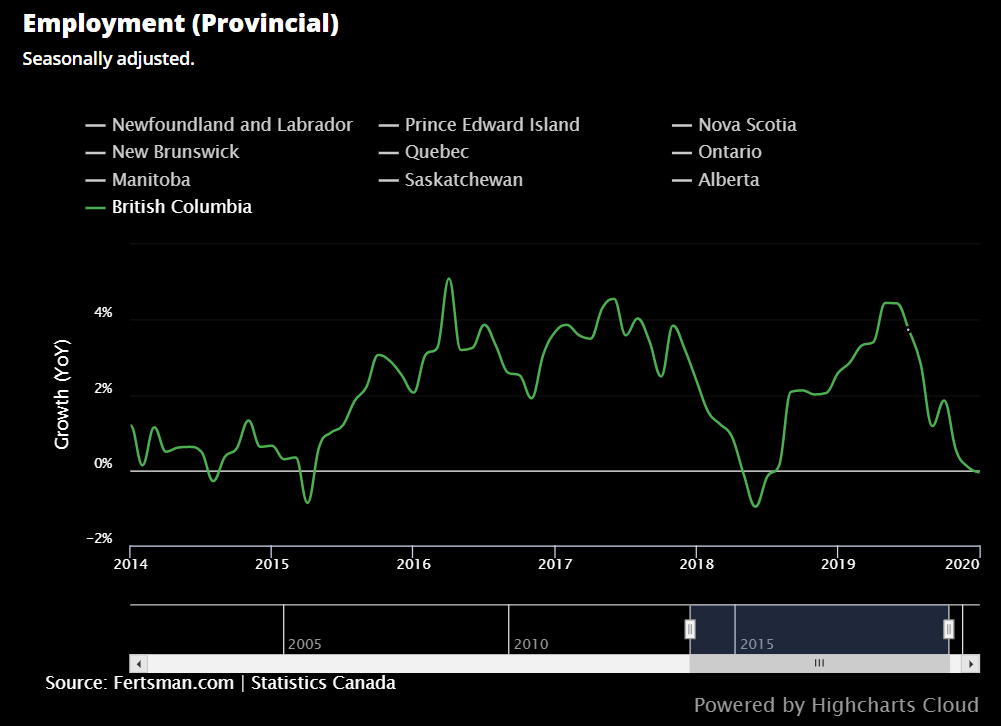

According to Statistics Canada's latest figures, employment growth stalled in January on a year-over-year and seasonally adjusted basis in British Columbia. These latest numbers, unless revised in the coming months, may be an early indicator of weakness in BC's economy. If confirmed, this would add BC to the group of other provinces currently struggling in Western Canada.

ARTICLE CONTINUES BELOW

As per the chart above, employment growth came in at -0.06% in January when compared to growth in January the previous year. This is the first contraction in year-over-year employment figures since July 2018. The estimate for total employed came in at 2,545,600 individuals, which is down from a peak of 2,575,800 in May 2019.

The goods-producing sector of the economy was down about 1.7% on a year-over-year basis. Both resource extraction and manufacturing posted declines, down about 11,000 jobs. While the services-producing sector of the economy saw gains overall, "transportation and warehousing" saw declines of about 5,500 jobs and "business, building, and other support services" lost over 10,000 jobs. "Information, culture and recreation" lost almost 14,000 jobs. Meanwhile, "Finance, insurance, real estate, rental and leading" saw gains of over 14,000 jobs.

Currently, I'm waiting for Q4 commercial bank statistics to be posted by Statistics Canada in order to get a better look at the economic situation in BC. I suspect all major credit categories (personal, business, and mortgages) are experiencing lower credit growth in Q4 on a year-over-year basis, which would explain at least some of the decline in employment figures. We've already begun to see a trend of growth deceleration in credit in previous quarters. You can check that data out by visiting the dashboard

and navigating over to the employment tab.

Cover image by: Aditya Chinchure via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX