Trend changes in the market this week: maybe there's a chance the Fed won't cut rates after all?

July 21, 2019

Erik Fertsman

The bullish momentum behind pretty much everything priced against the US dollar has began to falter this week, as trends break-down or get exhausted. Much of this bullish sentiment has been propelled by investor-speculation that the US's Federal Reserve will cut interest rates amid the trade-war, which would weaken global trade, manufacturing, and market expectations. This sentiment might just get a heavy dose of reality if the Fed doesn't come through at the end of the month with a rate cut.

This week everyone was watching to see if the CAD would break through the support level the USD established around the psychologically-key level of 1.30. It didn't break! If you zoom out further you begin to see why:

We're currently sitting at a major trend line, one that stretches back over 4 years. On top of that, there's plenty of momentum in the moving averages, and technical support levels are in favor of USD strength. Odds are high that we'll see things slide sideways, while everyone waits for the Fed to make its rate announcement at the end of the month. Either way, a bounce or a break is going to be a big deal that will determine which way things go from here.

As we know, a stronger CAD is not in the best interest of the Bank of Canada, whom in which wants to help out exporters, and hit inflation targets that, so far, have been helped along due to currency depreciation. If the CAD takes a strong turn by breaking down that 5-year-plus trend line, currency intervention will likely be on the table, just as the Bank for International Settlements encourages its counterparts to do.

How market expectations are playing out in other markets

Cryptocurrencies

Things are reverberating down into other markets, as well. This week in the bitcoin market we began to see something more than merely a consolidation after the digital asset took a swing at $13,000. Against the dollar, things have been really good this year. A few days ago, though, the parabolic advance came to an end:

The 50 candle exponential moving average on the daily time frame has provided some support for now, and as of writing, price has been back-testing the trend line. Other technicals like bitcoin's network value to transaction (NVT) ratio have began to dip, potentially confirming a change in trend. Just like the USD-CAD pair, market participants are going to be closely watching to see what the Fed will do.

Bitcoin has a lot of other problems, though. One of them is a potential regulatory clamp-down as exchanges continue to face regulator pressure, and politicians have began drip feeding concern over the nature and purpose of cryptocurrencies; especially inceptions like Facebook's Libra. In many ways, crypto assets are attempting to replace national currencies and banks - and this is not going to sit well with the banking industry and those they sponsor in Washington D.C. and other capitals.

Ethereum, a top crypto by market capitalization, and one that boasts additional programmatic features called "smart contracts," is also showing some weakness. This so-called "altcoin," like many others, closely follows bitcoin's valuation. Setting aside the many technical and fundamental challenges facing ethereum, the same regulatory and political pressures facing bitcoin apply. Currently, ethereum's price chart is trying to keep its head above the crucial trend line.

Here's two more key crypto assets that reveal the weakness unfolding in the crypto market:

The first is litecoin, which is scheduled to undergo a "halving" event in August. This will cause revenues for those folks who "mine" or support the litecoin network with computational capacity to see a decrease in their rewards, denominated in litecoin for the same quantity of hashing they do. The last time litecoin experienced a halving, it resulted in another year of bear market conditions.

The last one here, binance coin, was worth mentioning as it's a private crypto asset issued by one of the top crypto exchanges in the industry called Binance. As you can see, it has experienced significant asset price inflation. One of the fundamentals pushing the valuations has been the rate at which Binance has been burning its profits into the asset through its buy-back scheme. Even here we are beginning to see the trend change. Some traders may be betting on both discounts in cryptooverall, potential consolidation in profits for Binance, and a potential change in the quantity of profits they burn into the coin.

Gold and silver

To switch gears, metals have been making quite the comeback since last year. However, when you look at the larger time frames, it looks more like consolidation. Nevertheless, gold has added quite a bit onto its market cap, and has managed to go parabolic on the smaller scales. This upward momentum is largely driven by changing economic and political fundamentals around the world whereby risk-off assets have become an obsession.

Last week we got to see gold break through a 2-year trend channel, and price is now showing some volatile price rejection. It's not clear how much more negative the economic and political data can get, so bullish traders could get surprised by a neutral-Fed at the end of the month. That could send gold into consolidation, while risking sending the commodity back into a descending pattern.

