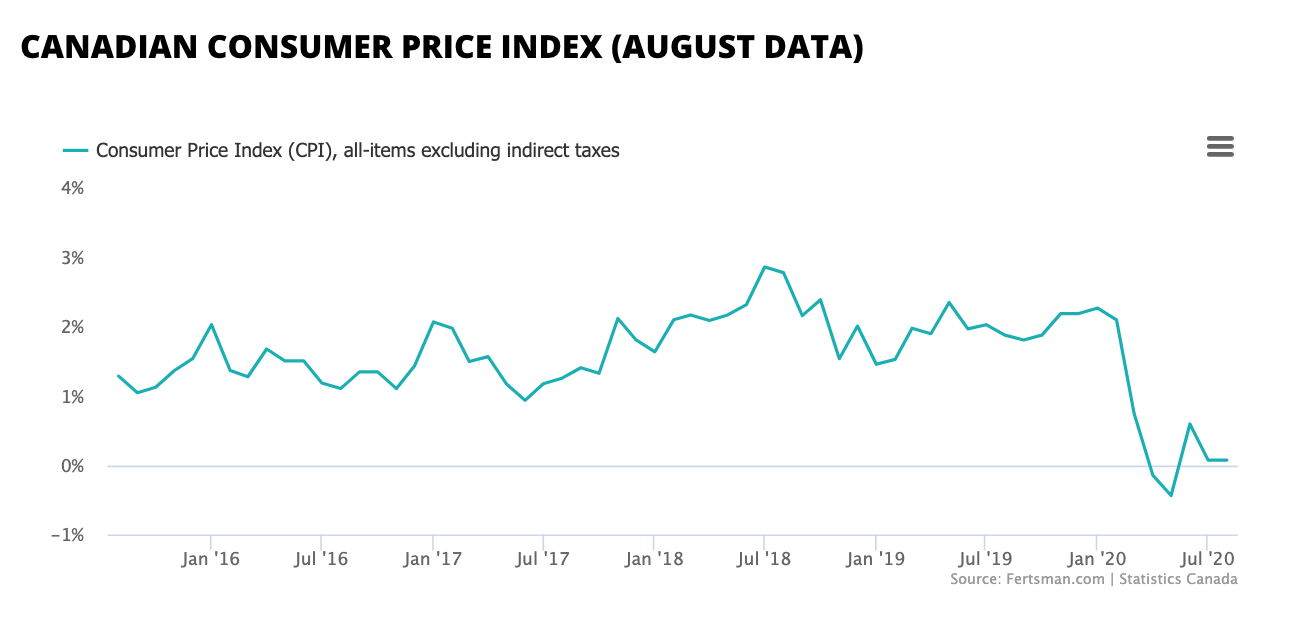

Canadian inflation in August was around zero

The latest data from Statistics Canada shows that overall inflation in Canada came in flat near zero, narrowly escaping a deflationary output. On a year-over-year basis, the CPI was up only 0.07% nationally. Inflation is the desired outcome for Canadians and governments, as it makes it easier to settle and service debt burdens.

The "recreation, education, and reading" statistics weighed down the index, with "travel services" and "education" reporting lower prices. Prices for "transportation" also dropped, with gasoline and air transportation prices down significantly. Prices for "clothing and footwear" were down markedly. Prices for telephone services were also down significantly.

While the national headline number shows a relatively tolerant outcome, subnational inflation figures show regional disparities that are cause for concern. All three territories posted deflationary numbers. Yukon, Northwest Territories, and Nunavut saw CPI come in at -0.9%, -1.3%, and -2.3%, respectively. All the Atlantic Canadian provinces also posted deflationary figures. Newfoundland and Labrador, Prince Edward Island, Nova Scotia, and New Brunswick reported -0.6%, -0.4%, -0.7%, -0.6%, respectively.

This week we reported that personal and business credit growth has been down significantly this year. Personal credit levels are actually in contraction. Price falls in the education, transportation, retail, and communication categories in the CPI may be linked to this lack of growth in credit across Canada. Lastly, the deflationary pressures in the Atlantic provinces and the territories may be linked to pandemic travel restrictions which have limited trade transactions.

Statistics Canada reports government finance numbers tomorrow. So, stay tuned.

Cover image by: Mark Smith via Unsplash

SHARE THIS ARTICLE

Enjoyed this article and want to support our work, but are using an ad blocker? Consider disabling your ad blocker for this website and/or tip a few satoshi to the address below. Your support is greatly appreciated.