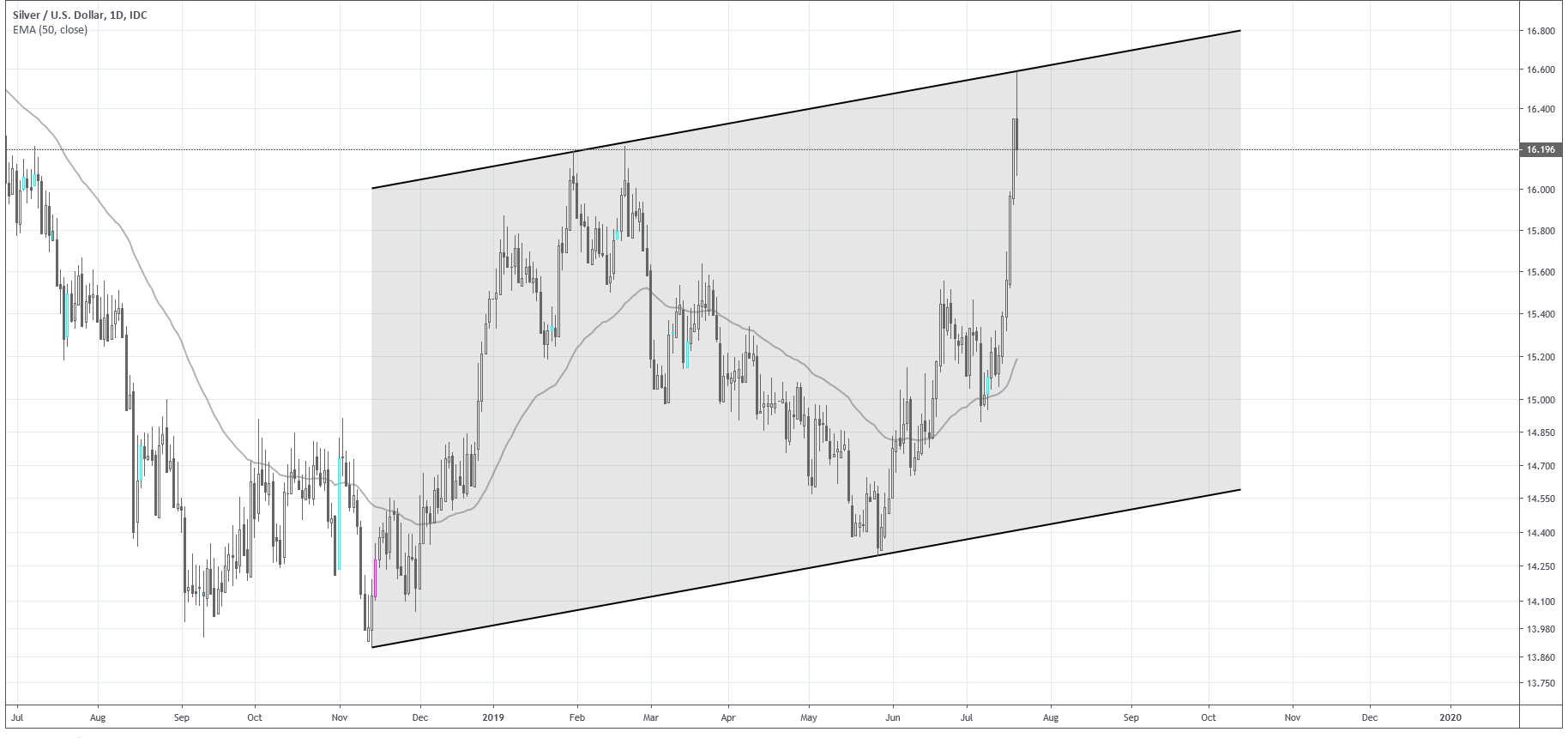

Gold's closest relative, silver, has not had the same luck and strength when compared to its more valuable sibling. These sharp price increases, for years now, have been followed by painfully-long price slumps. Currently, the asset is stuck trading within a rising flag type of channel, which is bearish in technical-speak, and when perceived within its overall price context. Silver really needs to break above it and close a solid landing without dipping back to those 14 US dollar lows.

Silver has quite the uphill battle ahead of it: if you take a look at the gold-silver ratio chart below, you'll see the extent to which gold has been gaining against silver over the last few years.

This is giving gold plenty of added support against its relative. The last few days has seen the ratio pullback sharply, given silver's rally. But with the trend line close by, it's hard to imagine silver being able to overtake gold's strength - especially in the event of a Fed surprise.

Tech stocks

Lastly, it's worth mentioning a few stocks in the equities market. Everyone has been watching stocks with a bit of perplexity. Economic indicators like the yield curve, which began inverting back in March, caused quite a bit of draw-downs in the markets. There's plenty of bad data, which you don't even need to dive deep for. Yet, this week the markets managed to break above some bearish trend lines:

Beleaguered stocks issued by beleaguered companies like nVidia and Tesla, who are struggling with output and profits, are in rally mode. Of course, we're not talking about stocks that are breaking their all-time-highs here, and things could change at a moments notice. What's more, $TSLA and $NVDA are trading at resistance levels. Yet, there's real technical strength here that has the ability to spark quite the frenzy if things go higher. All those draw-downs and defensive positions strategists and analysts have convinced their investors of, could come unraveled. Where will the money go? Tech stocks have plenty of appeal.

Anyway, these are four key sectors to watch in the coming weeks as everyone gets to digest fresh data that will start to pile-in. A Fed surprise will be enough to spoil the parties happening on pretty much every block, and currently all these price charts are a clear reminder of that.

Cover image source: AbsolutVision

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.

BTC Address: 13XtSgQmU633rJsN1gtMBkvDFLCEBnimJX